FEBRUARY 2021 MARKET UPDATE

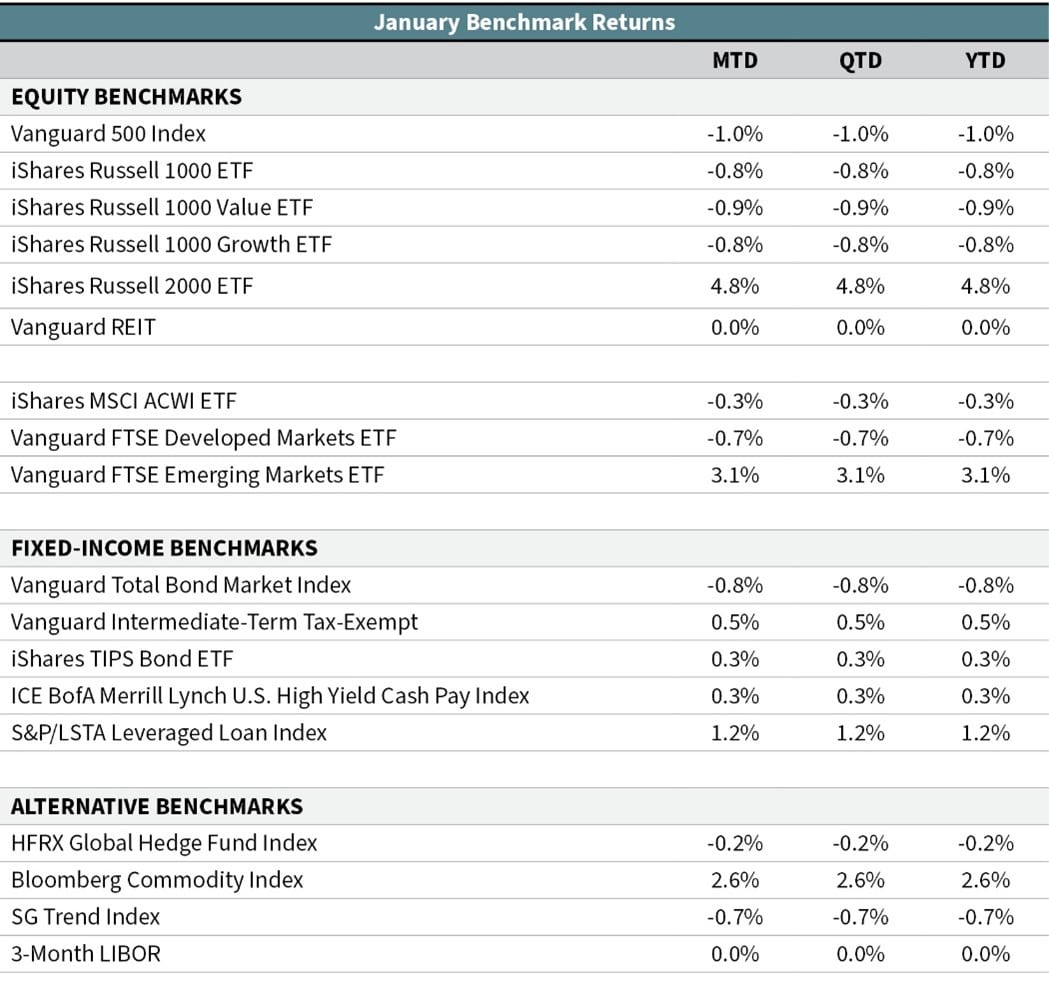

The S&P 500 ended January with an uneventful loss of 1%. However, it was anything but an uneventful month. With everyone happy to put 2020 in the rearview mirror, the new year didn’t offer much reprieve when, on January 6, the U.S. Capitol was stormed by rioters. Fortunately, there was no violence when Joe Biden was inaugurated as the 46th President of the United States on January 20.

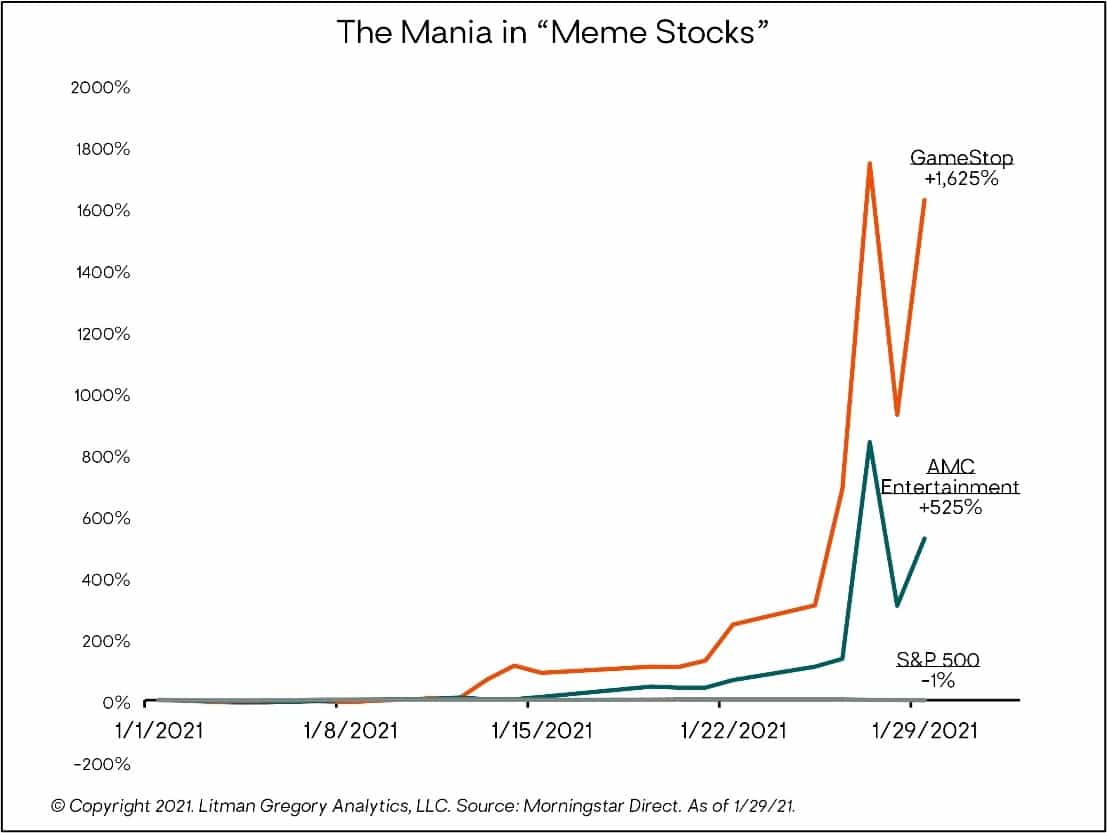

The last week of the month was capped off by speculative behavior in stocks such as GameStop and AMC Entertainment. Retail investors, many of whom banded together on the Reddit forum called WallStreetBets, piled into individual stocks and call options en masse. And with heavy short interest in these stocks, the heavy buying by retail investors led to a short squeeze and sent stock prices soaring. The meteoric rise of GameStop’s stock made it one of the largest holdings in the iShares Russell 2000 ETF, which gained 4.8% in January. At one point, the video game retailer’s stock was up over 1,700% for the year—giving the company almost a $25 billion market cap (after starting the year closer to $1 billion). The stock has since fallen back to earth—dropping more than 75% from its January high—after many retail brokerages (such as Robinhood) limited the buying of shares and options on many popular “meme stocks.”

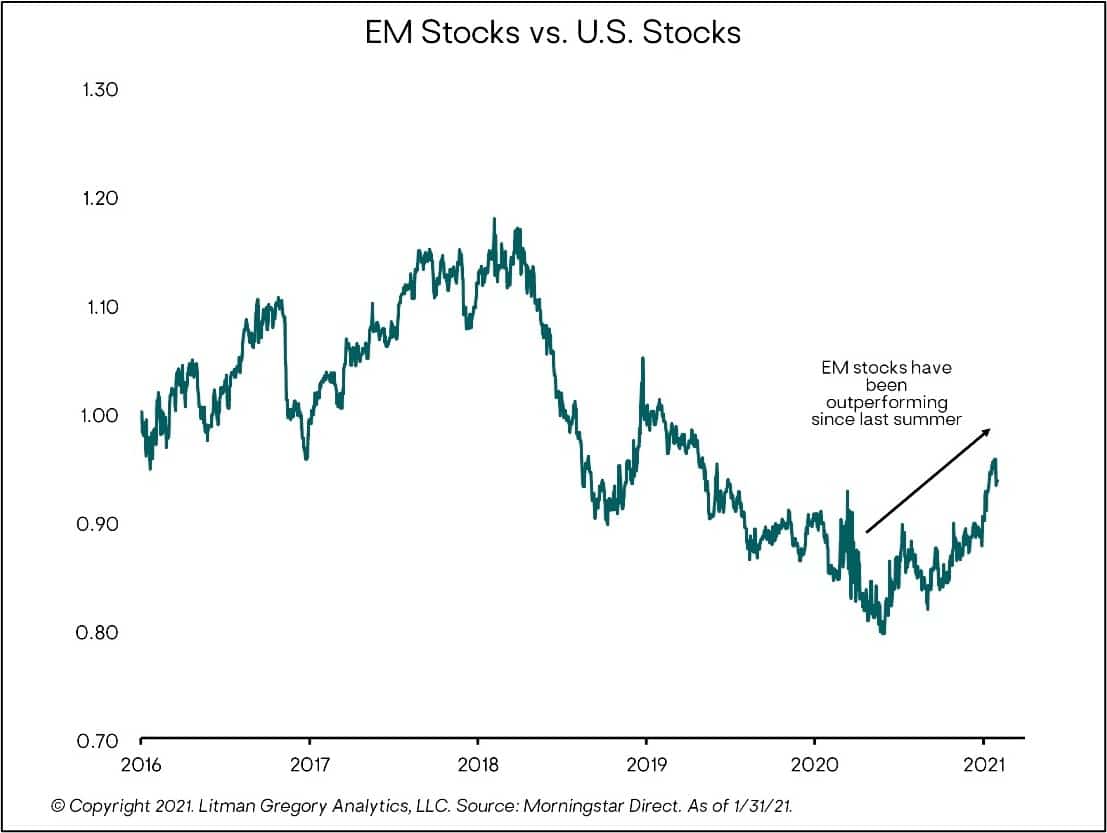

Overseas, emerging market (EM) stocks led the way with a positive return of 3.1% for the month (Vanguard FTSE Emerging Markets ETF). This marks four consecutive months of gains for EM stocks, during which they’ve gained 20.3% compared to an 11.0% return for the S&P 500. Developed international markets fell 0.7% in January (Vanguard FTSE Developed Markets ETF). Foreign stocks have started to outperform after initially trailing U.S. stocks in the first couple of months after the pandemic started. Since the start of June 2020, EM stocks have nearly doubled the return of U.S. stocks (40.6% versus 23.3%, respectively) and have started to reverse the trend of underperforming U.S.stocks that started in early 2018. The relative outperformance of foreign stocks coincides with the falling U.S. dollar throughout the second half of 2020. In January, the U.S. dollar appreciated a bit and was a headwind for foreign returns in dollar terms. Despite that, EM stocks outperformed U.S. stocks.

Interest rates inched higher in January. This led to losses in U.S. core bonds of 0.8% (Vanguard Total Bond Market Index) and a loss of 1.1% for the 7-10-year portion of the U.S. Treasury market. The 10-year Treasury yield has steadily increased since last summer and has now more than doubled since early August—going from roughly 0.52% to 1.09% at the end of January. Since the start of August, U.S. core bonds have lost 1.1% and the iShares 7-10 Year Treasury Bond ETF has fallen 3%. Strategies with credit exposure have fared much better during the rise in rates since August—with our non-core bond funds gaining mid-single digits since then. High-yield and floating-rate loans had a positive January with gains of 0.4% and 1.2%, respectively (the ICE U.S. High Yield Cash Pay Index and the S&P/LSTA Leveraged Loan Index).

— OJM Group Investment Team