FINANCIAL PLANNING FOR PHYSICIANS

A BEGINNER'S GUIDE

David B. Mandell, JD, MBA | July 7, 2023

If you’re a medical practitioner, you probably know that physicians are among the highest-paid professionals in the US. However, unique expenses like career-related insurance and medical school debt can put your income as a physician on the line without proper financial management. It would be best if you took measures to handle your finances properly.

Read below to learn more about financial planning and what it can do.

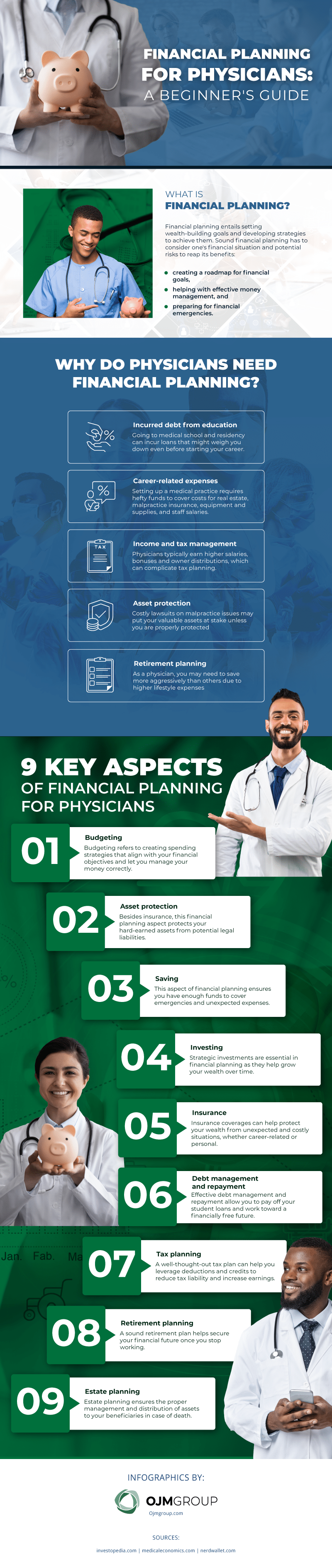

What is Financial Planning?

Financial planning is the practice of identifying your money goals and how to achieve them. Professionals analyze your income, expenses, assets, liabilities, and potential risks to create a sound financial plan.

Although anyone can benefit from financial planning, your being a physician makes financial planning all the more crucial. Financial planning lets you manage money and potential risks with your profession so you can perform your duties without worries. Some benefits of financial planning for physicians include the following.

1. Creates a roadmap for your financial goals

Financial planning allows you to develop concrete plans to achieve your wealth-building objectives. Whether buying equipment or saving for a retirement fund, you can better identify priorities and set realistic goals through financial planning. Plus, it helps you track your progress and adjust your strategies to accommodate current circumstances.

2. Helps with effective money management

Creating a budget, managing student debt, and identifying money-saving opportunities are all part of financial planning. It helps you understand your cash flow and determine areas where you can cut expenses. In effect, you can prioritize your spending better and avoid becoming tight on cash.

3. Prepares you for the unexpected

Emergencies and unexpected costs are the most significant expenses that blow through your finances. However, a financial plan can prevent this from happening. You can set up ample emergency funds to serve as a safety net in case of equipment repairs, insurance claims, etc., which may affect your earnings.

Why Do Physicians Need Financial Planning?

1. Incurred debt

Going through medical school and residency can be an exciting time. However, debt and loans can pile up on you during these career stages and leave you with many expenses to settle even before starting your practice.

Repaying these debts can be daunting, but solid financial planning for physicians can prevent them from weighing you down. You can stay on track with student loan payments until you eventually clear them, so you can move forward in your career without debt problems.

2. Career-related expenses

Besides student loans, many career-related expenses that add up quickly can cause cash flow problems. This is especially the case for those physicians who own their own practice.

On top of that, other expenses like insurance payouts, medical equipment and supplies, and staff salaries may dwindle your finances. Financial planning for physicians becomes essential to ensure you can continue practicing and keep a smooth cash flow.

3. Income and tax management

As a physician, you have a complex tax situation since your compensation puts you within higher tax brackets. So, effectively planning for this expense is crucial to minimize your tax burden.

A sound financial plan for physicians includes effective tax management strategies. Financial planners can advise you on maximizing tax-deferred retirement contributions, leverage deductions, and strategically monitor income and expenses. This way, you keep more of your hard-earned income and ensure you do not overpay taxes.

4. Asset protection

The unique professional risks you face can affect personal assets. For example, medical malpractice lawsuits can exceed typical insurance protection. To avoid this, consider a financial plan that includes protection strategies to shield your assets from potential legal claims and other threats.

An experienced financial planner can help you assess risks and develop a comprehensive protection plan for your peace of mind.

5. Retirement planning

Aside from professional risks, you have to consider your unique retirement needs. On the one hand, you have high earning potential but may have significant education debt on the other hand. As a result, you might need to save more aggressively than other professionals to ensure a comfortable retirement.

With a financial plan, physicians like yourself can better understand how much you need to save, how to invest your savings, and when your ideal retirement age is. You can also prepare for potential healthcare costs in retirement. That said, retirement planning for physicians provides a secure and enjoyable retirement without worrying about insufficient funds to support your dream lifestyle.

9 Key Aspects of Financial Planning for Physicians

1. Budgeting

Budgeting is about creating a spending and saving plan that reflects your financial objectives and priorities. You’ll need to keep track of your income and expenses, which can help you create realistic strategies to reach your money goals. Plus, it allows you to adjust your financial plan as needed.

This aspect lets you stay within your means while also allowing you to allocate resources toward other financial goals, like paying off debt, ordering medical supplies, or investing for retirement.

There are a variety of budgeting techniques you can use. One popular example is the 50/30/20 budget, which allocates 50% of your budget for needs, 30% for wants, and 20% for savings.

Another method is the zero-based budget, wherein you must justify all your expenses for a particular period starting from zero instead of referring to the previous budget. By the end of the period, your income minus your expenditures should be zero.

2. Saving

Saving strategies are essential to financial planning, especially when preparing for emergencies and unexpected events. For example, setting aside a portion of your income for future use ensures you have the money to cover the costs of further education, travel, etc. You can also use your savings for long-term goals like future training or retirement.

When establishing a savings plan, you must determine how much and where to put it aside. Regularly reviewing your game plan is also crucial so you can adjust accordingly. With this aspect of financial planning for physicians, you can identify areas to cut costs, save more money, and achieve your goals faster.

3. Investing

While a savings account is essential for future use and unexpected costs, inflation—the rate at which prices of goods and services increase—can decrease its value over time. As such, financial planning for physicians includes sound investment strategies to combat the effects of inflation on your money.

For instance, your financial plan may include purchasing stocks, bonds, or mutual funds to grow wealth. It may also combine these investment vehicles to diversify your portfolio and mitigate risks.

4. Insurance

A financial plan also offers adequate insurance coverage to protect your wealth against unforeseen circumstances or significant financial loss. Malpractice insurance, for instance, is critical for you as a physician. Lawsuits can be costly and even threaten your career, so it’s best to have this coverage to prevent major losses.

Aside from career-related insurance, financial plans also include personal ones. For example, permanent life insurance is a worthwhile investment to ensure your loved ones are cared for in the event of untimely death. Since there are several insurance options, working with a financial planner can help you obtain the appropriate coverage for your needs.

5. Debt management and repayment

Debt is a common issue many physicians face, especially with the cost of education and the expenses of setting up a medical practice. According to statistics, about 73% of medical school graduates have educational debt. Again, these debts can accumulate and weigh you down as you start your career.

Financial planning for physicians typically includes debt management and repayment programs to help settle these expenses effectively. With a solid plan, you can reduce financial stress and work toward a debt-free future.

6. Asset protection

You may accumulate properties, investments, and retirement funds as your career progresses. However, these assets can be at risk if you face legal action. As such, an ideal financial plan for physicians like yourself may consist of asset protection strategies—including limited liability companies (LLCs), trusts, and insurance policies—that shield your possessions from potential liabilities.

This way, you can focus on your medical practice with peace of mind, knowing your assets are secure and protected.

7. Tax planning

Financial planning for physicians also accounts for tax management. Since higher tax rate brackets can eat into your hard-earned income, financial planners recommend various strategies to minimize tax liability. They may suggest you leverage deductions and credits or structure financial transactions efficiently for tax purposes.

As a result, you can reduce your overall tax burden and allocate your savings toward other financial goals.

8. Retirement planning

Retirement planning for physicians often involves setting aside funds to support you when you are no longer in the medical practice. It looks into several factors like healthcare costs, social security, inflation, and current financial situation to help you set realistic goals and lifestyle. Ultimately, this plan can assist you in determining the best ways to save for retirement.

9. Estate planning

Estate planning for physicians—the aspect of financial planning for physicians that refers to managing and distributing your assets upon death—is as important as asset protection.

Estate planning for physicians helps your beneficiaries receive your retirement accounts and life insurance policies without the burden of significant estate taxes. By planning for your estate, you can ensure your wishes are carried out and your loved ones cared for.

Setting Your Finances on the Right Path

Your job as a physician means you face unique financial risks and expenses that can significantly reduce your hard-earned income without proper money and asset management.

In this regard, protecting your hard-earned money and other assets with a sound financial plan is in your best interest. This plan lets you focus on your work better, knowing your wealth and financial future are in order.

If you want to know how to secure your financial future and protect your assets, contact us at OJM Group. We are financial planners who specialize in working with physicians nationwide, ready to help you develop a sound financial plan.

Check out our bookstore and get a copy of our book, “Wealth Planning for the Modern Physician,” for more personal finance tips and guides for physicians.