SEPTEMBER 2023 MARKET UPDATE

THE MONTH AT-A-GLANCE

- The S&P 500 finished 1.6% lower during the month—it’s first negative month since February

- A stronger US dollar took a bite out of foreign equity returns with MSCI EAFE falling 3.8% and MSCI EM dropping 6.2%

- To start the month, Fitch Ratings downgraded US long-term debt from AAA to AA+

- Interest rates drifted higher amid growing “higher for longer” rhetoric—resulting in losses for core bonds

MARKET RECAP

The market started out the month on rocky footing—with the S&P 500 falling close to 5% over the first couple of weeks. Markets recouped some of those losses over the back half of August.

Growth stocks widened their lead over value stocks last month. The Russell 1000 Growth Index fell 0.9% compared to a drop of 2.7% for its value counterpart. Last year was a difficult year for growth investors, however, this year has been just the opposite. The Russell 1000 Growth Index has opened up a 26.3% gap over the Russell 1000 Value Index so far in 2023!

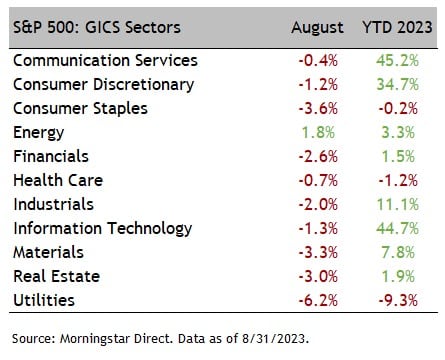

All but one sector was negative in August. Energy was the lone sector to post a gain (up 1.8%). Higher oil prices over the summer months have certainly helped energy-related stocks. Brent crude prices recently past $90/barrel after having been in the low-$70 range most of the summer months.

Equity markets overseas underperformed US markets. A strong dollar (up 1.7% in August) was a headwind for foreign stocks. Developed international stocks dropped 3.8% (as represented by the MSCI EAFE Index), while emerging-market stocks underperformed with a drop of 6.2% (as represented by the MSCI Emerging Markets Index). Chinese stocks fell 9% and were a material drag on the broader emerging-market index. Concerns about a slowing Chinese economy and a property sector that continues to struggle resulted in poor returns. China’s leadership has announced some target stimulus, such as rate cuts, lower mortgage rates, and lower down payment requirements. Despite this, confidence in China remains depressed.

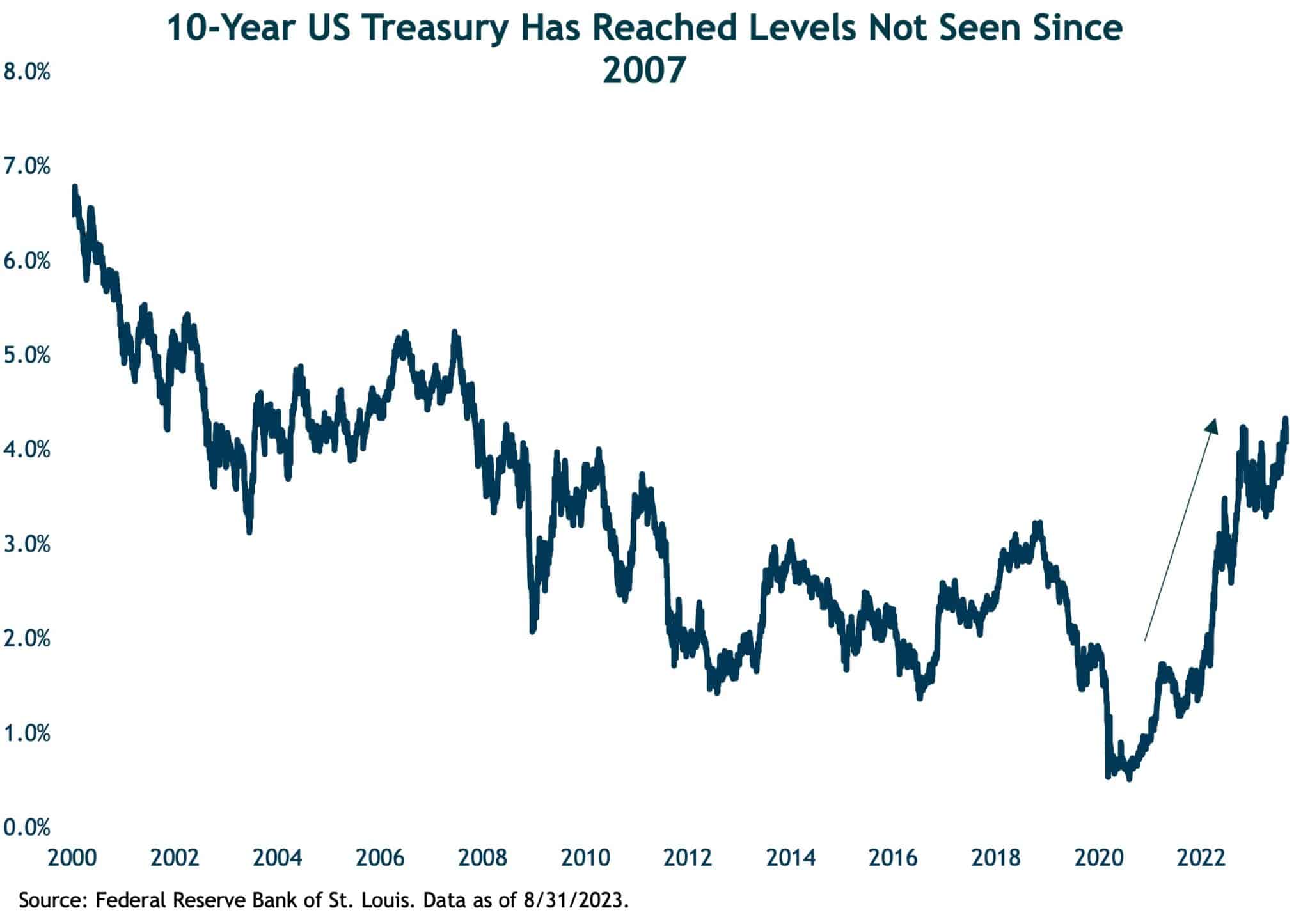

Interest rates were volatile in August and ended the month higher. Fitch Ratings’ downgrade of US government debt, as well as a growing belief in the “rates higher for longer” narrative, pushed 10-year Treasury rates from 3.97% to 4.34% before retreating to 4.09% at month end. The 10-year Treasury has eclipsed yield levels not seen since before the Great Financial Crisis. Higher rates resulted in a loss for the Bloomberg US Aggregate Bond Index (down 0.6% in August).

NOTABLE EVENTS

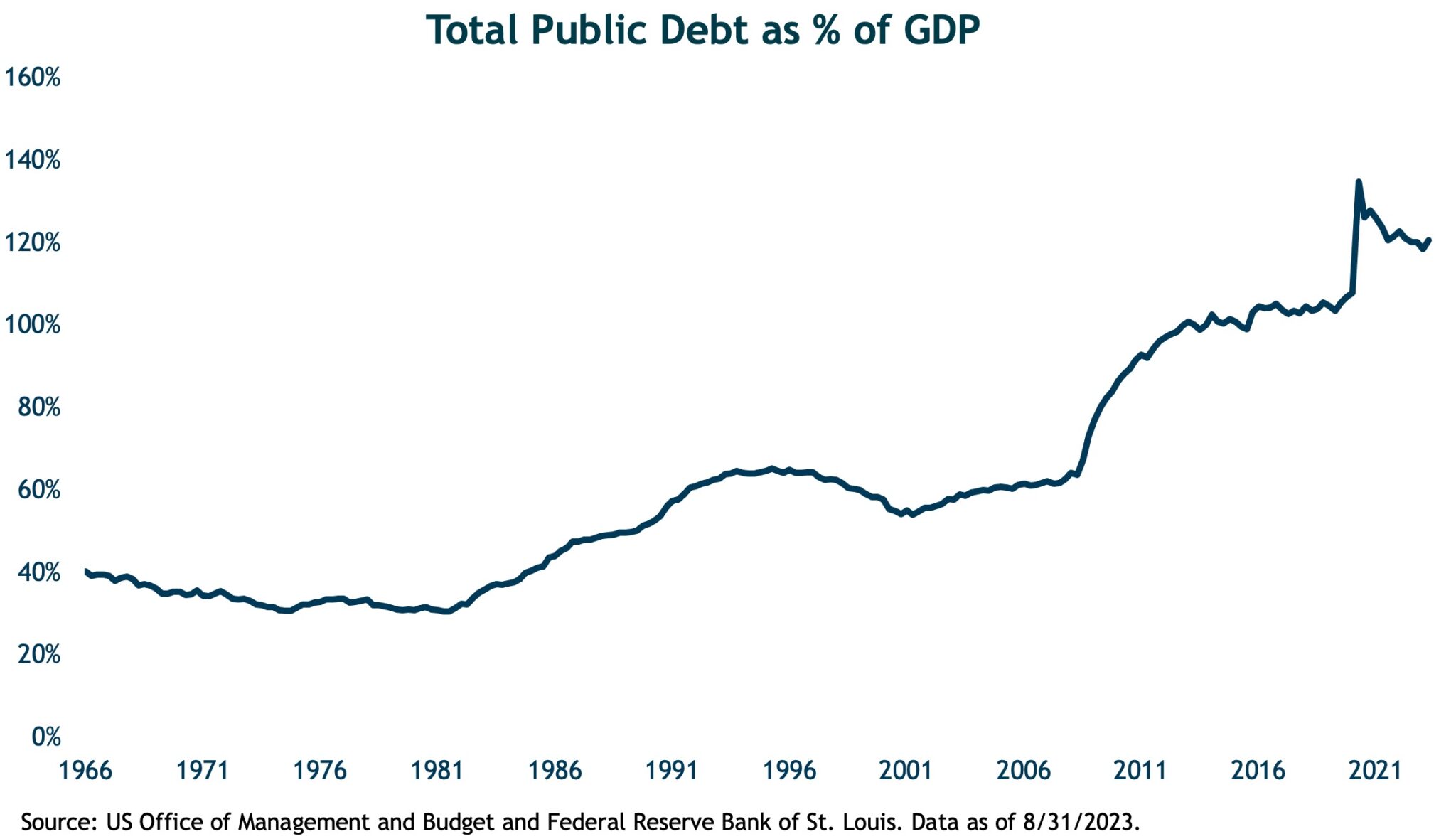

The month started out with a ratings downgrade of US debt by Fitch Ratings. The ratings agency downgraded US’ long-term rating from AAA to AA+. Fitch supported its decision by saying it “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance.” Standard & Poor’s made a similar decision back in 2011 to downgrade the US credit rating following another fight over the debt-ceiling. Much like in 2011, Fitch warned that this years’ debt-ceiling crisis could result in a downgrade.

Government debts did explode higher in the wake of the pandemic (see chart below). Debt as a percentage of GDP has come down in the last couple years thanks to strong nominal growth (i.e., a larger denominator). Prior to the pandemic, the federal debt to GDP ratio averaged closer to 100%. That figure is now 120%. Fitch notes that this debt ratio is more than 2.5x higher than the median AAA-rated country.

Interest rates did move higher as a result of the downgrade; however, it was relatively muted. The 10-year US Treasury started the month at 3.97% and moved up to 4.34% by August 17th—but eventually moved lower to 4.09% at month end. The stock market impact was also limited with the S&P 500 drifting down. Back in 2011, the stock market reacted much more negatively to S&P’s downgrade. The S&P 500 fell 13.9% in the third quarter of 2011 and had a drawdown close to 20% over those summer months. This time, the market had a 4.7% intra-month drawdown during August—showing little concern about the downgrade.