DECEMBER 2021 MARKET UPDATE

THE MONTH AT-A-GLANCE

- Equity returns were negative in November after faltering late in the month.

- Investors grappled with the uncertainty around the Omicron variant.

- The key inflation figure for the Federal Reserve rose 4.1% in October.

- Amid continued higher inflation readings, Fed chair Jerome Powell signaled a faster end to stimulus than what was previously laid out.

MARKET RECAP

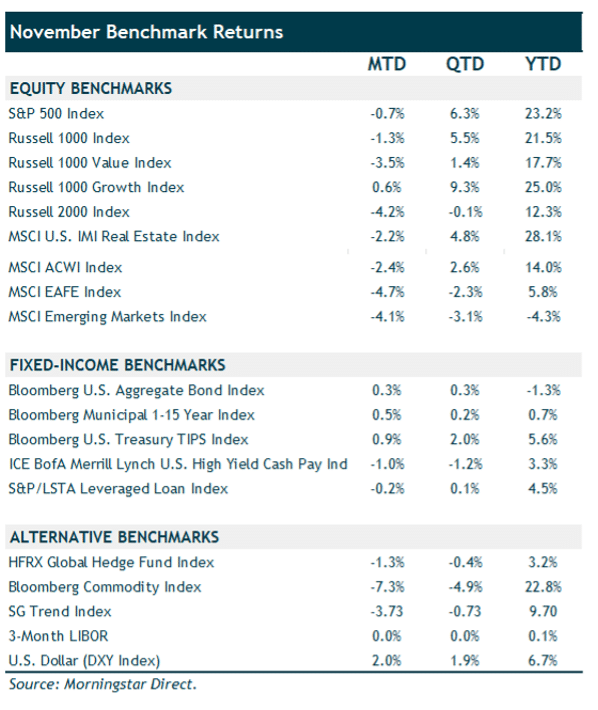

Equity markets were largely positive through Thanksgiving Day but finished the month negative thanks to a rout on the Friday after Thanksgiving. Ned Davis Research noted that it was the worst Friday after Thanksgiving on record for the S&P 500. Fears around a new COVID-19 variant (omicron) prompted the selloff and injected uncertainty into what was a largely complacent market. Then on the final day of November, Chair Powell’s testimony before the Senate Banking Committee caught some investors wrong-footed as his inflation outlook was relatively more hawkish. Some market participants may have thought an emerging variant would provide cover for the Fed to remain patient with its tapering plans; however, Powell’s comments indicate a stronger desire to keep inflationary pressures at bay, including possibly accelerating the pace of tapering and completing it in early 2022 rather than mid-2022. The S&P 500 finished the month down 0.69%. U.S. small-cap stocks fared worse with a loss of 4.17%. Foreign equity markets were negative in November and lagged U.S. stocks. Developed international stocks fell 4.65%, while emerging-market stocks lost 4.08%. A rally in the U.S. dollar during November was a headwind for foreign equity returns. The dollar appreciated 2% for the month, which cut into returns for dollar-based investors. The U.S. dollar (DXY Index) is now up 6.69% so far in 2021, proving to be a headwind for foreign assets.

The MSCI ACWI ex USA Index is up 9.34% in-local currency terms but up just 3.54% in dollar terms so far this year. Both figures trail the year-to-date performance of the S&P 500, but the dollar strength has certainly been a challenge.

In the bond markets, the 10-year Treasury yield decreased in November. The yield had been increasing modestly through Thanksgiving—going from 1.55% at the start of November to 1.67% on November 23. However, during the risk-off environment in late November, the 10-year Treasury fell 24 basis points to 1.43% at month-end. The yield curve flattened as the market continues to increase its expectation around Fed rate hikes in 2022. Despite concerns over higher inflation and a greater number of hikes next year, the core bond index eked out a gain of 0.30% in November.