MAY 2022 MARKET UPDATE

The Month at a Glance

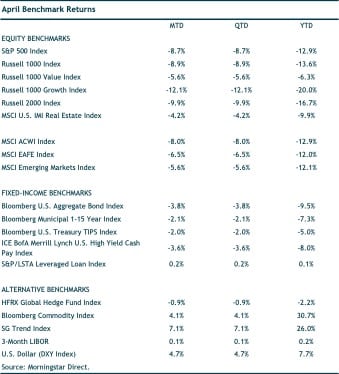

- Both equities and fixed income posted large losses for the month

- US core bonds fell 3.8% in April—posting their fifth consecutive month of losses

- The US dollar surged 4.7% last month, and has now appreciated 7.7% this year

- Despite the stronger dollar, foreign equity markets outperformed US indexes

MARKET RECAP

The S&P 500 had its worst month since the onset of the pandemic. The index dropped 8.7%—bringing its year-to-date loss to 12.9%. Small-cap stocks fared worse with a fall of 9.9%. With interest rates jumping higher in the month, value stocks outperformed growth stocks. The Russell 1000 Value index fell 5.6% compared to a drop of 12.1% for the Russell 1000 Growth index. Value stocks are ahead of growth stocks by 13 percentage points through the first four months of 2022. Increasing rates have had a chilling effect on P/E multiples—with higher multiple growth stocks taking the bigger hit. The forward P/E multiple for on the Russell 1000 Growth has contracted from around 33x at the start of the year to 25x at month end. Value stocks had more of a cushion—resulting in a smaller two-point contraction of their multiple (from 17x to 15x on the Russell 1000 Value index).

Despite a stronger US dollar, developed international equity markets fared better than domestic markets. Developed international stocks fell 6.5%, while emerging-markets stocks lost 5.6% in April. Year-to-date, the three major equity indexes have roughly the same returns. The S&P 500 is actually the laggard with a loss of 12.9%, compared to losses of 12.0% and 12.1% for MSCI EAFE and MSCI Emerging Markets, respectively.

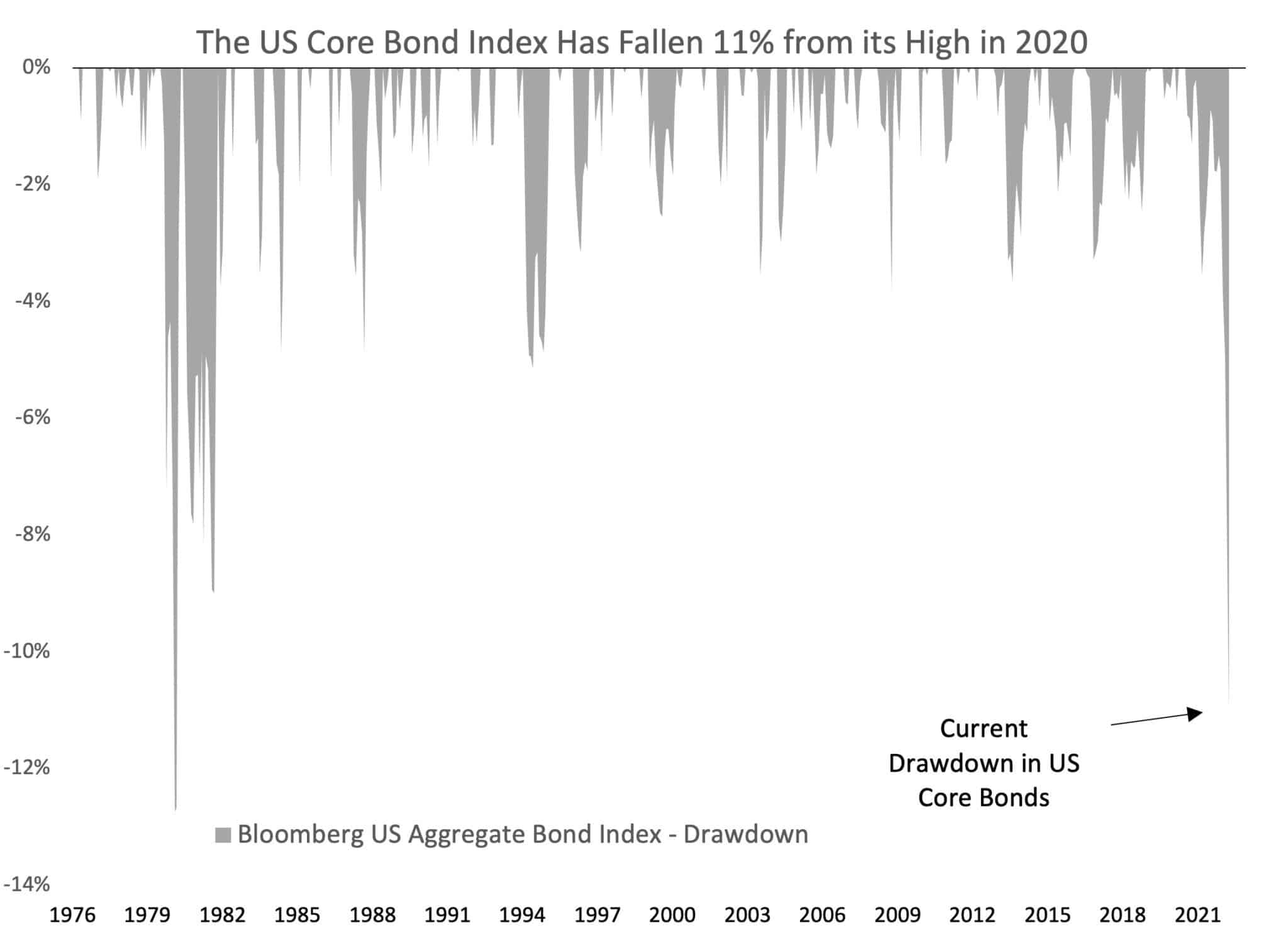

While investors have historically relied on bonds as portfolio ballast in times of stock market stress, that has not been the case so far in 2022. The core bond index dropped 3.8% in April, which was the third worst month on record. The US core bond index is currently in one of its worst drawdowns in its history (see chart below). It has fallen over 11% since August 2020. Only during a period in 1979-1980 has the index had a larger drop.

With both stocks and bonds in correction territory, there has not been anywhere to hide among the traditional asset classes. Among the different asset classes currently in portfolios, only managed futures have positive gains so far this year. Managed futures have benefited from the negative trend in bond prices and positive trends in commodities and the dollar.

NOTABLE EVENTS

Many investors turned their attention to the US Federal Reserve and future interest rate hikes. The Fed was widely expected to increase rates by 50 basis points at their early May FOMC meeting. And as we are writing, the Fed did in fact announce a half-percentage-point increase—bringing the Fed Funds target rate to 0.75%-1.0%. The Fed also announced plans to shrink its $9 trillion balance sheet starting next month. In his press conference, Chair Powell said that the committee is not “actively considering” raising interest rates by 75 basis points. The markets seemed to cheer on this statement, with investment commentators pointing to it as the catalyst that sent stocks up nearly 3% on the day. (However, as we finalize these comments the following day (April 5), stocks are giving back those gains and the 10-year Treasury yield has spiked above 3%. Suffice it to say, markets remain volatile!)

One surprising event in April was the negative real GDP print for the first quarter of 2022. GDP fell 1.4% compared to a consensus estimate of around 1% growth. Two factors, trade and inventories, pulled GDP lower. A huge increase in the US trade deficit (exports minus imports) subtracted 3.2% from GDP. And after a strong build in inventories in the fourth quarter of 2021, businesses continued to do so in the first quarter but at a much slower rate. The slower inventory build cut 0.8% from GDP. Excluding these two historically more volatile factors show an economy that grew mid-2%. Consumer spending, the most important driver of US economic growth, grew 2.7% in the quarter. Personal consumption makes up greater than two-thirds of US GDP and remained resilient in the first quarter—which is one reason many investors looked passed the negative GDP print.

INVESTMENT TAKEAWAYS

We have been positioned within our fixed income allocation to benefit relative to the core bond index in a period of rising rates. We have done so by investing away from the Agg index using a mix of active core bond funds that can manage duration, and flexible active bond funds that can take advantage of other (non-core) areas of the bond market.

We have seen this play out in the first four months of 2022 as the 10-year US Treasury rate has nearly doubled from its year-end level around 1.5%. The majority of active core and non-core bond funds are outperforming the index this year.

The logical follow-up question is when to add duration back into the portfolio (i.e., add more core bond exposure). There isn’t an easy way to answer this, but the path of inflation and rate hikes, as well as where the neutral rate resides, are key questions we are debating. The Fed currently has the neutral rate at 2.4% (it’s also known as the equilibrium rate that is neither too stimulative nor restrictive on economic growth). Nobody truly knows where that rate level is. Some investors believe the neutral rate is lower, while others believe it is higher. It is important because, in simple terms, if the neutral rate is, say, 1.5%, then monetary policy will become overly restrictive much sooner than the Fed realizes and would likely result in an economic slowdown if not a recession. On the other hand, if the neutral rate is 4%, then the Fed should be able to raise rates significantly without hindering economic growth too much.

The point at which monetary policy switches over to being too restrictive is a macroeconomic debate in which we don’t currently have a strong view. We continue to research multiple perspectives on this question. Broadly speaking, our portfolios remain more tilted towards a recovery in global economic growth and “risk asset” prices over at least the next six to 12 months, rather than a near-term recession. But given the inherent uncertainty, we structure our portfolios to be diversified across multiple asset classes and investment strategies to be resilient across a wide range of potential outcomes.