INVESTING AS A DOCTOR

5 TIPS FOR BEGINNERS

David B. Mandell, JD, MBA | September 6, 2023

As a doctor, you dedicate your life to caring for others and positively impacting their well-being. However, it’s equally critical to prioritize your financial health and secure a stable future. Venturing into the world of investing as a doctor provides an effective way to accomplish this goal.

As a medical professional with limited time, navigating the financial world can be complicated. Fortunately, you can learn to take charge of your financial future, whether you are just starting your medical career or a seasoned practitioner. Read to learn valuable tips and insights to navigate this new journey confidently.

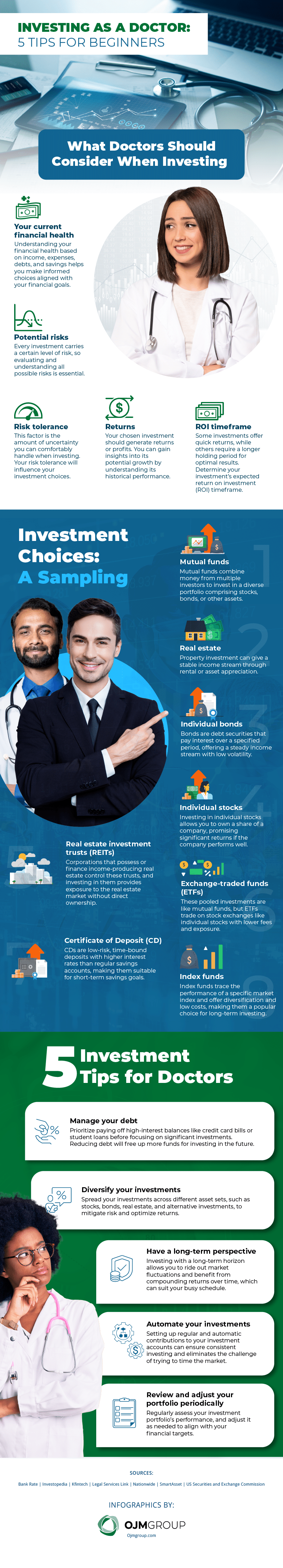

What Doctors Should Consider When Investing

Investing requires careful consideration of these fundamentalfactors to make informed and prudent decisions.

- Your current financial health

Understanding your financial health is the foundation for effective investing. Evaluate your income, expenses, debts, and savings to determine your financial situation. This assessment will help you set realistic financial goals and calculate how much you can comfortably allocate toward investments.

If you’re unsure where to start, you can look for a financial planner for physicians to give you the guidance you need.

- Potential risks

Every investment comes with a level of risk. Some investments may be volatile, while others might carry lower risks but offer more modest returns. Consider your risk tolerance and diversify your portfolio across different asset classes to spread risk and potentially enhance returns.

- Risk tolerance

Assessing your risk tolerance involves understanding your ability to endure fluctuations in the value of your investments without feeling anxious or making hasty decisions. Your age, financial goals, and investment horizon influence your risk tolerance.

If you’re a conservative investor, stable investments may be right up your alley. Others might be willing to take more risks by seeking higher returns through growth-oriented assets.

- Returns

Examining potential returns is crucial for evaluating your investment’s profitability. Historical performance data, current market trends, and expert analysis can offer insights into an investment’s potential growth.

However, remember that past performance does not guarantee future results.

- ROI timeframe

Different investments have varying timeframes for achieving returns. Some assets, like stocks, may offer the potential for rapid gains but come with higher short-term risks. While long-term investments, such as retirement accounts or real estate, may require patience to achieve substantial returns.

Always align your investment choices with your financial goals and timeline to safeguard your wealth and grow it over time.

Investment Choices: A Sampling

Investing wisely can be an effective way to accomplish financial objectives and increase wealth gradually. Here are some investment options.

- Mutual funds

Mutual funds pool money from multiple investors and invest it in a mix of stocks, bonds, and other assets. Professional fund managers oversee these funds, making them suitable if you’re seeking a hands-off approach to investing. They also provide easy access to investment opportunities without extensive knowledge or research.

- Real estate

Real estate investment can offer a stable income stream through rental properties or when the asset appreciates. Real estate investments provide a tangible asset to protect against inflation and generate passive income.

- Individual bonds

Individual bonds are debt securities that pay interest over a specified period. They provide a relatively stable income stream with less volatility than, say, stocks. A reliable way to preserve capital, bonds are suitable if you’re risk-averse and looking for predictable returns.

The three most common types of bonds are:

- Treasury: Also known as T-bonds, these low-risk, low-interest rate bonds are issued by the U.S. Treasury.

- Municipal: City or state governments issue these bonds to finance public projects, like infrastructure. Municipal bonds are normally exempt from taxes.

- Corporate: Private companies issue these bonds to raise capital. Compared to government-issued bonds, corporate bonds have higher risk and interest rates.

- Individual stocks

Investing in individual stocks means owning shares of a company. While stocks can be more volatile than other investments, they also offer the probability of significant returns if the company performs well. You may find this option appealing if you have a strong understanding of the market and the willingness to research and monitor individual companies.

- Real estate investment trusts (REITs)

REITs own or finance income-producing real estate, such as commercial properties, apartments, or healthcare facilities. Investing in these provides exposure to the real estate market without owning or managing properties directly. REITs can offer steady dividends and the potential for capital appreciation.

- Exchange-traded funds (ETFs)

ETFs are like mutual funds but trade on stock exchanges day in and day out, like individual stocks. They offer diversification across various assets and industries, giving you a cost-effective and efficient way to invest in the market.

- Certificate of Deposit (CD)

CDs are low-risk, time-bound deposits that banks offer with fixed interest rates and maturity periods. Typically, CD interest rates are higher than regular savings accounts. Plus, CDs with a longer-term offer higher interest.

You can use CDs to preserve capital while earning a guaranteed return as long as you keep your money untouched for the term. Otherwise, you might incur penalties.

- Index funds

Index funds aim to duplicate the performance of a detailed market index, such as the S&P 500. They offer broad market exposure and diversification involving various companies and sectors. Index funds are attractive if you want long-term growth with low expenses.

5 Investment Tips for Doctors

Adopting these investment strategies is paramount for securing your financial future.

- Manage your debt

Before making significant investments, prioritize paying off debts, such as credit card balances or student loans. Reducing debt will free up more funds for investing in the future, allowing you to build a stronger financial foundation.

- Diversify your investments

Spreading investments across different types of assets, like stocks, bonds, real estate, and alternative investments, is critical. Diversification helps mitigate risk and optimizes returns, as other asset classes perform differently under various market conditions.

- Have a long-term perspective

Adopting a long-term investment horizon lets you endure market fluctuations and benefit from compounding returns. This approach is especially advantageous if you’re a busy medical professional who may not have the time to manage your investments frequently and actively.

- Automate your investments

Setting up automatic contributions to investment accounts lays the groundwork for consistent investing. Automating your investments eliminates trying to time the market and helps maintain a disciplined approach to wealth-building.

- Review and adjust your portfolio periodically

Regularly assess your investment portfolio’s performance and modify it to align with your financial goals. The key is to stay on track and make informed decisions based on changes in your financial situation or the investment landscape.

Emboldening Doctors for Financial Success

Armed with invaluable insights and tips, you can now understand the importance of assessing risks, determining risk tolerance, and exploring the best investment options. By diversifying your investments wisely and maintaining a long-term perspective, you can unlock the full potential of your hard-earned wealth.

For personalized financial guidance, schedule a consultation with OJM Group. We are experts in tailoring financial planning to suit medical professionals like you.

If you want to learn more, don’t miss the opportunity to access tailored financial advice for doctors with free copies of resources from the OJM Group Bookstore.