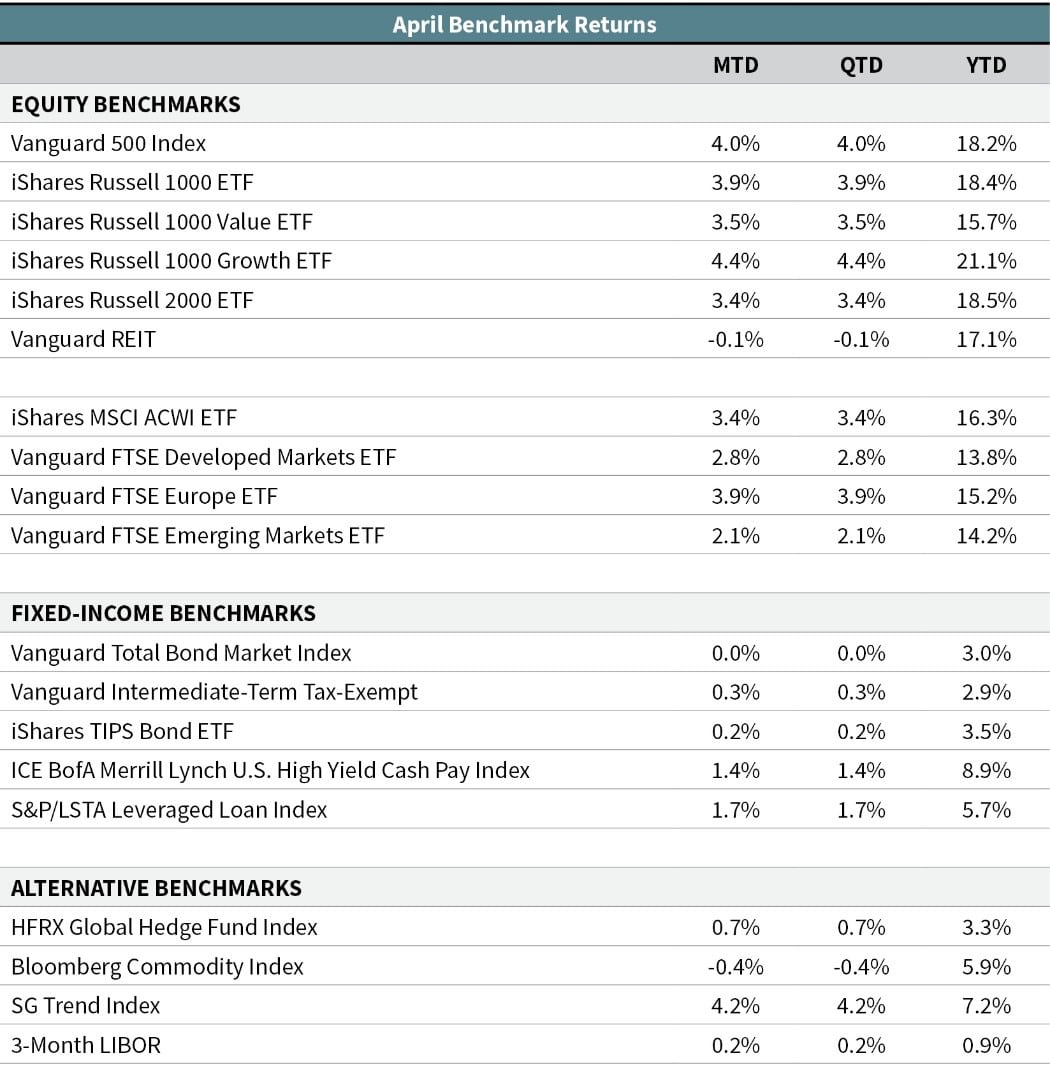

Stock markets around the world continued their upward climb in April. An index of global equities, the MSCI ACWI, is up over 16 percent in the first four months of 2019. This is its best four-month start to a year ever (going back to its inception date in 1988). The story is the same for domestic stocks. Larger-cap U.S. stocks (Vanguard 500 Index) have surged 18 percent this year—also their best start in over 30 years. Fears about a global recession, further interest rate hikes, a hard Brexit, and a U.S.-China trade war seem like distant memories. The reversal in equity markets and investor sentiment from the end of 2018 has been remarkable.

U.S. stocks led foreign equity markets in April. Large-cap stocks gained 4 percent and small-cap stocks (iShares Russell 2000 ETF) rose 3.4 percent for the month. Developed international stocks had gains of 2.8 percent (Vanguard FTSE Developed Markets ETF), with Europe helping the cause with a 3.9 percent return (Vanguard FTSE Europe ETF). Emerging-market stocks were also positive in April, notching a 2.1 percent gain (Vanguard FTSE Emerging Markets ETF). All major equity asset classes are up double digits for the year.

Interest rates across the U.S. Treasury curve finished the month pretty much where they started. U.S. core investment-grade bonds were flat in April (Vanguard Total Bond Market Index). Meanwhile, credit spreads continued to tighten after widening late last year. This led to continued price gains for the high-yield market in April, which is now up nearly 9 percent this year (ICE BofA Merrill Lynch U.S. High Yield Cash Pay Index). Floating-rate loans have also performed well and are up 5.7 percent in 2019 (S&P/LSTA Leveraged Loan Index).

—OJM Group Investment Team (5/6/19)