AN IMPORTANT COMPONENT OF A COMPREHENSIVE RETIREMENT PLAN

Investors are likely aware of Health Savings Accounts (HSAs) and their use by patients and doctors alike to pay for health-related expenses. Many may not know that HSAs can also offer a triple tax-savings benefit for account holders, as well as create a valuable resource for covering future healthcare and even long-term care expenses.

This article provides a brief overview of HSA basics, explains some of their lesser-known benefits, and outlines compelling reasons for implementing this financial vehicle as part of a comprehensive retirement plan.

What is a Health Savings Account?

An HSA is a useful and beneficial tool for anyone who needs to save money for health-related expenses that are not reimbursed by their high-deductible health plan (HDHP). An HSA is typically owned by an employee, but it can also be funded by both the employee and/or the employer. Some employers may choose to make an initial contribution to an HSA for an employee, and the employee can add to the account through payroll deductions or lump sum contributions.

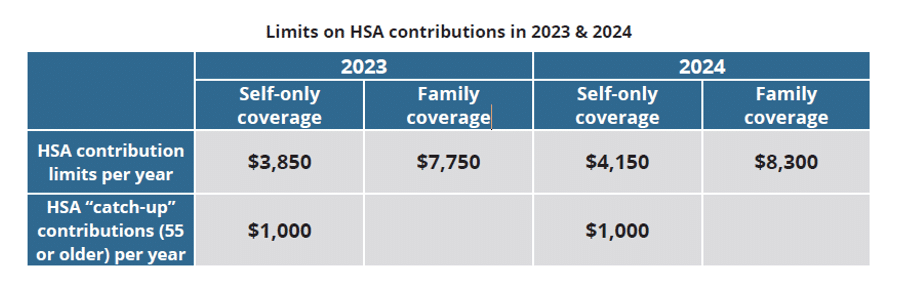

To be eligible for an HSA, an individual must have an HDHP and no other health coverage. They also cannot be listed as a dependent on someone else’s tax return. The IRS sets an annual limit for contributions to an HSA and offers the option of a “catch-up” contribution for account holders who are age 55 or older. (See Chart Below)

Additional Benefits of Health Savings Accounts

Those thinking about opening an HSA or increasing contributions to an existing account should be aware that HSAs offer some lesser-known advantages, especially when compared to other commonly used savings and investment vehicles.

Triple Tax Advantage

HSAs offer a powerful triple tax advantage. Contributions to an HSA can be made pre-tax (like 401(k) deferrals) or with after-tax dollars. (After-tax HSA contributions are deductible from income regardless of income bracket.) HSA earnings grow tax-free, and withdrawals are tax-free as long as they’re used to pay for qualified medical expenses.

Roll-over of Funds

Unused funds in an HSA will roll over from year to year, allowing you to save up for future expenses and avoid the risk of losing unused funds at year-end.

Contribution and Spending Flexibility

You can contribute as much (up to the annual allowable limits) or as little as you like to your HSA, giving you full control of your budget. HSAs can be used to pay for qualified medical expenses, such as doctor visits, prescription drugs, and dental care. Funds can also be used for over-the-counter medications and long-term care insurance premiums.

Access to Funds

HSA funds can be easily accessed in a variety of ways. Account holders can use a debit card or write a check to pay medical costs directly at the time of service, instead of having to submit claims or waiting to be reimbursed.

Portability of HSAs

HSAs are portable, meaning you can take them with you when you change jobs or even when you retire.

Implementing an HSA as Part of a Comprehensive Retirement Plan

In addition to deploying this tax-advantaged tool to cover health-related expenses, owners of HSAs can use these funds, in tandem with 401(k)s, IRAs, and brokerage accounts, as part of an overall retirement savings plan.

An HSA can become even more appealing for individuals approaching or already in retirement. If an individual under the age of 65 withdraws funds from an HSA to pay for non-healthcare expenses, the amount withdrawn will be subject to regular income tax plus a 20% penalty. The 20% penalty is eliminated for those who are 65 or older, thus creating an opportunity to use the funds in an HSA to pay for housing, travel, or other non-medical expenses during retirement.

Any money not spent on medical expenses can be invested, allowing you to build wealth to meet long-term financial goals. HSAs offer a wide range of investment options that allow account holders to grow their savings over time. When investing HSA funds, it is important to work with a professional advisor who is knowledgeable about the available options and can help select investments that are aligned with the account holder’s risk tolerance and long-term financial goals.

How Does an HSA Stack Up Against Other Retirement Savings Options?

Many high-net-worth investors have the income to maximize contributions across the spectrum of retirement accounts, including 401(k)s, Roth IRAs, and HSAs. However, when comparing the return potential of various savings and investment options, many are surprised that it can be more profitable in the long run to contribute to an HSA than to a 401(k), even if the 401(k) has an employer match. The reason revolves around the tax benefits of the HSA.

Let’s look at an example. If an employer offers a 25% match to an employee’s 401(k) contribution, but the employee faces a future tax rate of 20%, a $1,000 contribution to the 401(k) plan is still worth only $1,000 in future after-tax value. The employer match increases the value to $1250, but the future tax liability diminishes the account value back to the original $1,000. This scenario nets the same result as the employee contributing $1,000 of pre-tax income to an HSA, as long as the amount withdrawn from the account is used to pay for qualified healthcare expenses.

Based on this example, one can conclude that those who expect to pay taxes at any rate higher than 20% and can use liquid assets to cover medical expenses can fare better by contributing to an HSA account rather than to a 401(k) plan with a 25% employer match. It could even be argued that, for taxpayers with a combined state plus federal tax rate of 45% or more, an HSA could be superior to a 401(k) with a 75% employer match.[i]

Leverage an HSA to Boost Tax-Free Funds in Retirement

One strategy that can be used to further leverage an HSA is to make an annual HSA contribution and then pay for medical expenses using existing cash flow. You can repeat this process each year and compile healthcare expenses indefinitely into the future. (It’s important to keep good records of your unused qualified medical expenses.) In retirement, or at any age, you are then able to take tax-free distributions based on the total amount of expenses that you have accumulated over time.

Let’s further explore the ability to cash flow medical expenses despite having funds in an HSA to utilize. In the following comparison, Investor Isabel has $10,000 of pre-tax income to allocate and retirement accounts are not an option because he has already reached his maximum contribution limit(s) for the year.

In the first option, Isabel puts $3,000 into an HSA, uses those funds to pay her health insurance deductible, and takes the remaining $7,000 as pre-tax income. At a 25% tax rate, this $7,000 eventually turns into take-home pay of $5,250.

On the other hand, if the HSA contribution is preserved in the account and medical expenses are paid out of pocket, Isabel finishes with $3,000 in the HSA and $2,250 in a taxable brokerage or checking account. In the latter scenario, the net $5,250 is the same, however, Isabel now has $3,000 in HSA funds which will grow tax-free, similar to a Roth IRA. Exercising the option to pay for healthcare expenses with existing assets and not tap into an HSA until later in life can offer an additional advantage to an already powerful tool.

Conclusion

Their triple tax advantage, spending and contribution flexibility, and year-end rollover of funds make Health Savings Accounts an appealing option to accumulate savings for future healthcare expenses. Seek the help of a professional advisor with experience in financial modeling to help you integrate an HSA into your comprehensive retirement plan. The authors welcome your questions.

Resources:

[i] The Journal of Financial Planning, Could a Health Savings Account Be Better than Employer Matched 401(k)? by Greg Geisler