SEPTEMBER 2021 MARKET UPDATE

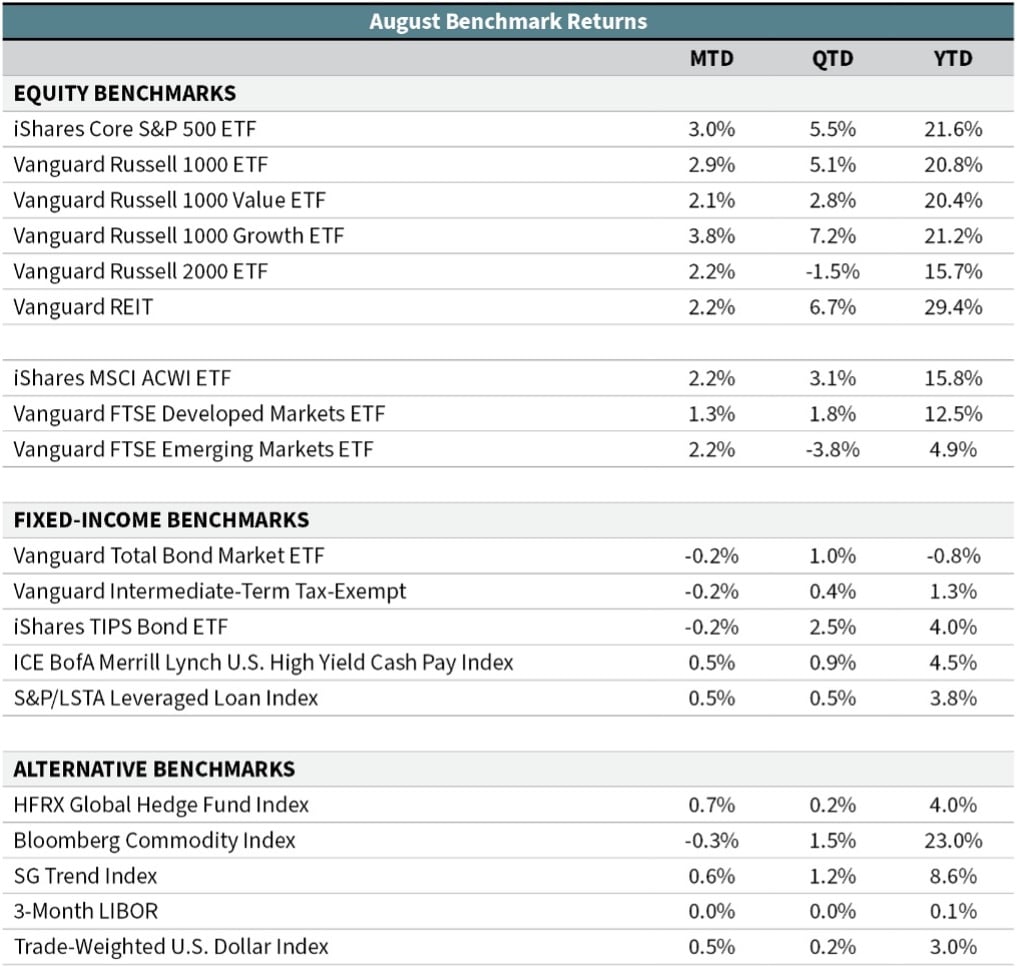

Global stocks churned 2.5% higher in August. The MSCI ACWI Index has had positive gains in seven straight months. Larger-cap U.S. stocks gained 3.0% (iShares Core S&P 500 ETF)—also their seventh straight positive month. International developed-market equities (Vanguard FTSE Developed Markets ETF) and emerging-market equities (Vanguard FTSE Emerging Markets ETF) were up similar amounts in August (1.8% and 2.6%, respectively).

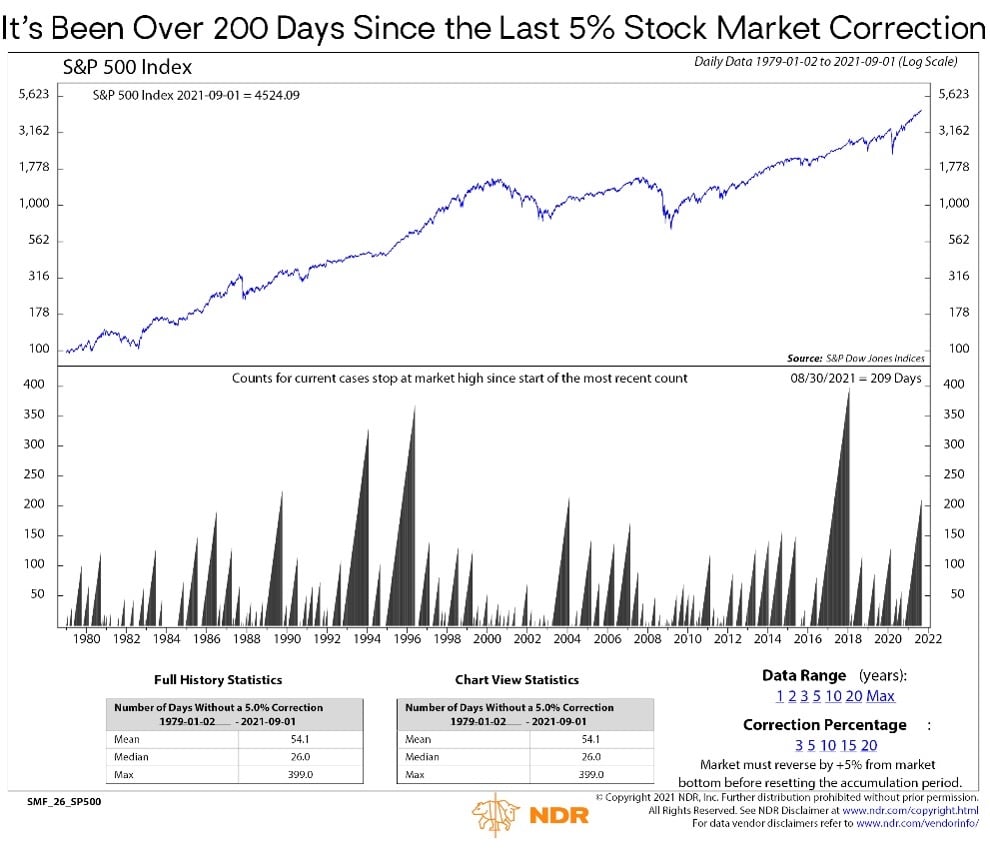

The winning streak for the U.S. stock market has largely been uninterrupted. Based on NDR’s calculations, the S&P 500 has not had a 5% drawdown since late October 2020 (more than 200 days ago). There are only a handful of instances in the last 40 years where the S&P 500 has gone longer without a 5% pullback (chart to the right). This is a notable stretch of calm.

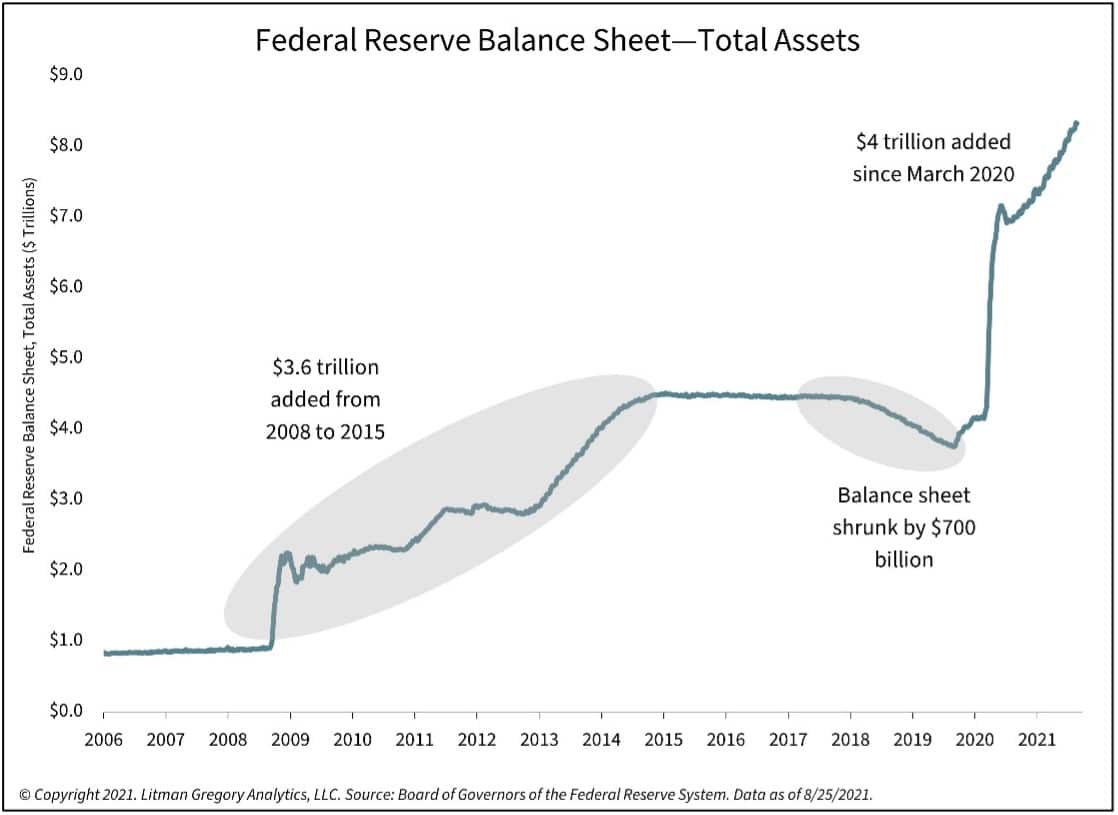

Central banks around the world can take credit for some of the pacification of the markets. The Federal Reserve continues to backstop the markets in the United States—and, in turn, investors are goaded into the market. The Fed Put is alive and well. The size and speed of the asset purchases by the Fed since the pandemic started makes the first three rounds of quantitative easing after the 2008 financial crisis look like child’s play. As shown in the chart below, the Fed’s balance sheet has increased by $4 trillion over the last 18 months (going from $4.2 trillion in March 2020 to $8.3 trillion in late August, and still increasing at $120 billion per month). In contrast, it took the Fed from late 2008 to early 2015 to add $3.6 trillion to their balance sheet.

Last week, Fed chair Jerome Powell remarked at his Jackson Hole speech that, “At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.” With the economy continuing to improve, tapering is on the table for the fourth quarter. Tapering does not mean the Fed will stop asset purchases, let alone that they are close to starting to raise interest rates.

When the Fed announced tapering in 2013, they reduced asset purchases from $85 billion per month to $75 billion per month—and it wasn’t until October 2014 that asset purchases were stopped. And it then took another three years for the Fed to start shrinking their balance sheet (selling assets). Over a period of about two years (2017 to 2019), the Fed shrunk its balance sheet by just $700 billion.

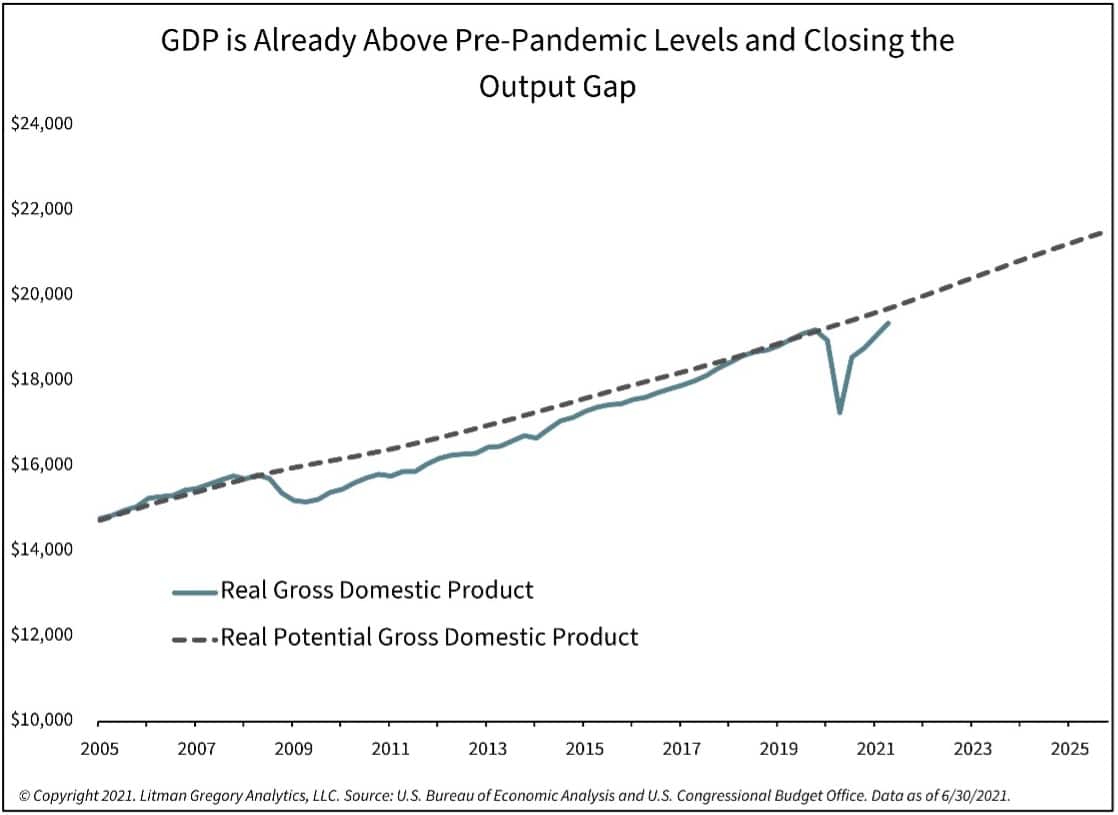

With the economy humming along (absent a massive resurgence in the pandemic or some other external shock) and already above pre-pandemic levels (see GDP chart on the next page), the Fed is at least planning to remove some liquidity from the markets in the coming quarters. Following the 2007–2009 recession, it took over a decade for the output gap to close (with actual GDP above estimated potential GDP). Assuming there isn’t another shock to the economy in the near term, the economy will reach its potential at a much faster clip than it did after the last recession. In fact, the current output gap is already smaller than what it was in 2013 when the Fed started tapering and is closer to the level it was when the Fed completely stopped asset purchases in late 2014.

In his speech, Powell was also clear that any reduction in asset purchases should not be interpreted as a “direct signal regarding the timing of interest rate liftoff.”

The Fed is in no hurry to raise interest rates and says it will not until the economy reaches the holy grail of “maximum employment” and inflation sustainably hits 2%. He reiterated that future rate hikes face a “different and substantially more stringent test” than what it will take for them to reduce asset purchases. Rate hikes remain out in the distance given the Fed’s current assessment of the labor market. The Fed’s challenge will be if inflation remains stubbornly well above 2% before their employment objective is attained.

Markets took Powell’s comments in stride and have remained relatively calm since his speech. Treasury yields fell modestly in the days following and ended August slightly higher than where they started the month. This resulted in a small loss of 0.2% for the U.S. core bond index in the month (Vanguard Total Bond Market ETF). Credit spreads of riskier bonds tightened in August—resulting in a gain of 0.5% for both high-yield and floating-rate loan indexes (the ICE BofA ML U.S. High Yield Cash Pay Index and the S&P/LSTA Leveraged Loan Index, respectively). Powell’s comments were largely as expected by the markets. But in the months and quarters ahead, the storyline will be around the Fed’s exit from ultra-loose policy.