AUGUST 2021 MARKET UPDATE

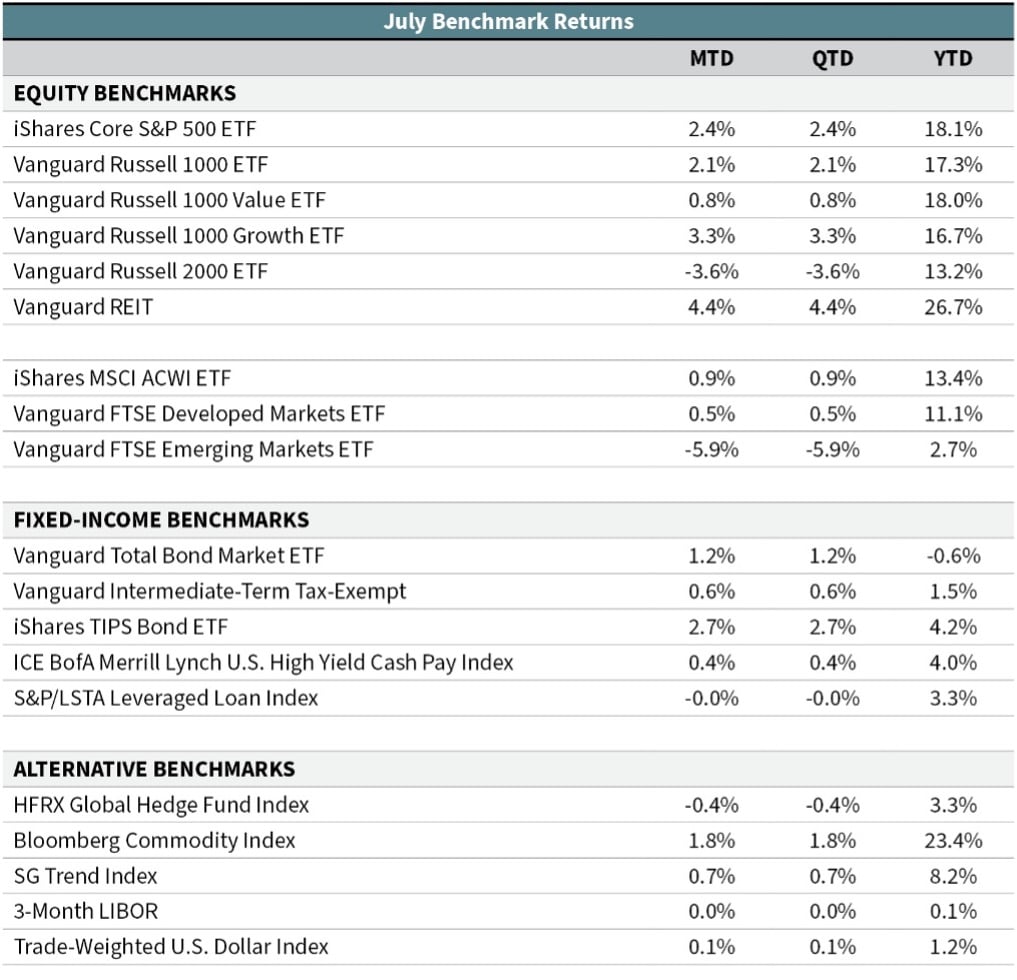

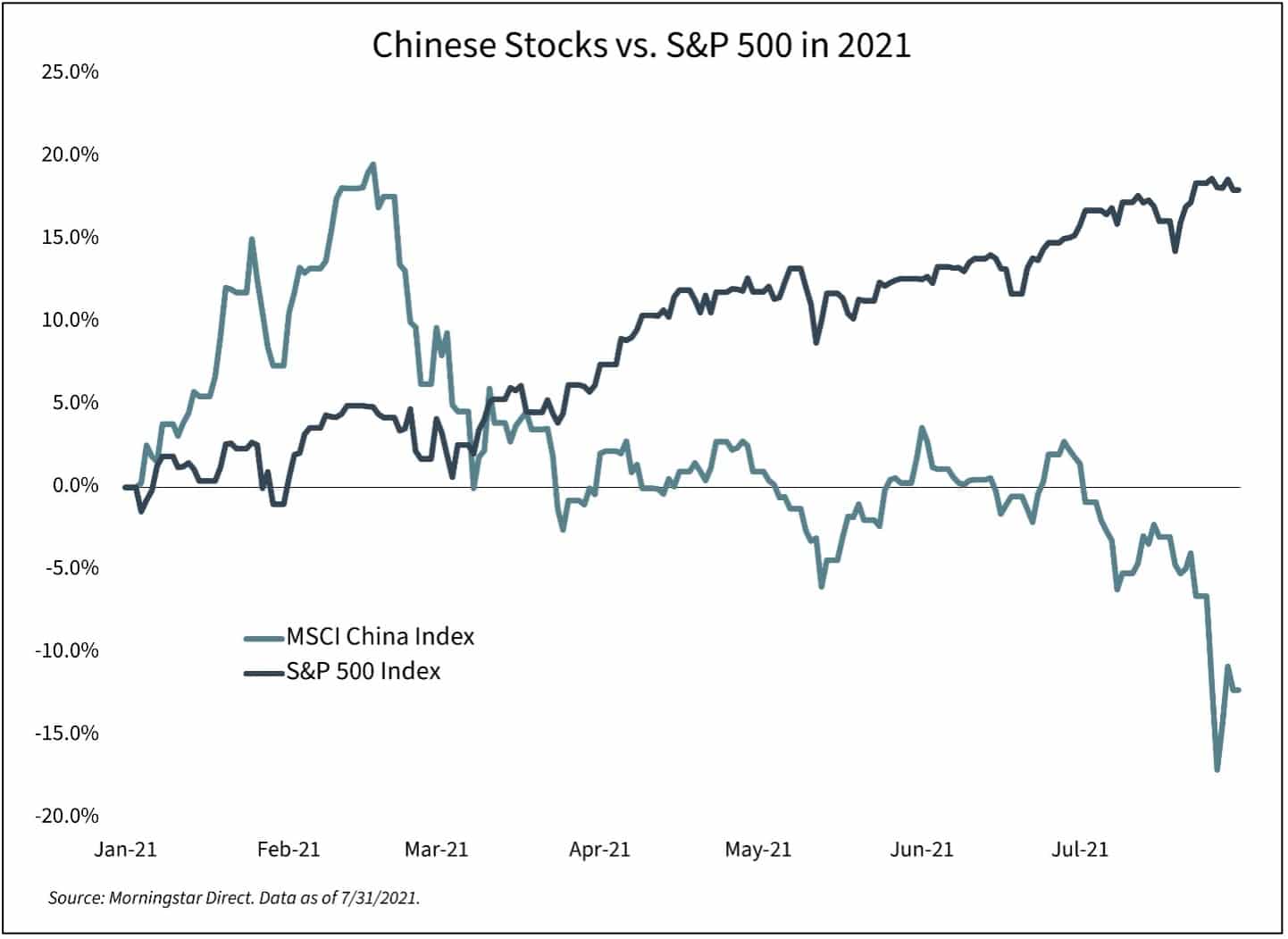

Developed equity markets continued to rise during July. U.S. stocks led the way with a gain of 2.4% (iShares Core S&P 500 ETF). Developed international markets notched a 0.5% return (Vanguard FTSE Developed Markets ETF). The headlines in July came out of emerging markets, more specifically China. Emerging-market stocks fell 5.9% in July (Vanguard FTSE Emerging Markets ETF), which was one of their worst relative returns versus developed markets on record. China was the driver behind the poor returns—thanks to a 13.8% drawdown in the MSCI China Index.

Chinese equities started off the year strong with a gain of nearly 20% into mid-February. However, since then Chinese equities have fallen nearly 27% on well-documented regulatory actions against a number of firms. The pain has been even worse in the technology sector—with many stalwart Chinese tech stocks (like Alibaba Group Holding and Tencent Holdings) down 30%–40% from their highs. The for-profit tutoring firms (New Oriental Education & Technology Group and TAL Education) were the worst hit given the government turned them into non-profit companies almost overnight.

We are actively evaluating portfolio exposure to China. Considering the developments, investors using an overly optimistic discount rate to value Chinese equities will probably need to increase it. In our top-down asset class analysis for emerging markets, we have and continue to use assumptions we consider to be sufficiently conservative. We will continue to share our thoughts as we learn more.

In the fixed-income markets, interest rates have steadily fallen since peaking in March. The 10-year Treasury rate dropped from 1.45% at the end of June to 1.24% at month close. This was a positive for bonds, resulting in a 1.2% gain for U.S. core bonds (Vanguard Total Bond Market ETF). Our flexible bond funds underperformed as they generally have more credit risk. Credit spreads widened modestly in July. Flexible bond fund returns were slightly positive.

Toward the end of July, the Federal Reserve issued its FOMC statement. The statement noted rising inflation but said it largely reflected transitory factors. Fed chair Jerome Powell admitted in his press conference that inflation came in higher than expected, however, the overshoot can be tied to a handful of categories (such as used car prices, airline tickets, and hotels) and was not spread broadly across the economy. He also said they expect inflation to continue to run above their 2% objective for a few more months before moving back toward 2%. Inflation reports over the next few months will be carefully analyzed by market participants.

—OJM Group Investment Team