Published in American Society for Dermatologic Surgery | July-August 2018

As principals of a wealth management firm with over 1,000 physician clients – including many dermatologists – we continually stress the importance of flexibility to our clientele. Because many circumstances beyond your control may significantly impact your ability to achieve your financial goals, flexibility is fundamental. In this two-part article, we will examine the key factors for which your wealth plan must provide flexibility.

➊ Changes in Income / Cash Flow

With the reimbursements always in flux and a cyclical economy continually impacting cosmetic medicine, income and cash flow are key factors to consider in any dermatologist’s wealth plan.

How do you incorporate income / cash flow flexibility into a wealth plan? By living below your means and prioritizing saving each month, quarter and year, you can position yourself to weather any temporary or even long-term hits to income / cash flow. Another important tactic is to implement savings vehicles that allow for uneven funding / investments. As an example, in the qualified retirement plan (QRP) arena, this might mean using defined contribution plans that allow flexibility in contributions each year, as opposed to a defined benefit plan which can require a certain level of funding or cause underfunding penalties. Even more relevant would be to utilize non-qualified plans that may allow much higher contributions than defined contribution plans when income is high, and contributions can actually be skipped entirely in years when income wanes.

Another example would be in the asset class of permanent life insurance, one that has the benefit of tax-deferred growth and top asset protection in many states. Here, flexibility would favor a universal life policy, where funding is flexible year-to-year, over a whole life policy, where funding must occur each year.

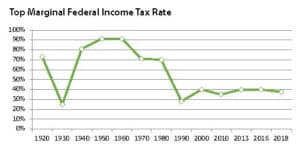

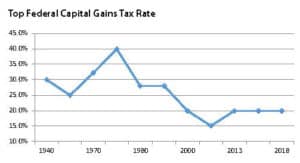

➋ Changes in Tax Rates

Taxes are the number two factor for which planning flexibility is strongly recommended. There have been significant changes in tax rates under the last four presidents.

Examining the charts below, it seems quite possible that, in the future, we could see tax

At our firm, we approach this through a process of tax diversification. While most firms concentrate only on asset class diversification in the context of investing, we believe it is essential to add a focus on diversification of a client’s wealth to tax rate exposure.

As an example, we might look at a client’s QRP assets as being subject to future income tax increases, since you must pay ordinary income taxes to gain access to QRP funds. Further, most personally-owned assets, from securities and real estate to closely held business interests, commodities and artwork, are subject to future capital gains tax increases. As capital gains tax rates increase, the value of these assets decline, at least in terms of how they might assist you in retirement.

Applying a “diversification” approach, we find that most physicians are inadequately invested in asset classes that are immune to future income or capital gains tax increases. These asset classes – including cash value life insurance, tax-free municipal bonds and Roth IRAs – should be part of every dermatologist’s wealth plan. Bottom line: You need to have flexibility against the possibility that tax rates increase, especially if those increases are significant.

Conclusion

Because risk and uncertainty are prevalent over the long term, flexibility is a crucial element of a conservative, yet creative, wealth plan. In Part II of this article, we will examine three additional elements: changes in the market, in liability and in health.

SPECIAL OFFERS: To receive free hard copies of Wealth Protection Planning for Dermatologists and Wealth Management Made Simple, please call 877-656-4362. Visit ojmbookstore.com and enter promotional code ASDS for a free e-book download of these books for your Kindle or iPad.

David B. Mandell, JD, MBA, is an attorney and author of more than a dozen books for doctors, including Wealth Protection Planning for Dermatologists and Wealth Management Made Simple. He is also a principal of the wealth management firm OJM Group ojmgroup.com, where Carole C. Foos, CPA, is a principal and lead tax consultant. They can be reached at 877-656-4362 or mandell@ojmgroup.com.