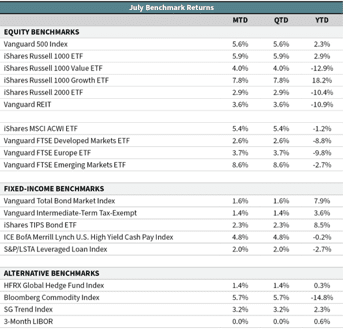

Global equities continue to march upward and dig out of the hole created in March. After falling more than 30% from the start of the year through March 23, the S&P 500 Index has rallied more than 47%. The 5.6% gain in July puts the S&P 500 back in the black for the year (up 2.3%). Smaller-cap U.S. stocks returned 2.9% during July—bringing their year-to-date tally to negative 10.4% (iShares Russell 2000 ETF). Emerging-market stocks fared well during July with a gain of 8.6% (Vanguard FTSE Emerging Markets ETF). Developed international stocks were up 2.6% (Vanguard FTSE Developed Markets ETF), boosted by a sharp 4% drop in the U.S. dollar index—its biggest one-month decline since September 2010.

Interest rates and credit spreads inched down modestly during the month. This helped the core bond index relative to the Treasury market. The U.S. core bond market gained 1.6% (Vanguard Total Bond Market Index), while the 7- to 10-year portion of the U.S. Treasury market returned 0.9%. The more flexible bond funds gained upward of 3.8% during July. Floating-rate loans gained 2% (S&P/LSTA Leveraged Loan Index).

The virus-induced shutdown of the economy resulted in its worst ever period, with real GDP falling 32.9% annualized during the second quarter. For comparison, the worst quarter during the financial crisis was a decline of 8.4% during the fourth quarter of 2008. The path of the economic recovery will largely be dependent on the course of the pandemic. The latter only got worse and became more widespread across the country during July. But at this point, most states are hitting pause on reopening instead of going back into a full shutdown. This should soften the impact—along with additional fiscal spending support—so the second quarter will likely mark the worst from an economic standpoint. But the cone of uncertainty is as wide as it’s ever been.

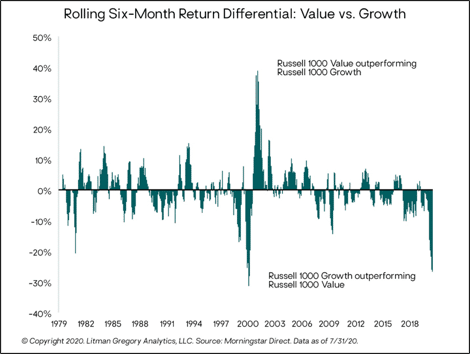

The divergence between value and growth stocks has been stark and widened further in July; larger-cap U.S. growth stocks gained 7.8% compared to 4% for their value counterparts (using Russell style indexes). The year-to-date differential between value and growth stocks is more than 30% in favor of growth. The short-term return discrepancy between the two segments is nearing levels last seen during the dot-com bubble of the late 1990s (see Value vs. Growth chart).

The obvious question is when and how can value win going forward given the current environment? While there are no explanations that we would identify with 100% certainty, the investment team at FMI recently wrote about several possible ways for value to win in their second quarter commentary. We’ve pulled out some of the scenarios they laid out (their commentary is recommended reading, quoted below):

- If it goes like the last big tech bubble, which peaked in March of 2000, there might not be any readily identifiable catalyst. Growth stocks just got too expensive. Speculation simply ran too hot. Expectations were far too high.

- Value could win if the cost of capital rises. Although the Fed is pulling out all the stops to suppress interest rates by printing money and monetizing government debt (and even buying corporate debt), that is not a strategy with limitless potential.

- Value could also win if the economy turns around and grows more rapidly than expected. Cyclical and other depressed companies could shine in that scenario.

- Value can also win simply because of size. The popular benchmarks are dominated by bigger companies, most of which are considered growth stocks; the amount of growth needed to move the needle has become high, and the law of large numbers can make it difficult to meet expectations.

- Value could win if investors refocus on balance sheets and self-funding operations. Many of the best performers in today’s environment are dependent on capital markets that can shut down when heavy turbulence hits. A market that turns sour tends to refocus investors’ minds on sustainable franchises instead of aggressive possibilities.

- Value could also win as asset allocators start focusing on risk mitigation and good values. Momentum is driving this market, not fundamentals.

—OJM Group Investment Team (8/5/20)