WHAT IT IS & HOW TO MINIMIZE IT

As investors age, they should consider the reallocation of their assets into increasingly conservative investments to best limit their exposure to loss. The idea of reallocating to more conservative assets can be troubling to those who are focused on maximizing returns because conservative investments tend to have limited upside potential. To understand why this move is often more beneficial than seeking higher returns in later life, one should be familiar with sequence of returns risk.

Sequence of returns risk is the danger that the timing of liquidation and withdrawal from a retirement account will coincide with a downturn in the market. If it does, then it effectively reduces the overall potential performance of the entire portfolio because a greater number of shares will need to be liquidated to get the income expected, thus leaving fewer shares in the portfolio to grow.

Sequence of returns risk may not be as important during an investor’s early or middle years, when time horizons are long, but during the withdrawal phase it is one of the most critical factors in the overall success of a retirement plan, making it a higher priority than chasing returns.

Let’s look at an example that clearly shows what ignoring sequence of returns risk can mean:

Two portfolios, A and B, each begin with $100,000. Each aims to withdraw $5,000 per year. Each portfolio experiences exactly the same returns over a 25-year period — only in inverse order — or “sequence.”

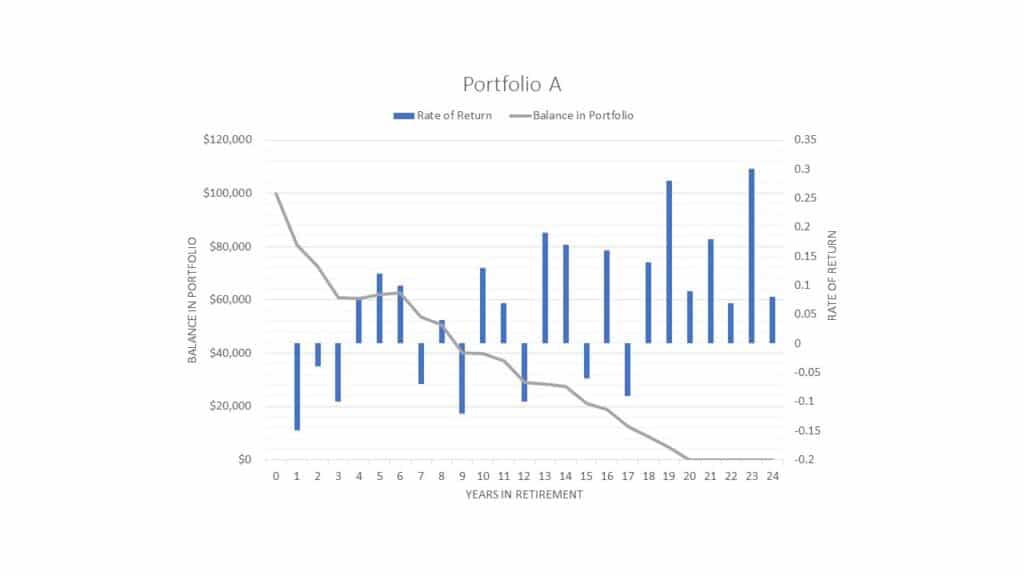

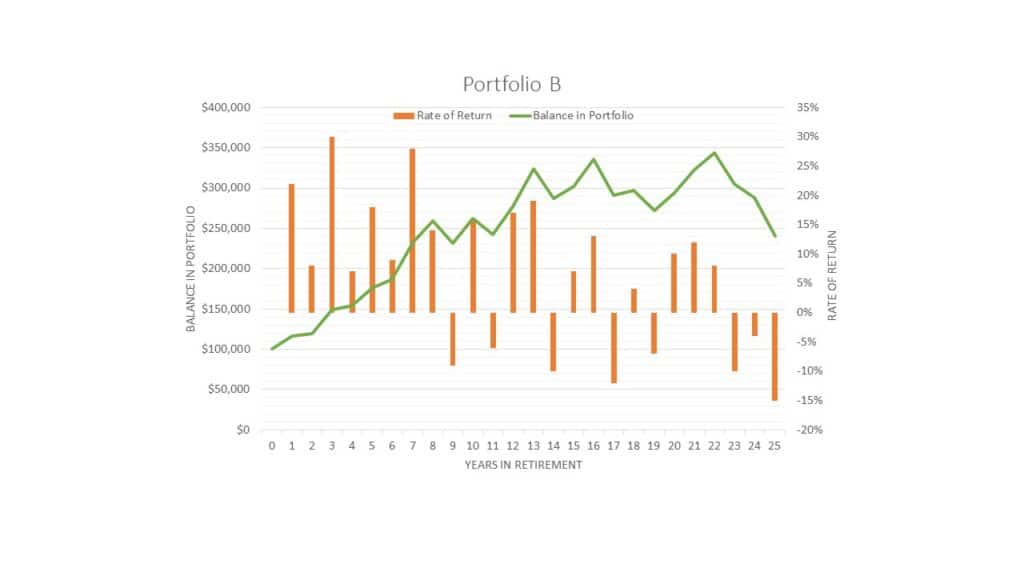

Portfolio A (Figure 1) has the bad luck of having a sequence of negative returns in its early years and is completely depleted by year 20. In stark contrast, Portfolio B (Figure 2) scores a few positive returns in its early years and ends up two decades later with more than double the assets with which it began.

Investors are often surprised, if not shocked, by the results of this example. The hypothetical example demonstrates two investors taking 5% of the initial principal. Portfolio A and B have the exact same mean return of 6.8% over a 25-year period with identical risk (i.e., standard deviation). Portfolio A ran out of money. Portfolio B experienced a 140% increase in value at the conclusion of the 25-year period. This significant disparity of portfolio outcomes is solely due to the sequence of the returns, and not the returns themselves.

Simply put, the negative years occurred early in Portfolio A, as withdrawals were being made for retirement income. This combination of down years and withdrawals ate away too much principal for the portfolio to survive until year 25. While Portfolio B had the same average numbers (return, compound growth rate and standard deviation), its negative years arrived during the later years of retirement. At that point, because of greater positive returns in early retirement, the portfolio could withstand the combination of down years and withdrawals.

What are the Odds of a Negative Equity Return?

The example above might give the impression retirement planning is nearly impossible due to the threat of negative returns early on. One obviously needs to minimize negative investment performance when possible and understanding the odds of an adverse investment outcome can serve as a valuable tool when designing an investment portfolio.

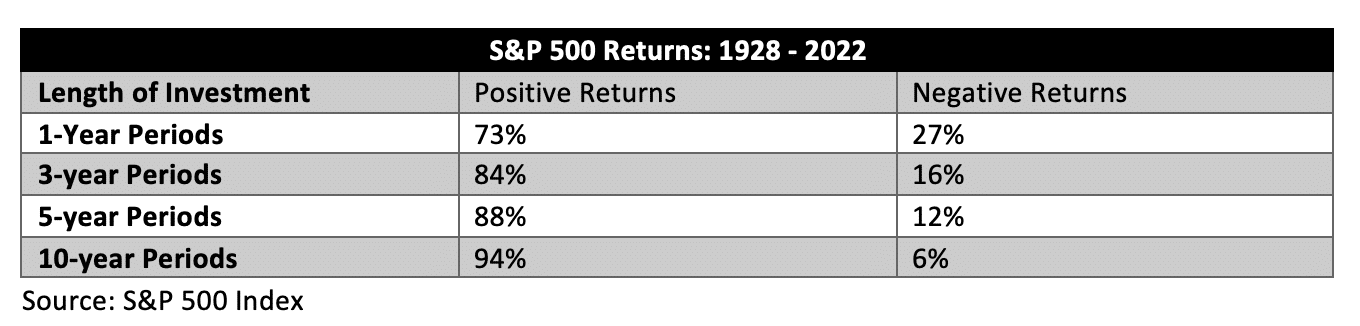

If the S&P 500 is used as the benchmark to determine the odds of a down market, one will find negative returns occur approximately once every four years (see chart below). Extending your time horizon means the likelihood of a negative return declines. Rolling ten-year periods where the S&P 500 experiences negative returns are rare, historically occurring slightly more than 5% of the time. Five-year and three-year rolling periods of negative returns are 2-3 times more likely to occur (12% and 16% respectively).

While the probability of negative returns may be low, an investor is not going to care about statistics and probabilities if he or she experiences a steep decline in principal the year they wish to retire (or in the years immediately preceding retirement).

Transitioning to a More Conservative Portfolio

When should an investor begin making the transition from an aggressive portfolio to one with risk management characteristics? The answer varies for everyone, with several factors influencing the appropriate path. Consider the following questions as a start:

- What is your anticipated retirement age, and how many years of retirement are you reasonably expected to fund?

- Do you have alternative sources of income in retirement?

- What percentage of your investable assets do you intend to withdraw each year?

- Are you emotionally prepared to experience large fluctuations in your net worth when you will no longer be receiving a regular paycheck?

- What is the makeup of your assets, and will a liquidation of equities create a significant taxable event?

The answers to these questions will certainly influence an appropriate plan. However, there is some general advice applicable to most investors. We noted above that historical data demonstrates that investors have a greater than one in four chance of losing money in stocks over a one-year period. While the odds suggest one is not likely to lose money over a 12-month period, it is the magnitude of those losses and when they occur that causes a retirement plan to fail. The S&P returns of 2002 (-23%), 2008 (-38%), and 2022 (-18%) have given us reminders of how quickly the stock market can quickly take away gains.[1]

Waiting until the year before you retire to reduce risk is too late. A common recommendation is to begin reducing risk between 3-5 years prior to when funds are needed. Investors with portfolios allocated primarily to equities should begin to diversify no later than five years prior to the time they need to access their assets. Transitioning from stocks to bonds and cash equivalents will minimize portfolio volatility and will substantially decrease the odds of investors being forced to sell assets at a loss. Stock prices and bond prices rarely move in tandem. The bonds in a portfolio not only provide income but also provide investors with an asset to liquidate while waiting for stocks to recover.

The ability to avoid liquidation of investments at an inopportune time (after a sizeable correction), reduces the sequence of returns risk in a portfolio. As demonstrated in the example, minimizing volatility and sequence of returns risk is more important than maximizing returns.

Conclusion

While reducing risk is important, we are not suggesting risk should be eliminated entirely. If one is funding 15 to 30 years of retirement or more, a portion of the portfolio should remain in equities. Stocks continue to be an excellent long-term hedge against inflation, and diversification is a critical component of a successful retirement plan. A professional advisor with expertise in financial modeling can provide valuable assistance with diversifying your portfolio during your pre-retirement years so that you can achieve your long-term financial goals.

[1] https://www.macrotrends.net/2526/sp-500-historical-annual-returns