December 2025 Market Commentary

The rally in risk assets stalled in November. Equity markets experienced their largest drawdown since April. Bubble concerns around AI investment and a repricing of a December rate cut were the key drivers behind the retracement. Despite this, global equities finished the month flat.

Market Overview

The S&P 500 eked out a 0.2% gain in November, bringing its year-to-date return to 17.8%. From an all-time high in late October, the S&P 500 declined over 5% before recovering most of the losses over the final week of the month. Concerns around AI-related valuations and ongoing spending hit growth stocks resulting in the Russell 1000 Growth Index falling 1.8%. Value stocks (Russell 1000 Value) outperformed with a return of 2.7%. Small-cap stocks (Russell 2000 Index) fared relatively better than large-cap stocks with a return of nearly 1% in November.

Foreign developed stocks (MSCI EAFE Index) gained 0.6% in the month, modestly ahead of domestic stocks. Emerging-markets stocks (MSCI EM Index) fell 2.4% in November. The U.S. dollar has remained range bound since the summer, which has had a minimal impact on international returns in recent months. The large decline in the dollar at the start of the year and into Liberation Day was where the majority of year-to-date outperformance for international stocks occurred.

Investment-grade core bonds (Bloomberg US Aggregate Bond Index) rose 0.6% in November as the 10-year Treasury yield drifted lower towards 4%. Lower-quality high-yield bonds (ICE BofA US High-Yield Index) gained 0.5%. Despite equity market volatility, credit spreads remain historically tight, suggesting that the bond market doesn’t see a recession on the horizon. Tight spreads leave coupons as the main driver of credit returns going forward.

Fed Watching

Expectations around a December rate cut shifted meaningfully throughout November. Immediately following the Fed’s 25 basis point rate cut in late October, the market started pricing in a two-third’s probability of a end-of-year cut. However, those odds feel below 30% following hawkish Fed commentary and the release of the October Fed meeting minutes, which showed a sharply divided Fed. Some members supported additional cuts while others wanted to hold rates steady amid higher-than-target inflation. Ultimately, dovish comments, a cooling labor market, and souring consumer sentiment changed the narrative late in the month, and the probability of another 25 basis point rate cut is highly likely (nearly 90%) in December.

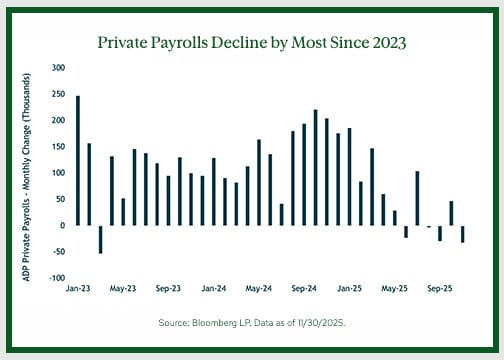

The labor market continues to send mixed messages. While October data will likely be omitted from history due to the government shutdown, the unemployment rate continued to creep higher in September, hitting nearly a four-year high at 4.4%. ADP’s jobless claims continue to show hiring in somewhat of a standstill. Private employment in the U.S. has shown losses in four of the last six months. Only July and October have shown payroll gains dating back to the summer. Labor market data seems to reinforce further easing from the Fed despite an inflation rate that currently sits above their long-term 2% target.

Wrapping Up Third Quarter Earnings Season

Earnings season for S&P 500 companies has just about concluded with 96% of companies having reported. Earnings continued their robust trend. Trailing 12-month GAAP earnings jumped 17.5% from the previous year, notching their third straight double-digit growth rate. A solid 81% of S&P 500 companies beat earnings expectations, which exceeds the average beat rate of closer to 75% over the past decade. Based on FactSet data, the S&P 500 is expected to report its highest sales growth rate in three years. The current FactSet estimate is for 8.4% year-over-year sales growth in the third quarter. All GICS sectors had positive sales growth.

Looking forward, earnings growth estimates are for mid-teens growth for 2026. It is likely that these estimates get lowered throughout the course of next year, however, with market valuations as high as they currently are, earnings growth will need to do much of the heavy lifting for the market to achieve double-digit returns.

Overall, corporate America remains healthy despite an uncertain macro and geopolitical environment. Revenue growth continues its positive trend, margins continue to expand and at all-time highs, and overall profitability remains healthy.

Concluding Comments

The economic backdrop remains complicated, but the U.S. economy continues to show an ability to absorb shocks. Policy direction is still in flux, global tensions linger, and certain areas of the market look overly enthusiastic, but the broader economy has proven steady. Corporate results have generally been solid, the labor market, while cooling, has not yet frozen over, and the Federal Reserve has started cutting rates after having been on pause for a couple years. Taken together, these elements point to a slowdown, not a slide into recession. Typically, a Fed easing cycle that does not coincide with a recession is a tailwind for risk assets.

We continue to believe that the current climate calls for a balanced approach. There are positives to point out such as strong corporate fundamentals, continued capital expenditures, easier monetary policy, and fiscal thrust from the One Big Beautiful Bill. However, this is balanced against geopolitical uncertainty, historically high valuations, and narrow market leadership from a handful of companies. With the optimism currently priced into assets, we continue to maintain our measured and diversified stance, not leaning too much in either direction. As always, we are assessing the market environment for opportunities to take advantage of.

DISCLOSURE:

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.