JUNE 2022 MARKET UPDATE

The Month at a Glance

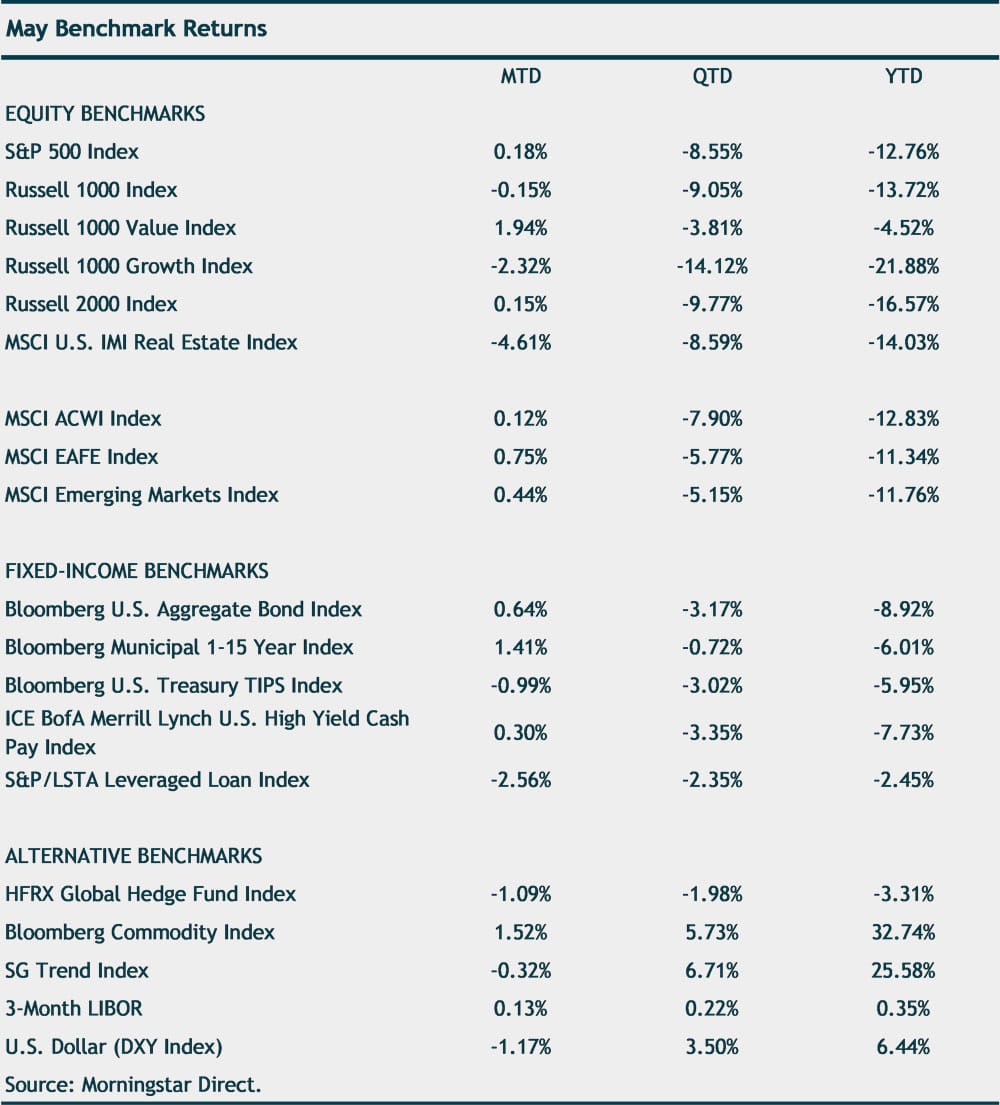

- Both equities and fixed income were positive in May

- US core bonds gained 0.6% in May—notching their first positive month this year

- Global equities produced slight gains in the month

- A weaker dollar helped foreign equities (both developed and emerging markets) outpace US stocks by a modest amount

- The Federal Reserve hiked the Fed funds rate by 50 basis points, marking the first hike of this size in more than two decades

MARKET RECAP

After seven straight weeks of losses, US equities posted a strong gain in the final full week of May and eked out a positive month. It was the longest negative weekly streak since early 2001. The strong gain of 6.6% for the week ending May 27th propelled returns for the month into positive territory. The S&P 500 finished up 0.2% in May. Small-cap stocks matched the return of large-cap stocks. Value stocks outperformed their growth counterpart; the Russell 1000 Value index gained 1.9%, while the large-cap growth stock index fell 2.3%. Value stocks are more than seventeen percentage points ahead of growth stocks so far in 2022—making this the best start to a year for value relative to growth stocks (dating back to index inception in 1979).

Developed international and emerging-markets equities narrowly outperformed U.S. large-cap stocks in May. MSCI EAFE gained 0.7% in the month—bringing its year-to-date loss to 11.3%, which is ahead of the S&P 500 negative return of 12.8%. Emerging-markets stocks were slightly positive with a gain of 0.4% in May. Emerging-markets stocks have broadly the same year-to-date losses as developed markets.

The year-long rally in the U.S. dollar paused in May, which helped returns for dollar-based investors in foreign markets. The dollar has surged more than 13% over the past year (see chart below). Over the past year, MSCI EAFE is up 1.1% in local currency terms (beating the one-year return of U.S. stocks) but is down 10.4% in dollar terms – i.e., after converting the depreciating foreign currency returns into dollars.

Bonds rallied in May and posted their first monthly gain of 2022. The US core bond index returned 0.6%. The US Treasury yield curve continued to flatten during May but is far from inverted. The 10-year rate fell from 2.99% at the beginning of the month to 2.85%. On the shorter end, the three-month Treasury rate rose above 1% for the first time since the onset of the pandemic. Floating-rate loans fell 2.6% in May—their worst month since March 2020. The negative returns for floating-rate loans were largely due to technical factors. Investors rotated into high-yield bonds, which gained 0.25% in May.

NOTABLE EVENTS

On the topic of inflation, prior to this morning, there was a growing consensus that the peak in US inflation was nearing an end. Headline inflation for April came in at 8.2%—down from 8.6% the month before. The month-over-month inflation reading also came down last month to 0.3% compared to 1.2% in March.

Today’s May consumer price index report suggested inflation may not have peaked, indicating prices rose 8.6% year over year. Excluding food and energy from the index, resulted in a 6% increase from last year[i]. The disappointing inflation report triggered today’s sell-off in stocks.

[i] https://www.cnbc.com/2022/06/09/stock-market-news-open-to-close.html