THE MONTH AT A GLANCE

- US stocks surged 9.2% in July—their best month since November 2020

- US core bonds gained 2.4%, which was by far their best month in 2022

- Inflation (CPI) in June registered a hotter-than-expected 9.1%

- US GDP was negative for the second straight quarter

- The Federal Reserve hiked its target range of the federal funds rate by 0.75% to 2.25%-2.5%

MARKET RECAP

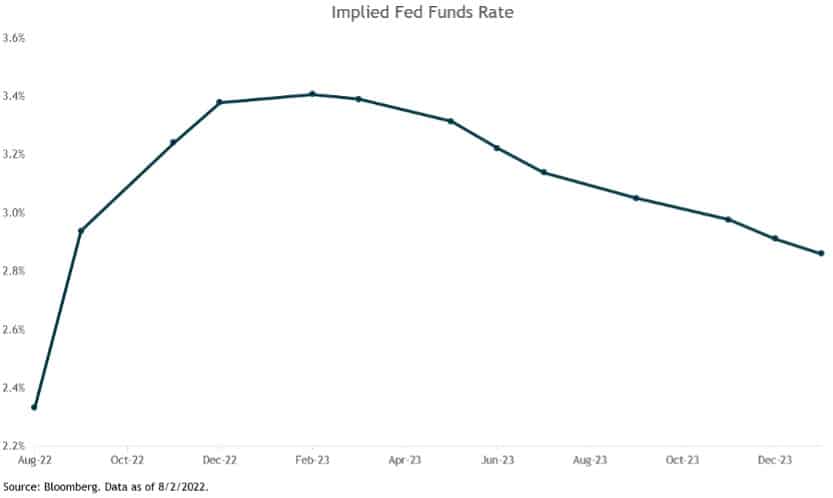

Headlines like “inflation at 40-year highs” and “US in a recession” were abundant in July. Despite the gloom, asset prices had their best month in years. The S&P 500 jumped an impressive 9.2%, while the Bloomberg US Aggregate Bond Index returned a respectable 2.4%. Not quite the outcome one might have assumed given the onslaught of negative news. However, given the speed of tightening by the Fed in recent months, investor expectations are shifting towards a potential Fed easing sooner rather than later. “Bad (economic) news is good (market) news” as it might cause the Fed to pivot from their aggressive hiking stance. The Fed funds futures market is currently pricing in a peak policy rate of 3.4% in February 2023 (100 basis points higher from its current level), with the Fed then cutting rates to 2.9% by year-end (chart below).

With the thought the Fed might be forced to return to a less restrictive monetary policy, investors bid up longer-duration assets in the month. The Russell 1000 Growth index returned 12% in July, which was its best month since April 2020. Their Value counterpart posted a solid gain of 6.6%. Value stocks remain more than 12 percentage points ahead of growth stocks this year. The Russell 2000 Index also notched a strong gain of 10.4% last month.

Developed international and emerging-markets equities underperformed US large cap stocks in July. MSCI EAFE gained 5.0% in the month, while emerging-markets stocks were slightly negative. EM stocks were dragged lower by Chinese equities. The MSCI China Index had a notable decline of 9.5% in July. A new wave of fines on Chinese tech companies hurt sentiment. And China’s ongoing real estate problems made headlines with news of some Chinese boycotting their mortgage payments on presold homes (it is common in China that mortgage payments are made before new properties are finished). In a July research note from Capital Economics, they write “the boycotts appear to reflect growing concern among homebuyers about the ability of indebted developers to deliver the homes they have sold, as well as some discontent about declines in new home prices, which have left many buyers sitting on paper losses.”

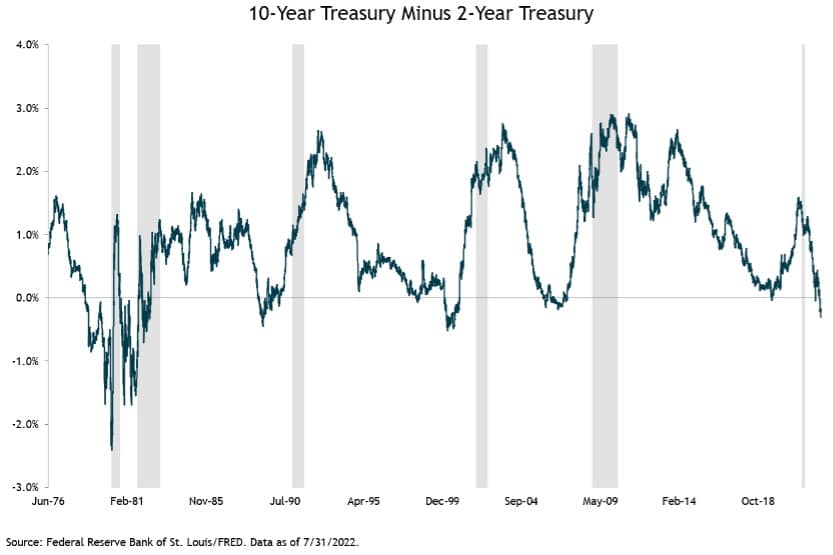

Despite a Fed Funds rate that was increased by 75 basis points, bonds rallied in July and posted their best monthly gain since August 2019. The Bloomberg US Aggregate Bond Index gained 2.4%. The 10-year rate fell to 2.67% at the end of the month. The US Treasury curve inverted again in July (all the way from six months to 10 years). The six-month T-bill is now yielding 2.91%, and the closely watched 10-year minus 2-year Treasury yield was negative 22 basis points at month end. You have to go back to 2000 to find this segment of the curve this deeply negatively sloped. Historically, negative yield curve slopes are harbingers of recession, although the timing until the recession onset has been highly variable.

NOTABLE EVENTS

Soaring inflation and slowing economic growth grabbed much of the headlines in July. But risk assets paid no heed to a higher-than-expected inflation print, a second consecutive negative GDP figure, and another 75 basis point hike by the Federal Reserve. The federal funds rate is now 2.25%-2.5%, which is FOMC participants’ estimate of the longer-run “neutral” rate (where they economy is operating at “full employment” without inflationary or deflationary pressures).

There is much debate as to whether the US economy is in a recession or not. Regardless of what side of the argument you are on, two things are clear: (1) momentum in the economy is slowing and (2) inflation is stubbornly high. Fed Chair Powell said in his recent press conference that he didn’t think the economy was in a recession (but one wouldn’t expect him to say otherwise); he cited the continuing strength in the labor market as counterevidence to a recession.

Part of the recent negative GDP figures can be attributed to inventory de-stocking, which shaved two percentage points off GDP growth in the second quarter. Ongoing supply chain issues resulted in many companies over-ordering goods—which was a significant contributing factor to strong GDP growth in the second half of 2021. Inventories aren’t typically such a large swing factor to GDP, however, in recent years it has played a much larger role from quarter-to-quarter given the uncertainty around supply chains. The more important factor at this point is the labor market. As long as the employment picture doesn’t weaken materially or the economy experience a significant negative shock, the Fed will continue to raise rates until they see inflation come back towards their target.