AUGUST 2025 MARKET UPDATE

MARKET OVERVIEW

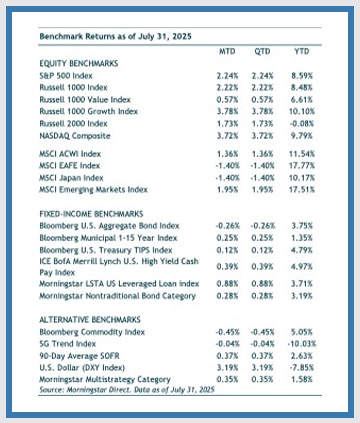

July was an eventful month for markets, as investors balanced encouraging economic data with uncertainty. Through July the S&P 500 reached an all-time high helped by strong earnings reports, especially from large tech firms, and growing confidence that the U.S. might avoid a recession thanks to signs of a resilient consumer and a healthy labor market. Inflation also came in below expectations, though it remains above the Fed’s long-term target. These positive signs, however, raised questions about how long the Federal Reserve may need to keep interest rates elevated.

Trade policy remained front and center, though investors seem increasingly less sensitive to these headlines. Late in the month, the U.S. reached new agreements with both Japan and the European Union. Meanwhile, a key deadline in U.S.–China trade relations was extended as both countries agreed to prolong their current tariff pause by another 90 days. These developments were seen as constructive steps toward greater stability in global trade.

The S&P 500 rose 2.2% in July, driven by continued earnings strength in the technology and communication services sectors. Year to date, the index is up 8.59%. The Nasdaq posted a stronger 3.7% return in the month, supported by continued optimism around AI-driven productivity and corporate investment in infrastructure. Small-cap stocks also moved higher in July, gaining 1.7% (Russell 2000).

Outside the U.S., developed international stocks (MSCI EAFE Index) took a breather, dropping 1.4% in July, yet remain positive 17.77% year to date. Emerging market stocks (MSCI Emerging Markets) rose 1.9% in the month and are up 17.5% this year through July.

Within fixed income, our expectation has been and continue to be that rates will remain volatile and range bound, which was the case in July. The 10-year Treasury yield started the quarter at 4.24% and ended slightly higher at 4.37%. In the month, investment-grade core bonds ended the quarter down 0.3 % (Bloomberg US Aggregate Bond). Lower quality high-yield bonds were up slightly at 0.4% (ICE BofA US High Yield).

INVESTMENT ENVIRONMENT

Tariffs, The Fed, and The Dollar

As we look to the remainder of 2025 and into next year, there are a few key themes we’re keeping an eye on, namely trade, the labor market, and monetary policy.

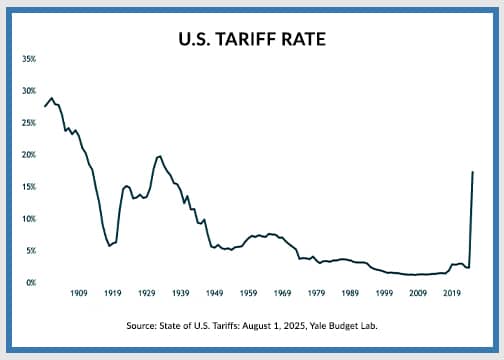

Let’s start with tariffs, which are an important input that influences how businesses plan, price, and invest. In late July, the U.S. reached trade agreements with major trading partners including Japan and the European Union. These deals brought some welcomed clarity. Both trade agreements set a 15% base tariff on most imports from those regions, which is a notable increase from the previous 10% level, but lower than earlier threats of 25% or more. In exchange, Japan agreed to reduce tariffs on U.S. autos and industrial goods and pledged $550 billion in U.S. investments. The EU committed $600 billion through 2028, focusing on sectors like energy and defense.

While we’ve avoided the worst-case scenario, tariffs are still historically elevated and evolving. Some sectors such as steel, aluminum, and copper, remain under pressure, with tariffs as high as 50%. And more targeted tariffs are expected soon in industries like semiconductors and pharmaceuticals. We also have to wait and see the final agreements between the U.S. and China and Mexico, both of which have been extended by 90 days, before we have a more complete picture.

For perspective, tariff levels have jumped from around 2% at the start of the year to between 15% and 20% today. That’s a sharp and broad-based increase, which ends up being a tax on businesses and consumers that will put pressure on the economy.

The key question now is who bears the cost. So far, there’s some indication that foreign suppliers (such as Japanese automakers) are absorbing some of the tariff hit, but it’s still unclear how much of the cost burden will ultimately be passed along to U.S. businesses and consumers. So far, the pass-through of costs to consumers has been more muted than expected, at least for now.

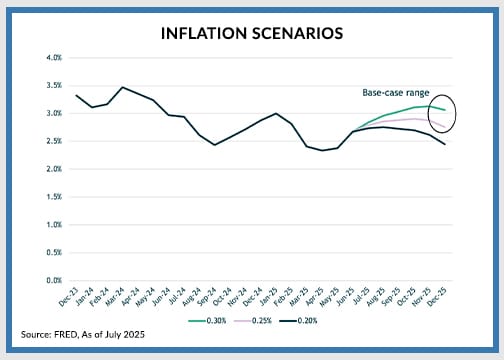

Looking ahead, we expect tariffs will lift inflation over the next few quarters. Our base case is that core inflation (CPI) will edge up from the current 2.67%, possibly reaching low 3% levels by year-end. This view reflects the delayed impact of these tariffs, which we expect will continue to filter through the economy over the coming months. The chart below illustrates inflation outcomes using constant month-over-month scenarios through the end of the year.

While recent trade negotiations have brought a bit more stability, tariffs remain an economic headwind, and they’ll likely remain a source of cost pressure and policy uncertainty for both businesses and households into 2026. Again, the extent is still unknown, but we think with more clarity, businesses can adjust input costs and/or restructure products to help preserve margins and minimize the potential negative impact of price increases.

So far the tariffs have not had a material negative impact on the economy. Looking ahead, our base case is that the economy will continue to slow, but we don’t see a recession on the immediate horizon. We think it’s possible that GDP could fall below 1%, which is slow, but not negative.

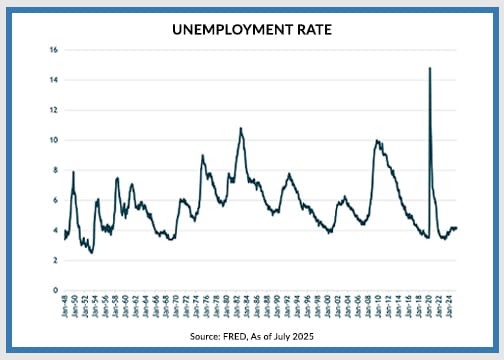

The labor market through July has been a key source of strength. Hiring is soft, but layoffs are still low and that’s been helping to maintain a low and steady unemployment rate. The unemployment rate has been in the low 4% range over the last 12 months. We expect unemployment will rise gradually but not spike. We have also seen wage growth outpace inflation for 26 consecutive months.

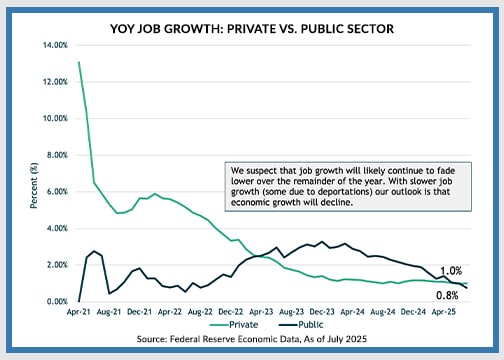

But not all is rosy in the labor market. One concern we have is that private sector job growth has been slowing. As shown in the chart below, year-over-year private sector job growth (green line) has declined sharply over the past few years and in recent months it has hovered around the 1% level. With respect to public jobs (blue line), we also see a slowdown of job growth. Overall, these levels of job growth suggest only a modest level of economic growth.

Meanwhile, the consumer has been holding up as evidenced by the latest consumer spending report. Keeping a close eye on the consumer is important as consumption accounts for roughly two-thirds of the U.S. economy. We are seeing some weakening in areas such as non-essentials. But helping to support the consumer is their higher net worth, with the biggest gains coming from financial assets such as brokerage accounts and 401(k)s, which are at all-time highs, and real asset values such as homes increasing in value.

Against the backdrop of full employment and still-elevated inflation, the Fed, as expected, held rates steady in the late-July meeting at 4.25-4.50% for the fifth consecutive meeting. However, it was notable that two Fed governors (Michelle Bowman and Christopher Waller) disagreed, each favoring a 25-basis point rate cut while the rest voted to hold rates steady. It was the first time since December 1993 that two Fed ‑governors formally dissented from a rate decision.

We think the divergence of views within the FOMC not only reflects the complexity of the current macro landscape, but also whether Fed policy should be proactive or reactive. The two dissenters argue that while inflation and unemployment are currently consistent with a modestly restrictive stance, looming risks warrant easing policy now to stay ahead of deteriorating conditions. Waller articulated this perspective recently, suggesting that elevated inflation is largely a temporary result of tariffs and likely to subside without Fed action. Powell described this as a “reasonable base case.” In contrast, the reactive camp remains cautious, concerned that tariff-driven inflation could trigger a rise in long-term inflation expectations if the Fed appears too dovish. With short-term inflation expectations already climbing, they fear this could keep inflation higher for longer, necessitating continued policy.

The Federal Reserve’s decision to hold rates steady despite political pressure from President Trump served to underscore its independence, a key pillar of economic stability. This is essential as central bank independence helps anchor inflation expectations, supports market confidence, and help keep long-term borrowing costs in check. Political interference or abrupt leadership changes risk undermining that credibility, which could increase uncertainty across the economy, and potentially unanchor long-term interest rates.

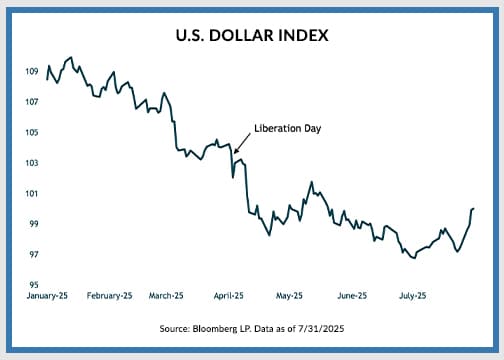

Regarding the U.S. dollar, after falling over 10% in the first half of the year, it rebounded in July, rising 3.2% even as tariff headlines intensified. Below is a year-to-date chart of the trade-weighted U.S. dollar versus other developed market currencies.

In our view, the dollar generally tracks macro fundamentals but there are periods of disconnect. One key driver is the comparative level of interest rates between the U.S. and other major economies. Higher U.S. rates typically attract capital and support the dollar. The dollar also tends to benefit when markets grow uneasy as it remains the world’s safe-haven currency. Other forces like U.S. fiscal discipline, investor confidence, and relative economic growth also play important roles. Historically, when the U.S. economy outperforms, the dollar strengthens. And while fears about the dollar losing its reserve status are likely overstated, they can still spark volatility.

One indicator we watch closely is the relationship between the trade-weighted dollar and five-year TIPS yields, which reflect inflation-adjusted expectations for Fed policy. These usually move together, but through the first half of the year, the dollar has lagged behind rising real yields, which we think signaled investor caution about the U.S. outlook amid renewed trade tensions.

The current level of inflation supports the dollar’s recent move as the Fed was not in a hurry to cut rates. This helped the dollar in July. If the labor market can remain healthy, we believe there may be more dollar strength ahead if inflation momentum persists. But any hint that the economy is weakening, prompting a Fed rate cut, we would likely see the dollar decline.

INVESTMENT IMPLICATIONS

Turning to the equity market, amid this backdrop of macro uncertainty and policy transition, equity markets continue to reach all-time highs. Tariff-exposed sectors remain under pressure, while much of the recent rally has been concentrated in areas like AI-driven technology, which has seen outsized gains since April. Valuations, meanwhile, offer little cushion for disappointment, with the margin compressing. In this environment, we think a long-term lens is paramount. We believe the macro backdrop does not currently warrant a regional overweight or underweight stance.

In fixed-income, while credit spreads are tight, yields are relatively attractive especially in non-traditional parts of the bond market. Our focus remains on high-quality instruments that can deliver attractive income without assuming excess credit or duration risk. We remain selective, emphasizing capital preservation and liquidity while monitoring for dislocations that may present longer-term opportunities. As policy and economic signals evolve, maintaining a disciplined, through-the-cycle investment approach will be critical.

DISCLOSURE:

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.