A 2023 update and new benefit for 2024

Most Americans would agree that money spent on higher education is incredibly important, as assets invested for this purpose have the ability to powerfully change the trajectory of a young person’s life. For this reason, many parents (and grandparents) strive to help their children pursue their dreams through higher education.

Unfortunately, for many the high cost of college and graduate education can be a challenging. Based on 2019-2020 figures, the College Board® states the average tuition and fees for a private college to be $36,880 annually and $10,440 per year for an in-state public university.1 In other words, the four-year cost of a private college is likely to exceed $147,000 if inflation were unrealistically removed from the equation. These figures do NOT include room and board, books and supplies, or many other typical expenses college students incur.

At many schools, the pace of tuition increases has dwarfed the inflation rate, a statistic that all but ensures that higher education may be out of reach for many of today’s American children. Student loans can be taken, but if managed improperly, these loans can saddle a young adult with insurmountable debt during their prime earning years.

Wouldn’t it be great if you could give your child (or grandchild) a “scholarship” to help them achieve their higher education goals? A college savings plan can leverage the power of time and compounding interest when saving money for higher education. This article focuses on the most widely used college savings plans, often referred to as 529 plans.

Named after Section 529 of the Internal Revenue Code, 529 plans are state-sponsored, tax-advantaged savings accounts designed to help families and individuals save for future education expenses.

There are two main types of 529 plans:

- 529 Prepaid Tuition Plans: These plans allow you to prepay tuition at today’s rates for use in the future when your beneficiary (the student) attends a participating college or university. This can be a good option to lock in tuition costs and hedge against future increases.

- 529 Savings Plans: These are investment accounts that allow you to save for education expenses such as tuition, fees, books, supplies, and even certain room and board costs. The money you contribute to a 529 savings plan is invested in a variety of investment options, typically including mutual funds or similar investment vehicles. The earnings on these investments can grow tax-free, as long as they are used for qualified education expenses.

529 Plan Basics

- Tax Benefits: Contributions to 529 savings plans are not federally tax-deductible, but the earnings grow tax-free if used for qualified education expenses. Many states also offer state income tax deductions or credits for contributions to their own state’s 529 plan.

- Qualified Expenses: Qualified education expenses can include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. Additionally, up to $10,000 per year per beneficiary can be used for K-12 tuition expenses.

- Flexibility: 529 plans offer flexibility in terms of changing beneficiaries. If one child doesn’t use all the funds, you can often change the beneficiary to another eligible family member without incurring penalties.

- Contributions: While there are maximum limits to how much you can contribute to a 529 plan, these limits are generally quite high, often exceeding $300,000 or more depending on the state.

529 plans have been great educational tools to help families save money for college and use that money, tax-free, to pay for college expenses. While the plans are still relatively young, they continue to adapt and get new benefits as the popularity of using these accounts continues to rise.

New solution for 529 plans offers added flexibility

We often hear from parents and grandparents about the rigid rules for qualified distributions from 529 plans. Many worry that funds will be stranded in 529 plans by children who don’t use them.

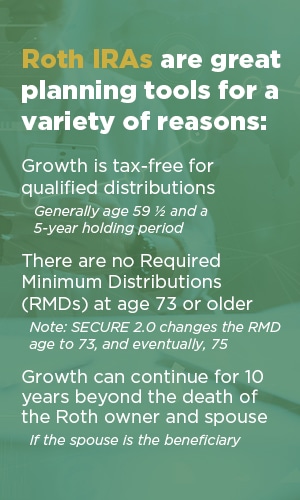

While 529 funds are supposed to be earmarked for education expenses, the new Roth IRA transfer provision provides a workaround for balances that aren’t being used for educational purposes. Without the provision, the growing, unused funds would be taxed at the investor’s income tax rate—and if the funds were used for ineligible expenses, the money would get hit with a 10% tax penalty.

Beginning in 2024, taxpayers with 529 plan balances will be able to transfer those balances to Roth IRAs. However, this provision comes with many rules and restrictions, including:

- A lifetime maximum of $35,000 can be rolled over from a 529 plan to a beneficiary’s Roth IRA.

- Annual Roth IRA contribution limits apply to rollovers (in 2023, the limit is $6,500, which means it would take six years to convert $35,000 from a 529 plan to a Roth IRA).

- Because the annual transfer amount is subject to the IRA limit, the beneficiary must have compensation.

- Conversions can only be made to a beneficiary’s Roth IRA; a parent saving with a 529 plan in a child’s name cannot convert unused funds back into their own retirement account.

- Rollovers are not allowed until a 529 account has been open for at least 15 years.

- Contributions to the 529 plan made within the previous 5 years (and the earnings on those contributions) are not eligible to be transferred.

As an example, Dr. Smith is the owner of a 529 plan for his daughter Jane, age 25. Dr. Smith opened the account when Jane was an infant. The account had more than was needed for Jane’s education, and Jane has no further plans for formal education. Jane has no siblings and currently has no children. Let’s assume the 2024 IRA contribution limit remains at the current limit of $6,500. Dr. Smith can transfer $6,500 in 2024 to Jane’s Roth IRA account, assuming Jane has not made any IRA contributions in 2024 and Jane has compensation income. He can continue to transfer $6,500 per year (or the indexed IRA contribution limit amount) into Jane’s Roth account annually until he has transferred $35,000 into the account from the 529 plan. Jane’s Roth IRA will grow on a tax-deferred basis and she will be able to take tax-free distributions from the account after age 59 ½.

This new rule helps families who have set aside funds in 529 plans avoid taxes and penalties if the beneficiary ultimately finds an alternative way to pay for higher education. Because the Roth IRA income limits ($153,000 for single filers and $228,000 for joint filers in 2023) do not apply to this transaction, even high-income investors who have been held back from creating Roth IRAs could do so using the 529 plan transfer.

With careful planning and an early start on saving, 529 plans make excellent tax-efficient college savings options and allow you to harness the incredible power of a compounding interest to help your child or grandchild achieve their higher education dreams. The added flexibility with 529-to-Roth conversions makes these plans an even more attractive tool for achieving education and retirement goals.