NAVIGATING FINANCIAL HEADWINDS IN OUR OCTOBER 2023 MARKET UPDATE

THE MONTH AT-A-GLANCE

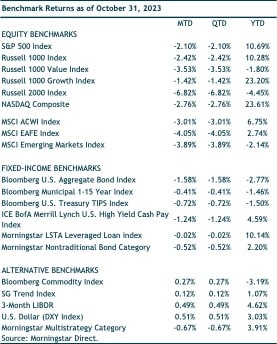

- The S&P 500 fell for the third straight month—falling more than 10% from its summer high

- Smaller cap stocks (Russell 2000 Index) fared the worst with the Russell 2000 dropping 6.8%

- Global tensions escalated following terrorist attacks in Israel

- Foreign markets (MSCI ACWI ex. U.S.Index) modestly underperformed US counterparts as they lost closer to 4% in the month

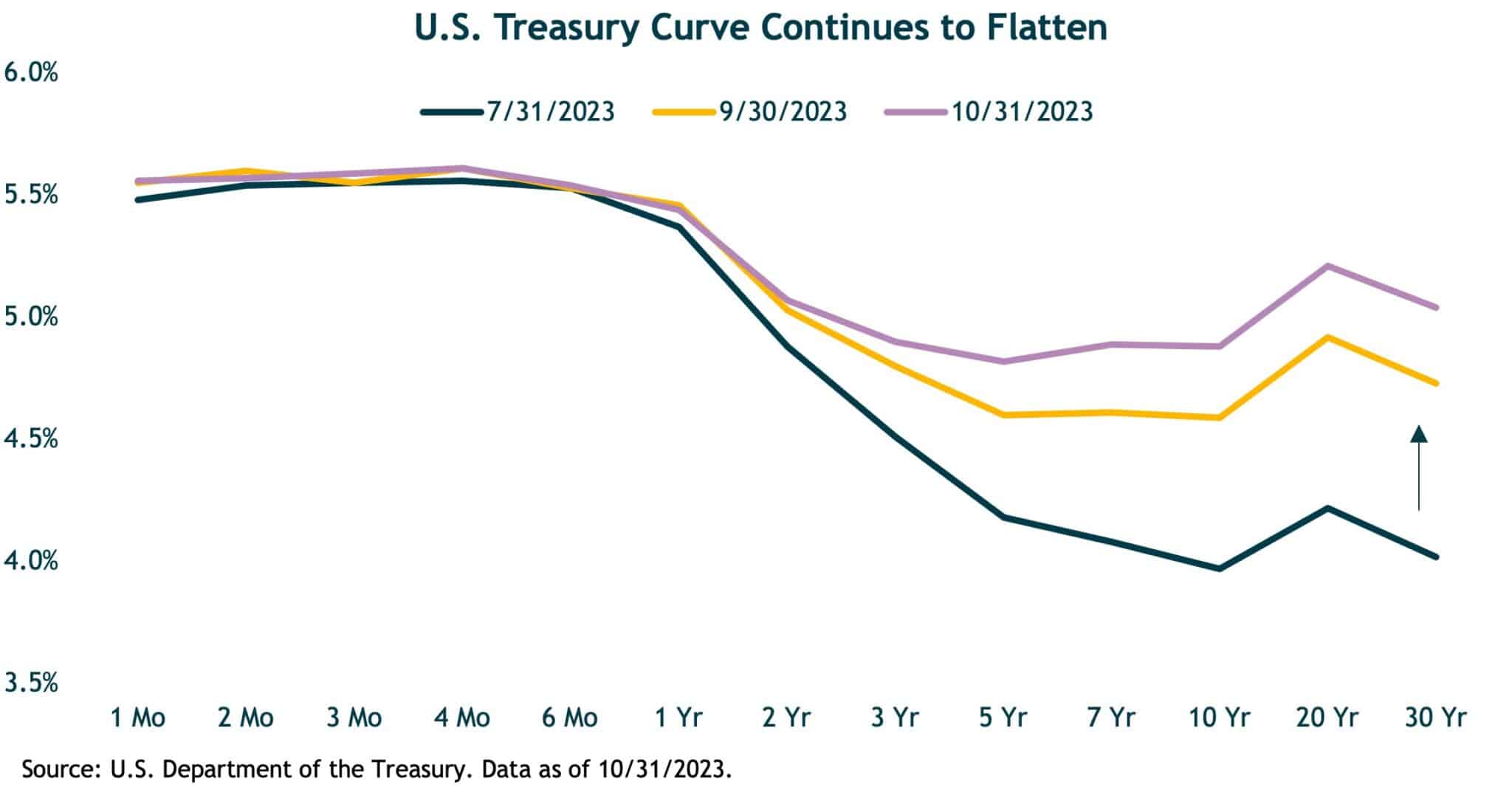

- Interest rates moved higher in the month with the 10-year US Treasury briefly touching 5%

MARKET RECAP

Looking at October’s market downturn, stocks and bonds fell simultaneously amid higher interest rates and intensified global tensions. The S&P 500 Index lost 2.1% in October—bringing its cumulative loss since the end of July to 8.3%. The Bloomberg U.S. Aggregate Bond Index fell 1.6% in October, which was its 6th straight month in the red.

Despite the higher rates, growth stocks outperformed value stocks last month. The Russell 1000 Growth Index fell 1.4% compared to a drop of 3.5% for the Russell 100 Value Index. Value stocks are now negative on the year (down 1.8%). The Magnificent Seven stocks saw their paths diverge during the month. Microsoft, Amazon.com, and Meta Platforms notched gains. On the other side, Apple, NVIDIA, Alphabet, and Tesla experienced negative returns. Tesla was the worst performer among the group with a fall of nearly 20%.

Foreign equity markets underperformed U.S. markets. The Dollar was relatively flat during the month—as it appreciated sharply against the Yen but depreciated versus the Euro. Developed international stocks (MSCI EAFE Index) dropped 4.1%, while emerging-market stocks (MSCI Emerging Markets Index) fell 3.9%. The eurozone economy decelerated further to start the fourth quarter—with the HCOB Flash Eurozone PMI Composite falling to a 35-month low.

Interest rates moved higher during October—particularly the long end of the U.S. Treasury curve. The longest dated maturities (10+ years) saw their yields increase by 0.3 percentage points during the month. Since the Fed last hiked rates (late July), the benchmark 10-year Treasury rate is up nearly a full percentage point. Long-term Treasuries continue to suffer. The ICE U.S. Treasury 20+ Year Index fell 5.4% in October—bringing its year-to-date loss to over 14%. Long bonds are in a historic drawdown with the aforementioned index nearing a cumulative loss of close to 50% over the last three years.

NOTABLE EVENTS

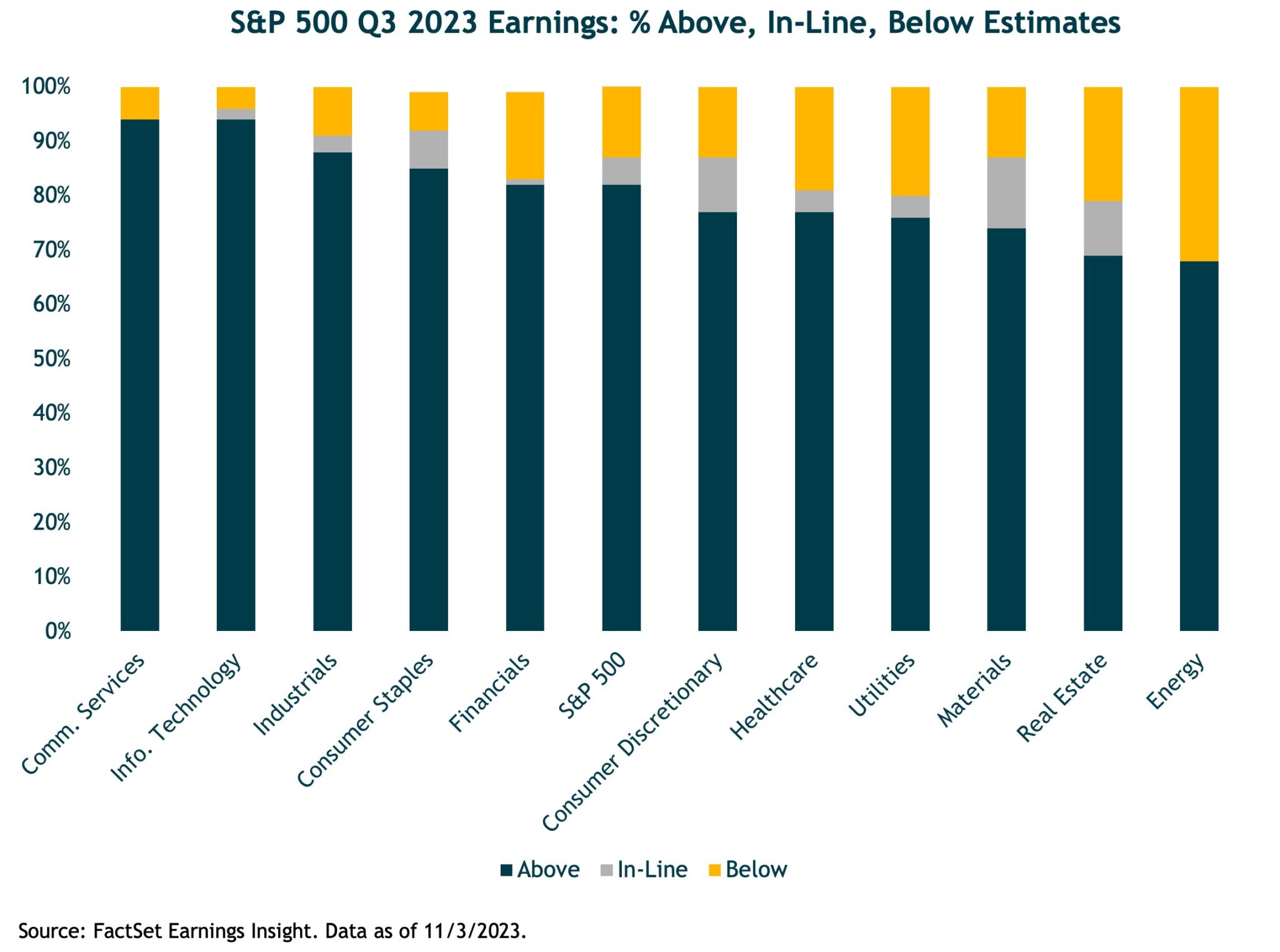

Third quarter earnings season is in full swing for U.S. companies. Based on early November FactSet data, 82% of S&P 500 companies have reported earnings per share that are above estimates. This is above the longer-term surprise average in the mid-70% range. The current trailing 12-month GAAP EPS estimate is for $189.57, which would be a 1.3% year-over-year increase. If this number holds, it would be the first increase since a year ago.

The most noteworthy news came just days after month-end, when the Fed announced for the second consecutive meeting that it will hold interest rates steady. Rates remain in a range of 5.25% to 5.50%, the highest level in 22 years. The Fed’s decision to pause again surprised no one. “Higher for longer” remains the theme as the Fed remains resolute in its goal of returning inflation back to its 2.0% target. The Fed is walking a fine line as raising rates too far could hurt the economy, while doing too little runs the risk of inflation becoming entrenched. But given the speed and magnitude of rates hikes over the past year and a half, the Fed is watching to see if the effects of tightening are still playing through the system. The Fed has one more meeting in mid-December and current market consensus is that rates will remain unchanged, though the Fed has messaged that future rate hikes are not off the table.