Lessons from a Recent $43 Million Malpractice Verdict

Among the various types of liability that physicians may face, including employee claims, HIPAA violations, cyber liability and slip-and-fall injuries, medical malpractice may be the most impactful.

The consequences of possible medical malpractice liability should be considered by physicians who treat relatively young, otherwise-healthy patients because these patients may experience a long period of debilitation should they have an unsatisfactory outcome. That potential liability multiplies significantly when treating professional athletes who have high incomes and short careers. One can see how exposures can easily go beyond the malpractice insurance coverage provided by a traditional $1 million/$3 million malpractice policy and far exceed those limits.

We saw these factors come together in the recent malpractice legal action in which Chris Maragos, a former captain of the NFL Philadelphia Eagles, sued his orthopedic surgeon and the practice itself. After a jury trial, in which several high-profile athletes testified on behalf of Maragos and orthopedic surgeons testified on behalf of the defendants, the jury handed down a verdict that ordered $43.5 million in damages be paid to Maragos ($29.2 million by the surgeon and $14.3 million by the practice).

Since this verdict was announced, we have seen a sharp uptick in questions from physicians of all specialties about asset protection planning. Therefore, we decided to re-visit the topic here.

Asset Protection Planning Definition

The goal of asset protection planning is to position a physician’s assets in such a way that makes it difficult, and in certain cases nearly impossible, for a future lawsuit plaintiff to gain access to them. A well-executed asset protection plan can surely help the physician feel more secure because they know they will not lose what they have worked so hard to build.

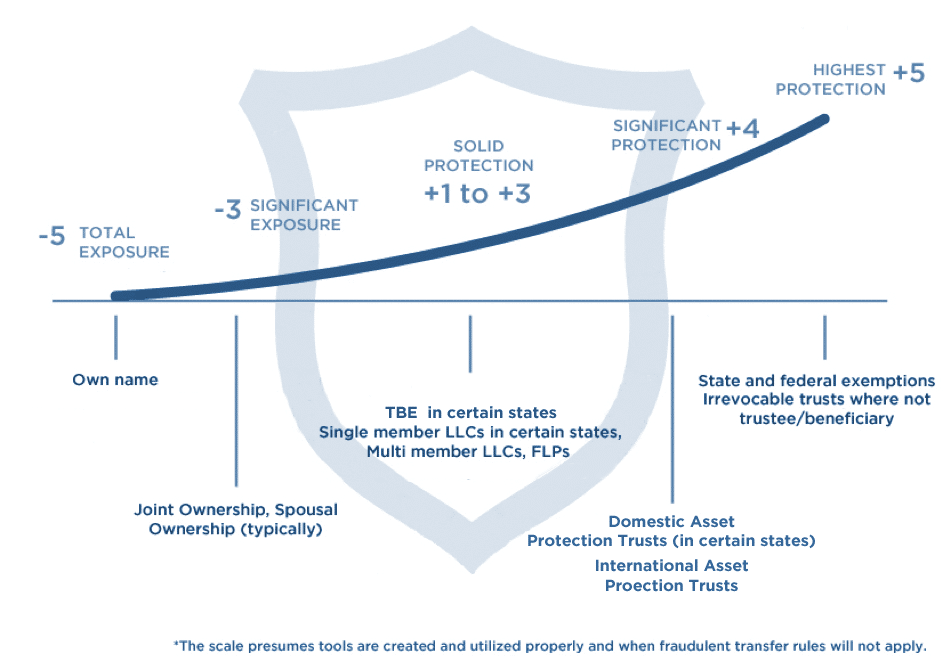

A fundamental concept for physicians to understand about asset protection planning is that it is a discipline of degrees rather than a black/white or vulnerable/protected analysis. In fact, we use an asset protection rating system for a client’s overall situation that uses a rating from -5 (totally vulnerable) to +5 (superior protection). The goal is to move as much of the physician’s wealth as possible from the negative vulnerable positions to the higher, positive protected positions — ideally, doing that with as little cost and interruption as possible. The illustration gives a visual representation of the various levels of exposure and protection that any one asset can have due to its ownership method and the state and federal laws that are involved.

Tools to Shield Personal Assets

Personal asset protection encompasses shielding an individual’s home, retirement accounts, other investment accounts, second home or rental real estate and valuable personal property.

We typically recommend that physicians leverage their state’s exempt assets as a priority, because these assets enjoy the highest +5 level of protection and these assets involve no legal fees, state fees, accounting fees or gifting programs. In other words, you can own the exempt asset outright in your name, have access to its value and still have it 100% protected from lawsuits against you.

Each state law has assets that are absolutely exempt from creditor claims, thereby achieving a +5 protection status. Many states provide exemptions for qualified retirement plans and IRAs, cash within life insurance policies, annuities and primary homes. Make sure you seek an asset protection expert to determine the exemptions that apply to your situation.

In some states, tenancy by the entirety (TBE) can be a valuable ownership form for married couples, as certain assets in such states are protected completely from a claim against only one spouse. About 20 states have TBE protections for some type of asset class. As is the case with exemptions, the rules vary widely among the states and expertise is needed here.

Beyond exempt assets and TBE, basic asset protection tools, like family limited partnerships (FLPs) limited liability companies (LLCs), and certain types of trusts should be used. FLPs and LLCs provide good asset protection against future lawsuits, allow for maintenance of control by the LLC/FLP manager or general partner (typically the physician and/or spouse) and can provide income and estate tax benefits. Specifically, these tools will usually keep a creditor outside the structure through “charging order” protections, which typically create enough of a hurdle against creditors to allow the physician to negotiate a favorable settlement. For these reasons, we often call FLPs and LLCs the “building blocks” of a basic asset protection plan.

There are many types of trusts that also provide significant protection for physicians. These can range from life insurance trusts or charitable remainder trusts to grantor retained annuity trusts and domestic asset protection trusts. Each type of trust has pros and cons, costs and benefits. For now, it is important to understand that only irrevocable trusts provide asset protection benefits. Although revocable trusts are valuable for estate planning and incapacitation planning, they do not provide any asset protection benefits, at least as long as you are alive.

For all FLPs, LLCs and trusts, the asset protection benefits are reliant upon proper drafting of the documentation, proper maintenance and respect for formalities, and proper ownership arrangements. If all these are in place, a physician can typically enjoy solid asset protection for a relatively low cost.

Timing is Everything

The timing of asset protection has a fundamental impact on its effectiveness. This is because federal law and the laws of every state have what are called “fraudulent transfer laws,” “fraudulent conveyance laws,” or, most recently, “voidable transaction laws.” These laws can be used by a judgment creditor to undo any transfers made after liability is “reasonably foreseeable.” Thus, the longer the time period between the implementation of asset protection planning and the occurrence of a liability situation, the better.

Practicing medicine has inherent lawsuit risks, which are primarily from medical malpractice, as a recent high-profile, high-verdict legal case demonstrates. If it is implemented in a timely manner, asset protection planning can help physicians of all specialties protect their assets in the event liability does occur.

References:

www.inquirer.com/news/philadelphia/chris-maragos-eagles-lawsuit-verdict-knee-injury-trial-20230213.html