AUGUST 2023 MARKET COMMENTARY

THE MONTH AT-A-GLANCE

- U.S. stocks, and global equities more broadly, continued their winning ways in July. The S&P 500 gained 3.2%, developed international stocks (EAFE) were up 3.2%, emerging markets returned 6.2%, and the Russell 2000 gained 6.1%.

- Hope grew for an economic “soft landing” as U.S. inflation continued to fall while economic growth (Q2 GDP) was stronger than expected.

- Investor sentiment in the U.S. is now extremely optimistic. At extremes, this is a contrary indicator for future market returns.

- While the recent growth and inflation news is encouraging, we remain concerned about the elevated risk of an economic and earnings recession within the next year, which is not adequately discounted in the S&P 500 at current levels.

MARKET RECAP

Global equity markets rallied in July, with emerging markets leading the way. The MSCI EM Index gained 6.2%, propelled by an 11% gain in Chinese stocks. Both the S&P 500 and MSCI EAFE indexes gained around 3.2%. In a sign of a broadening market rally – i.e., beyond the Magnificent Seven mega-cap U.S. tech/AI stocks – the small-cap Russell 2000 Index outperformed the S&P 500, returning 6.1% for the month.

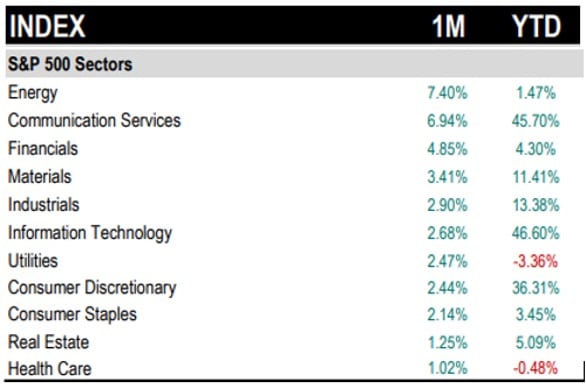

The S&P 500 hit a 15-month high at month-end and is up 21% for the year. All 11 S&P 500 sectors rose in July, led by Energy. However, as the table below shows, the divergence in returns across sectors for the year to date has been extreme. The top three sectors – Information Technology (top holdings: Apple, Microsoft, Nvidia), Communication Services (Alphabet, Meta) and Consumer Discretionary (Amazon, Tesla) – have returned 36% to 47%. Meanwhile, the bottom three sectors – Utilities, Health Care and Energy – have been negative or barely positive.

In the bond markets, U.S. interest rates moved a bit higher in July as the Fed hiked the fed funds rate another 25bps. The 10-year Treasury yield ended the month at 3.95%, breaching 4.0% early in the month (and again in early August). The Bloomberg US Aggregate Bond Index was flat for the month. Riskier credit performed well, with the ICE BofA US High Yield market gaining 1.4% in July.

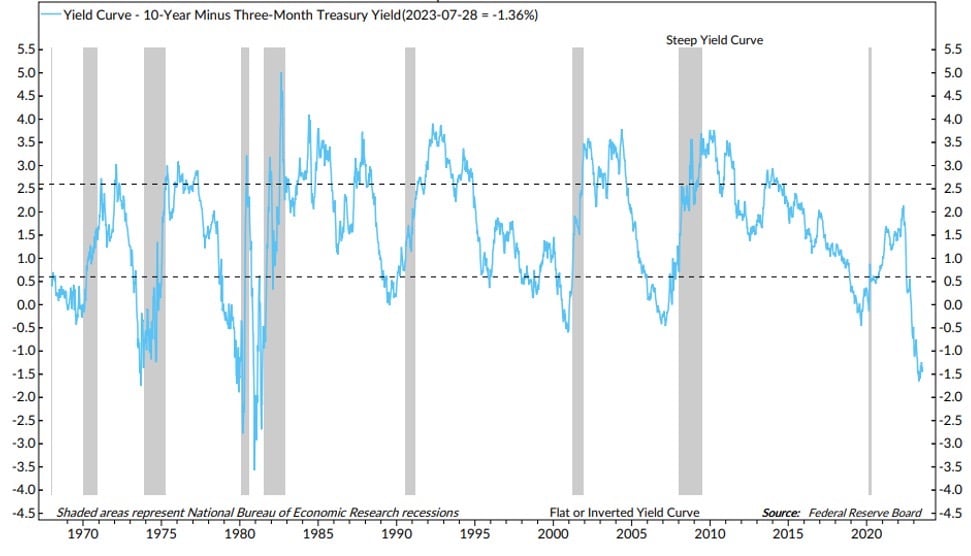

The Treasury yield curve remains deeply inverted—with short rates meaningfully higher than those at the long end—a key recessionary leading indicator, historically.

NOTABLE EVENTS

Big picture, the key driver of the strong equity market in July was good economic news on both the growth and inflation fronts, which continues to positively surprise market participants. (See chart below.) Many investors have been positioned for a recession this year as the Fed has aggressively tightened monetary policy in order to bring core inflation down to its 2% target. But the economy and labor market have remained resilient in the face of 525 basis points (5.25%) of Fed rate hikes since last March. The economic data in July continued to support the soft-landing narrative: that the Fed can bring inflation down to target without pushing the economy and corporate earnings into a sharp recession.