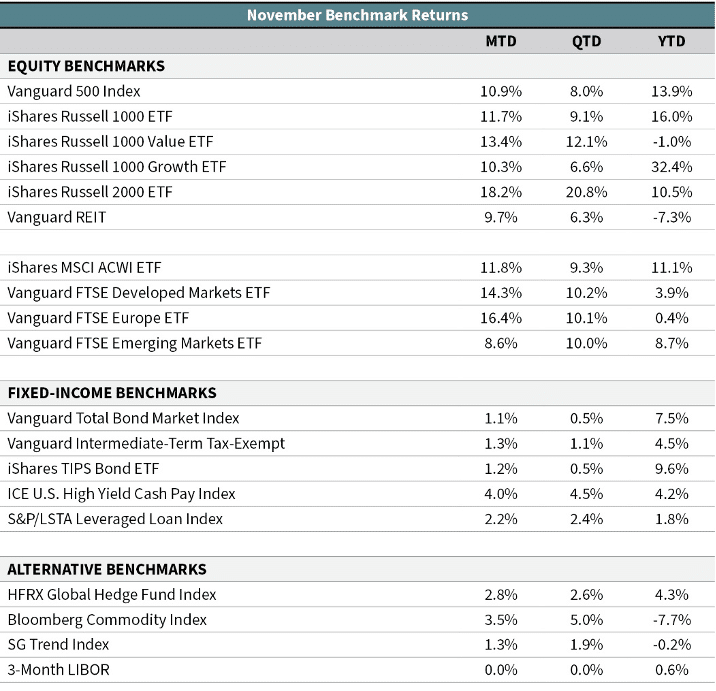

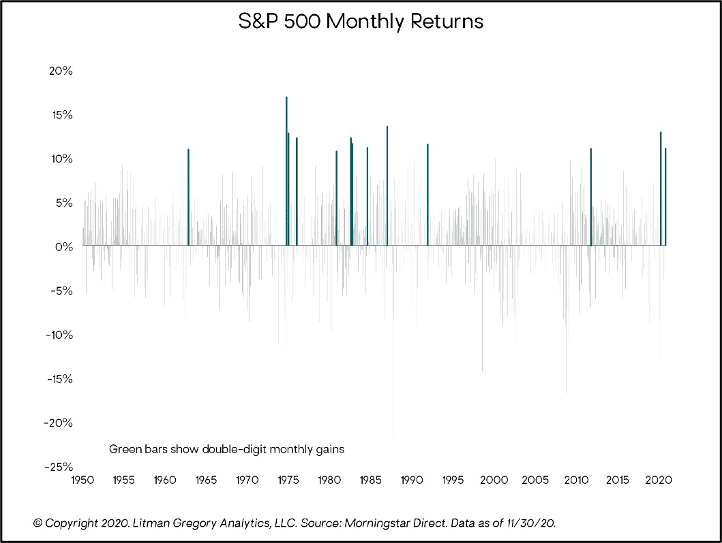

Equity markets around the world notched one of their best months ever in November. Large-cap U.S. stocks gained nearly 11% (Vanguard 500 Index)—making it just the thirteenth time the index has been up double digits in a month dating back to 1950. Double-digit monthly gains in the stock market are rare (highlighted green in the chart below). It has happened just three times in the last 20 years—two of which happened this year (April and November). But not to be outdone by their larger brethren, smaller-cap U.S. stocks posted the highest ever monthly return in the history of the Russell 2000 Index with a gain of 18.4%. The next-best month for smaller-cap stocks was almost 200 basis points lower than November’s return. And in the 40-plus year history of the index, there are only three other months with returns greater than 15%. These are impressive gains for stocks in a calendar year, let alone a single month!

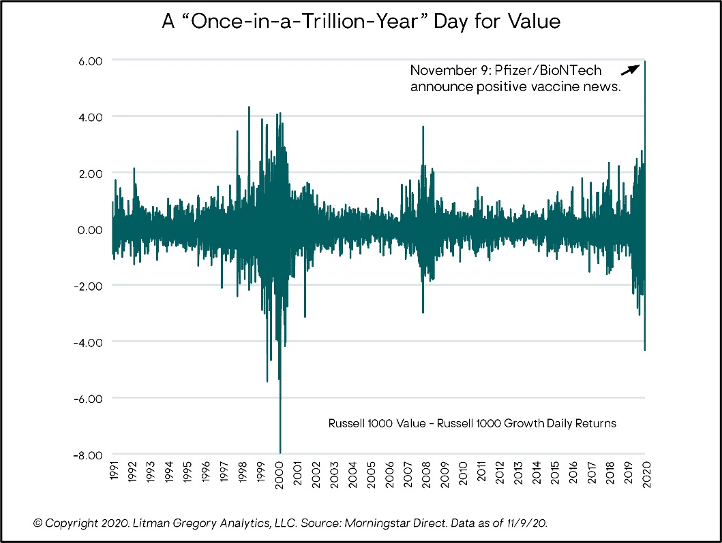

Investor sentiment jumped sharply during November thanks to clarity around the presidential election and positive news about the efficacy of several COVID-19 vaccines. This helped propel cyclical stocks that are more dependent on economic strength. The larger-cap value index (Russell 1000 Value) was up 13.5% last month—its second-best month since the index’s inception in 1979. On Monday, November 9, when Pfizer/BioNTech announced interim results from their Phase 3 study, value stocks had a historic day, jumping 4.1% while the Russell 1000 Growth Index fell 1.8%. The nearly 600-basis-point value-vs.-growth outperformance in a single day is the largest dating back to 1991 (the year daily returns are available in Morningstar Direct for these indexes).

Equity returns were also strong overseas. Developed international stocks (Vanguard FTSE Developed Markets ETF) gained 15.5% in November. This was the index’s third-highest monthly return since 1970 and its largest since 1990. Emerging-market stocks (Vanguard FTSE Emerging Markets ETF) had a very strong absolute gain of 9.2% but trailed developed-market returns for the month. A falling U.S. dollar helped investors who were unhedged. The U.S. dollar appreciated sharply during the height of the market selloff in March as many investors piled into safe-haven assets. But since then, the DXY Index has fallen more than 10%. This has been a tailwind for investors in foreign assets.

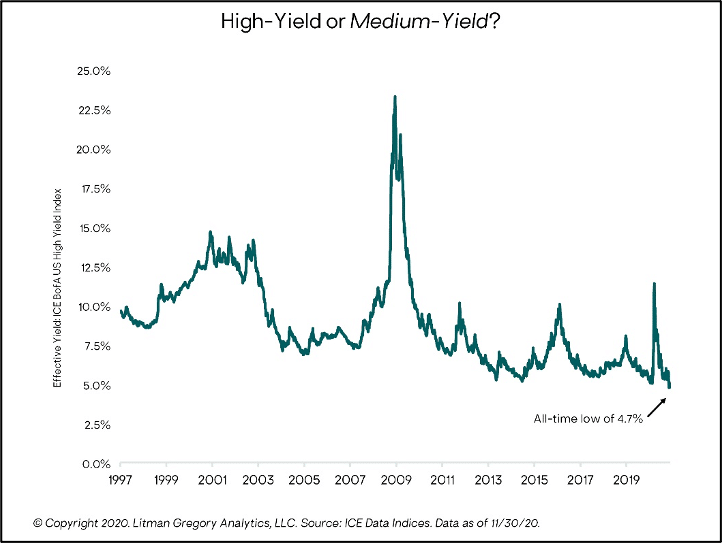

Finally, the bond markets were up modestly during the month. Interest rates across the U.S. Treasury curve finished the month at roughly the same level where they started. Credit-sensitive areas of the bond market outperformed due to further spread compression during the month. U.S. high-yield—if you can still call it that (maybe medium-yield is more appropriate)—hit an all-time low yield in November. The yield on the index touched 4.69%. It is the first time the high-yield index has ever had a four-handle. Part of the lower yield can be explained by an increase in the highest-quality segment of the index (BB-rated), which is as large as it has ever been; it makes up nearly 56% of the index compared to 49% as recently as year-end 2019. This increase in quality has happened as a handful of “fallen angel” bonds have been downgraded from investment-grade to the upper tiers of the high-yield index (such as Ford and Kraft Heinz). Spread compression led to a solid 4% return for high-yield bonds in November (ICE BofA U.S. High-Yield Cash Pay Index). Floating-rate loans gained 2.2% (S&P/LSTA Leveraged Loan Index), while U.S. core bonds had a positive return of 1.1% (Vanguard Total Bond Market Index).

—OJM Group Investment Team (12/3/20)