November Investment Commentary

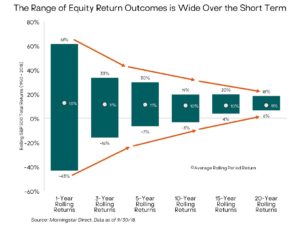

The wide range of stock market outcomes over brief time periods (see chart) makes it nearly impossible to predict what will happen next month, next quarter, or next year. And even if you do get it right once and sidestep a large market decline, you must make another successful timing bet to re-enter the market. We don’t think this is a repeatable investment strategy that would be successful over a long-term investment horizon. Since 1950, in a given 12-month period, US stocks have increased by as much as 61 percent and fallen as much as 43 percent. However, the range of outcomes for stocks narrows as investor’s time horizon lengthens. For example, over 20-year periods, the market return has ranged from a positive 6 percent at the low-end to 18 percent at the high-end. But to enjoy those positive long-term returns you had to remain disciplined and stay the course during the inevitable painful/scary shorter-term market drops.

There were many negative headlines in October and lots of things to seemingly be concerned about; however, US stocks fell only about 10 percent from their highs in September (after rising nearly 400 percent since March 2009).

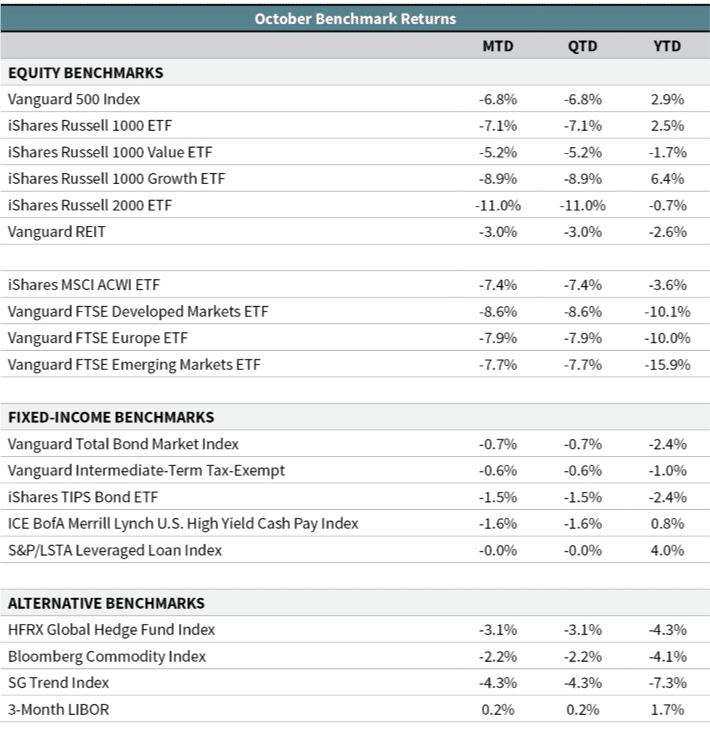

Beyond the stock market, October may have felt more volatile than usual due to losses in fixed-income markets, which many investors rely on to offset equity losses. US core bonds fell 0.8 percent in October, while high-yield bonds fell 1.6 percent and floating-rate loans had very small losses. A 60/40 portfolio of US stocks and core bonds fell over 4 percent in October, which is one of the larger drawdowns in the post–financial crisis period. It remains our expectation that low starting bond yields are unlikely to offset equity market losses to the same extent we’ve historically seen during bear markets. This is one reason we have invested in an array of alternative investments.

The recent volatility in the markets has understandably come with questions, such as, “Is this the start of deeper losses to come?” and if so, “What changes are being made to portfolios?” We don’t know if October is the start of further losses or not. We do know that stocks are volatile and at times go down, despite what we’ve seen over the last nine years. The market turbulence in October has not led us to make any portfolio changes. But, as we close out 2018, our team will be executing changes across our portfolios either through rebalancing or tax loss harvesting.

—OJM Group Investment Team (11/6/18)