ASSET PROTECTION FOR DOCTORS

3 EFFECTIVE STRATEGIES

David B. Mandell, JD, MBA | July 18, 2023

Doctors like yourself invest countless years and resources into education and training to provide exceptional patient care. However, the world is unpredictable, especially for medical practitioners and providers. Legal disputes, financial uncertainties, and potential liabilities are always lurking, so protecting and preserving your hard-earned wealth is crucial.

Asset protection is a planning discipline that safeguards your money, home, investments, and other valuable possessions from unforeseen threats to your financial well-being. The following visual guide sheds light on the significance of asset protection for doctors and provides practical strategies you can employ to mitigate financial risk.

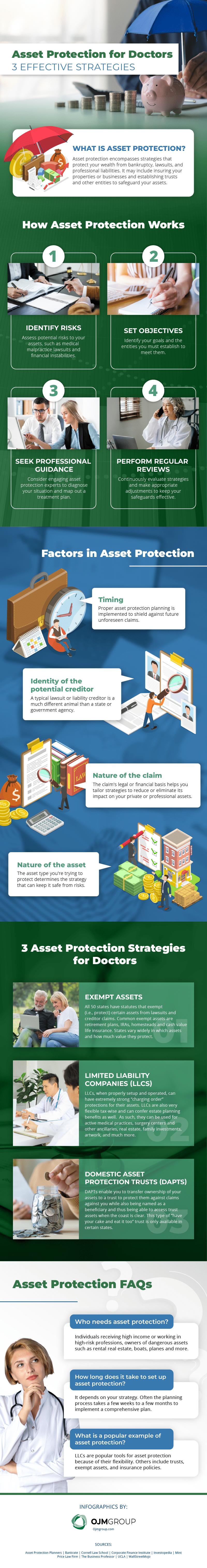

What Is Asset Protection?

Asset protection involves implementing legal and financial planning strategies to safeguard wealth from risks, including bankruptcy, legal conflicts, and professional liabilities. It protects your hard-earned assets to lessen the impact of these events on your financial stability, enabling you to survive threats to assets.

How Asset Protection Works

There are numerous legal and financial strategies involved in asset protection. As such, the specific steps to guarding your wealth vary depending on your approach, but they generally develop in the following process.

1. Identify Risks

Start by conducting a thorough assessment of potential risks to your assets. As a doctor, some liabilities you may face are malpractice lawsuits, employee claims, HIPAA violations, slip and falls from real estate, auto accidents, and more.

2. Set Objectives

Do you want to protect specific assets, minimize tax obligations, or safeguard wealth for your heirs?

3. Seek Professional Guidance

Consider getting help from experienced professionals specializing in asset protection and wealth management. They eliminate guesswork and guide you through developing a protection plan tailored to your needs.

4. Perform regular reviews

It is important to evaluate and adjust your strategies occasionally to keep them updated on changes in the law. Legal structures often require some annual maintenance of formalities as well.

Factors in Asset Protection

Asset protection is a multi-faceted approach involving the following factors to determine an appropriate strategy.

1. Timing

The best time to create an asset protection plan is when there are no looming creditors that can take away your assets. There are laws against moving assets once a liability becomes “reasonably foreseeable”, such as the Uniform Fraudulent Transfer Act. These rules are why asset protection is a “planning” strategy that prepares for potential liabilities.

2. Identity of the potential creditor

Certain creditors may also have more power than others, making protections less effective. Government agencies are an example of such.

Creditors fall into the following classes, depending on the strategies applicable to them:

- Unsecured creditors: They don’t have a claim against any specific asset. Establishing trusts or LLCs and leveraging exemptions can protect your wealth against their claims.

- Secured creditors: They have claims against particular assets you’ve placed as collateral. Some strategies you may implement are negotiations for favorable terms and restructuring debts.

3. Nature of the claim

What’s the legal or financial basis on which the creditor is trying to access your assets? Understanding the nature of their claim can help you tailor holistic strategies to your specific needs.

4. Nature of the asset

Finally, your strategies depend on the types of assets needing protection. Some may have an exemption associated with them already, making protection easier. For others, legal tools will be required.

3 Asset Protection Strategies for Doctors

As a medical practitioner working directly with patients, you’re often vulnerable to lawsuits and other liabilities that can drastically impact your hard-earned wealth. So, consider the following strategies to protect your assets from risk.

1. Exempt Assets

Exempt assets refer to specific types of property or assets that are legally protected from being seized or liquidated. These assets are exempted from the claims of creditors under the law, allowing individuals to retain ownership and control over them. The specific exemptions vary from jurisdiction to jurisdiction and can be found in laws related to bankruptcy, debt collection, and other legal frameworks.

All 50 states have statutes that exempt (i.e., protect) certain assets from lawsuits and creditor claims. Examples of exempt assets include retirement plans, IRAs, homesteads, and cash value life insurance. States vary widely in which assets and how much value they protect.

2. Limited liability companies (LLCs)

Protect your wealth from liabilities by separating business and personal assets in an LLC. For instance, if you structure your business as an LLC and it faces lawsuits or debts, creditors generally won’t be able to reach your private assets. Conversely, if you incur liabilities as a private individual, your business assets are safer from creditors.

This strategy is possible due to its limited liability structure, where business losses can only amount to how much you’ve invested in the LLC, effectively shielding your private assets from risk.

3. Domestic asset protection trusts (DAPTs)

Domestic Asset Protection Trusts (DAPTs) are a type of irrevocable trust established in a state that allows them. With DAPTs, you’d be able to transfer ownership of your assets to a trust to protect them from claims against you. At the same time, you would be a beneficiary and still have access to trust assets.

Asset Protection FAQs

Let’s answer other burning questions about asset protection below.

1. Who needs asset protection?

Individuals receiving high incomes or working in high-risk professions can benefit from asset protection strategies. Those with dangerous assets like rental real estate, boats, and planes also need asset protection.

2. How long does it take to set up asset protection?

The time it takes to set up asset protection depends on your strategy. Typically, it takes one to two months from start to finish.

3. What is a popular example of asset protection?

The most common example of an asset protection tool is a limited liability company. Others include trusts, limited partnerships, insurance policies, retirement plans, and exempt assets.

Secure Your Hard-Earned Wealth with Asset Protection

Doctors like yourself have invested blood, sweat, and tears into getting where you are. As such, taking the appropriate measures to secure your hard-earned wealth is only logical.

Protecting your assets with the relevant strategies provides a financial security that most physicians would value. It allows you to focus on what matters most—providing high-quality healthcare with the peace of mind that your financial well-being is safe and sound.

We at OJM Group, a wealth management firm that has worked with over 1,500 physicians across the U.S., can help you take the necessary steps toward financial freedom. Check out Wealth Planning for the Modern Physician to learn more about essential financial tactics. Get your free copy or ebook download from the OJM Group Bookstore.