MAY 2021 MARKET UPDATE

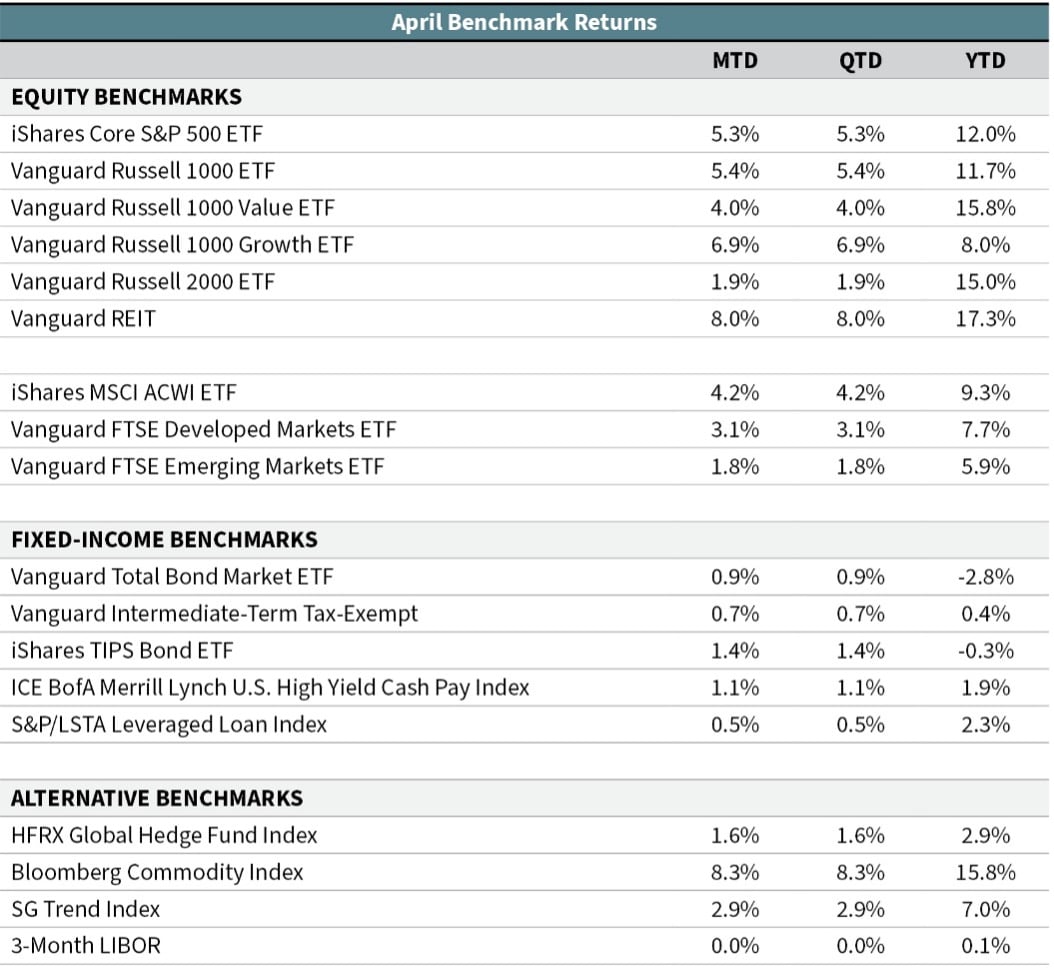

Equity markets notched their best month of the year in April. Most of the major asset classes were positive, with the U.S. dollar being the lone asset that lost value. However, unlike in the first quarter, larger-cap U.S. growth stocks led the charge upward. The Russell 1000 Growth Index gained 6.8% in April, while its value counterpart returned 4.0%. The broader S&P 500 gained 5.4%. Smaller-cap U.S. stocks posted a gain of 2.1% in April (Russell 2000 Index). For the year, value stocks and small-cap stocks remain the clubhouse leaders. Larger-cap U.S. value stocks (Russell 1000 Value Index) are up 15.7% year to date and smaller-cap U.S. value stocks (Russell 2000 Value Index) have gained 23.6%. The S&P 500 is now up 11.8% in the first four months of 2021.

Foreign equity markets were positive in April but did not keep up with U.S. stocks. Developed international stocks (Vanguard FTSE Developed Markets ETF) rose 3.1% and emerging-market stocks (Vanguard FTSE Emerging Markets ETF) gained 1.8% in April. Unhedged international investors were helped by a falling U.S. dollar during the month. The MSCI ACWI ex USA Index was about 1.5% better in U.S. dollar terms than it was in local-currency terms during April.

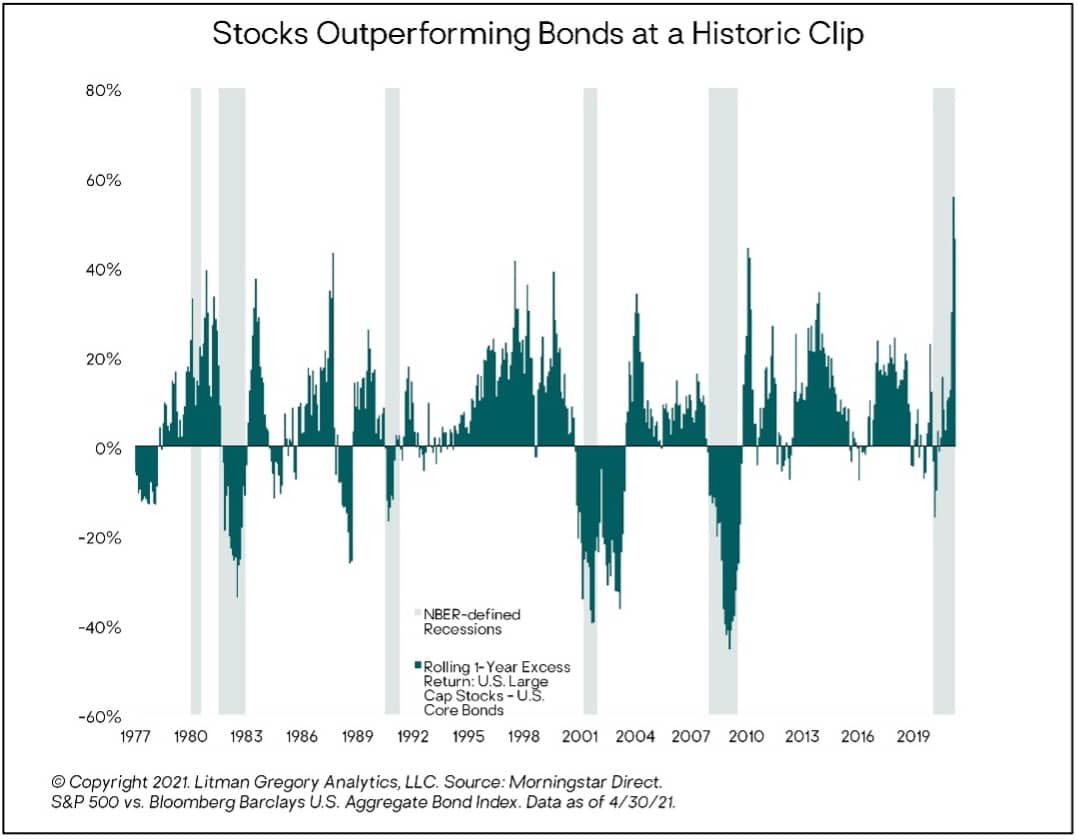

The upward march in interest rates paused during April. This helped core bonds post their first monthly gain of 2021. The U.S. core bond index gained 0.9% and the seven- to 10-year Treasury portion of the bond market returned 1.0% (iShares 7-10 Year Treasury Bond ETF). The return gap between stocks and bonds over the past 12 months is historically high (see the following chart). Bonds are slightly negative over the past year and the S&P 500 is up 46.0%. This current difference is greater than it has been in the past, but it is largely consistent with stock market rebounds off the bottom in past drawdowns around recessions (with 2002 being an exception).

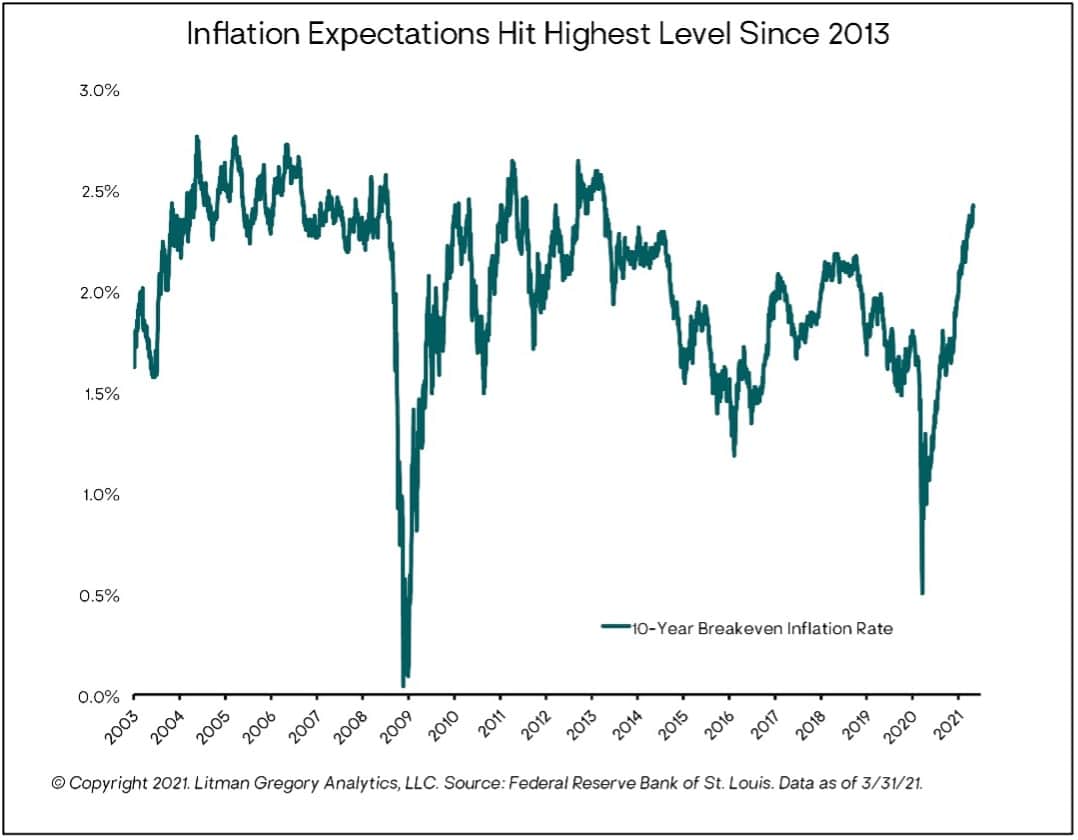

Inflation continues to be a central narrative in the markets. There are plenty of headlines alluding to higher prices throughout the economy—for example, lumber, corn, copper, semiconductors, home prices, and rental cars, to name a few. Some of these items show up in the surge of the U.S. producer price index (PPI), which recently had its largest 12-month gain in nearly a decade. Part of the rise in the PPI can be attributed to ongoing bottlenecks and supply chain issues, which many believe will prove to be temporary. It remains to be seen if companies will push through their higher input costs onto consumers on a sustainable basis. Inflation expectations did continue to grind higher in April reaching 2.4%. The 10-year breakeven inflation rate (which is a measure of what market participants expect inflation to be over the next 10 years, on average) hit its highest level since 2013.

Our view continues to be that the near-term spike in U.S. consumer price inflation, which we are starting to see, will prove to be short-lived as the year-over-year “base effects” compared to the pandemic lows 12 months ago unwind and current supply bottlenecks resolve as the global economy reopens on the back of increasing vaccinations. We do not expect a sharp and sustained rise in the core inflation metrics the Federal Reserve focuses on over the next few years at least. However, as we’ve also said, our portfolios have exposure to several asset classes and strategies that will benefit from global reflation, including an increase in inflation toward or above the Fed’s 2% long-term target.

—OJM Group Investment Team (5/6/21)