MARCH 2021 MARKET UPDATE

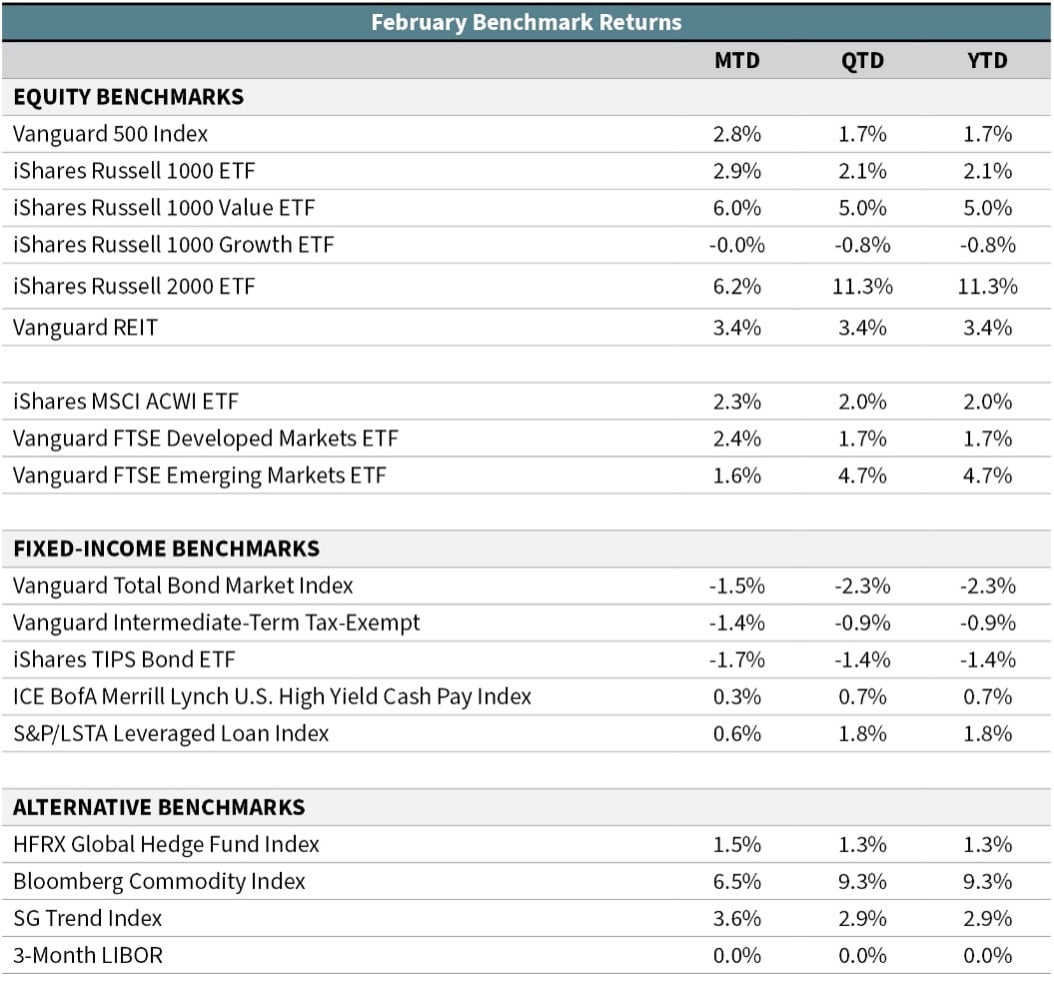

Equity markets started the month of February on strong footing with a 6% gain in the S&P 500 over the first two weeks. The S&P 500 then gave back some of those returns with a loss during the final week of the month; however, overall, it still delivered a positive gain in February of 2.8%. Smaller-cap U.S. stocks fared even better with a return of 6.2% last month—bringing their year-to-date gain to 11.3% (iShares Russell 2000 ETF). Foreign equity markets lagged U.S. markets in February. Developed international stocks trailed slightly with a gain of 2.4% (Vanguard FTSE Developed Markets ETF), while emerging-market stocks returned 1.6% (Vanguard FTSE Emerging Markets ETF).

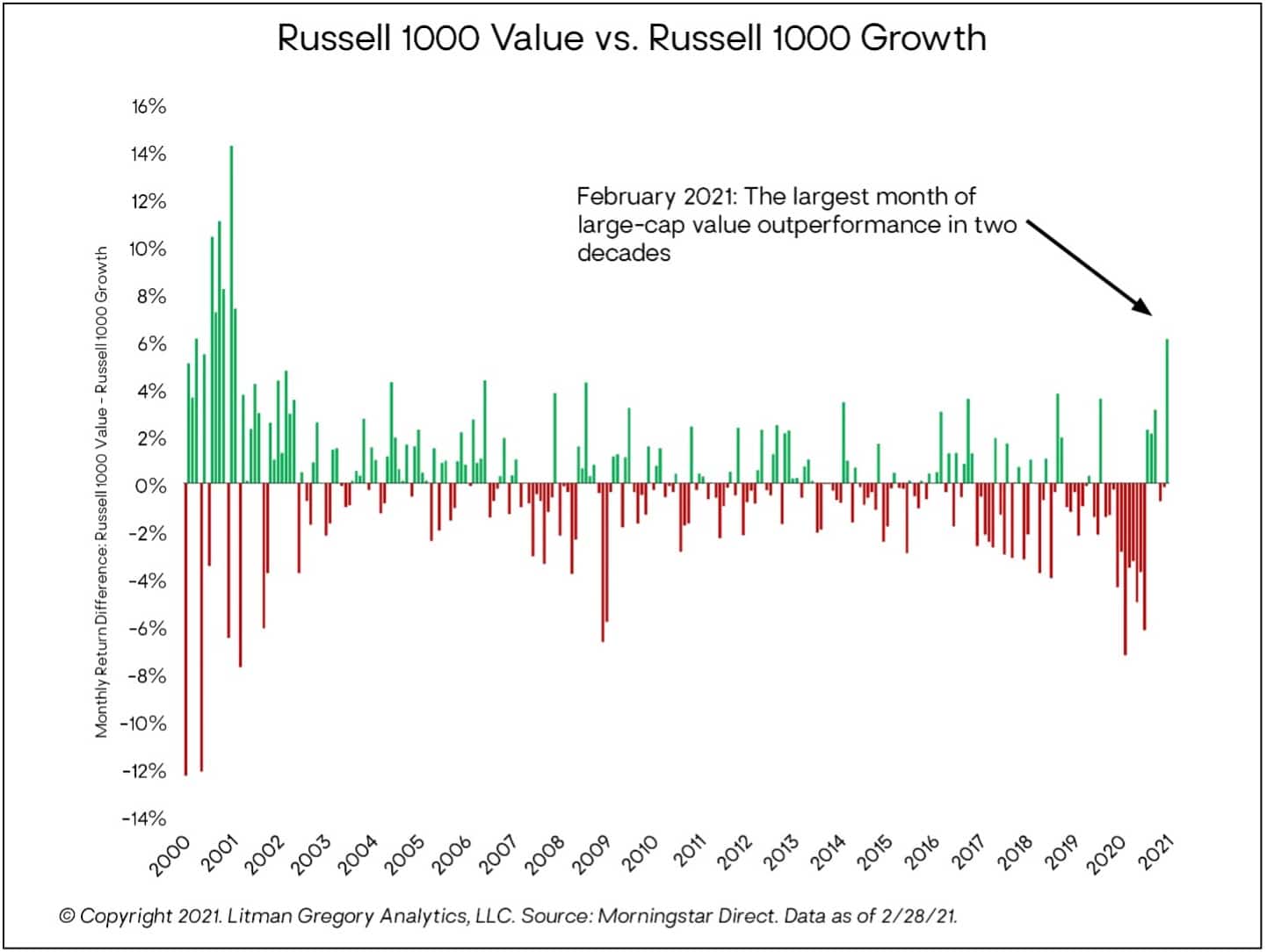

Volatility during the last week of the month can be partly attributed to rapidly rising interest rates. The 10-year U.S. Treasury hit a level not seen since before the pandemic started a year ago. The 10-year yield briefly broke through 1.60% on February 25 before eventually closing at 1.54% that day. While the higher rates are largely seen as a consequence of an improving economy, the nearly 40-basis-point rate increase during the month spooked investors—particularly those invested in assets that have benefited from lower rates (longer-duration assets). For example, growth stocks sold off more than 6% in the second half of February as rates really started accelerating higher. Over the same two-week stretch, value stocks were flat. During the full month, the Russell 1000 Value Index outperformed its growth counterpart by 607 basis points, which was its best relative month of outperformance in 20 years.

As bond yields jumped higher, it led to the 10-year Treasury rate finally reaching parity with the S&P 500 dividend yield. The benchmark 10-year rate has been below the dividend yield of the S&P 500 for about 18 months. The yield premium for the S&P 500 is now almost gone. However, roughly half of the stocks within the S&P 500 still have a higher yield than the 10-year Treasury. Prior to yields collapsing after the 2008 financial crisis, it was uncommon for a meaningful segment of the S&P 500 to have a superior yield to the 10-year Treasury.

Unsurprisingly, rising yields hurt bond indexes in February. The U.S. core bond index fund (Vanguard Total Bond Market Index) lost 1.5%, while the iShares 7-10 Year Treasury Bond ETF fell 2.4%. These funds have lost 2.3% and 3.4%, respectively, so far in 2021. Flexible and absolute-return-oriented bond funds fared better during the month, with the majority of the active funds posting positive returns. Floating-rate loans were also positive with a gain of 0.6% last month (S&P/LSTA Leveraged Loan Index). They have now gained 1.8% year to date.

—OJM Group Investment Team