ECONOMIC DATA REFLECTS STABILITY WITHOUT STRENGTH

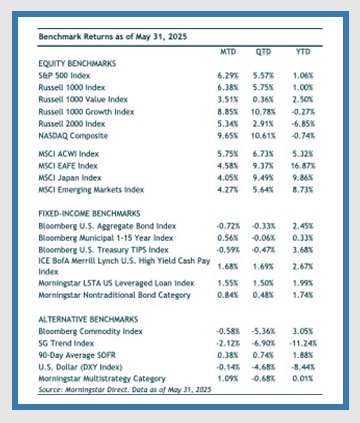

U.S. equity markets rebounded in May, with the S&P 500 gaining 6.3%, its strongest May since 1990, and the tech-heavy Nasdaq advancing sharply (9.6%) on the back of strong earnings from AI leaders like Nvidia. This strong market performance seemed to be driven more by improving investor sentiment and corporate earnings results than by fundamental shifts in the macroeconomic backdrop. However, over the final two weeks of the month, markets lost momentum, with the S&P 500 trading in a choppy, sideways range just shy of 6,000, reflecting investor uncertainty.

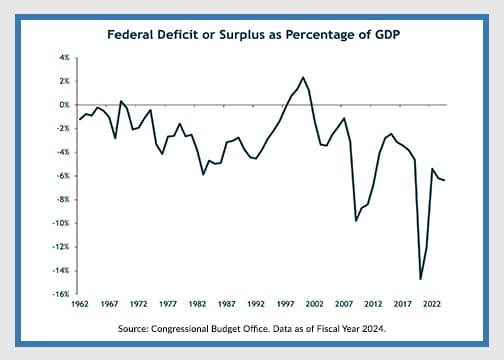

Meanwhile, bond markets were under pressure in May amid growing fiscal concerns. Trump’s proposed “One Big Beautiful Bill,” a sweeping tax and spending package, fanned worries about larger deficits. (See chart below for growing deficit, which stands at approximately 6.4% of GDP.) This led investors to sell long-term Treasury bonds, lifting yields rose across the curve. The 10-year Treasury yield started the month at 4.17% and reached 4.6% before retreating to 4.41% by month end. The 30-year Treasury yield also climbed during the month, reaching 5.1%, its highest level since 2023.

Another key driver behind higher yields came on May 16, when Moody’s downgraded the U.S. credit rating from Aaa to Aa1. The agency cited the roughly $36 trillion debt load and an unsustainable fiscal path, warning that deficits will widen (to near 9% of GDP by 2035, from 6.4% in 2024) driven by rising interest costs, tax breaks, growing entitlement spending, and weak revenue. Moody’s noted that successive administrations had failed to rein in deficits, and this move put Moody’s in line with S&P and Fitch (which cut the U.S. below AAA in 2011 and 2023, respectively). In our opinion, this latest downgrade from Moody’s will not have any material investment implications.

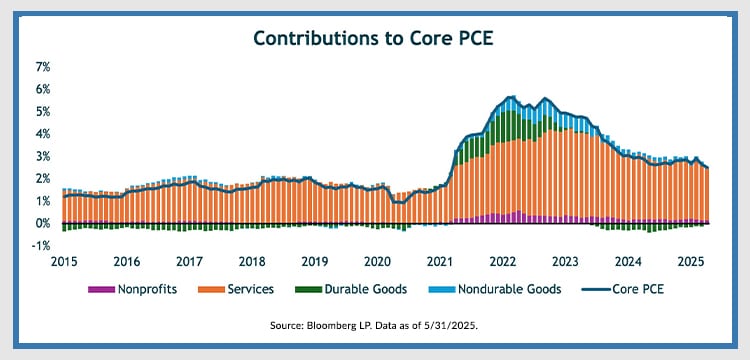

On the economic front, the data continues to reflect stability without strength. The labor market remains resilient for now with unemployment holding at 4.2%, wage growth outpacing inflation for 24 consecutive months, and the number of job openings remain aligned with the number of job seekers. Yet, broader indicators don’t suggest momentum for a new economic expansion. Core PCE inflation, which is the Fed’s preferred inflation measure that excludes volatile food and energy costs, eased to 2.5% year-over-year in April, in line with expectations and below March’s 2.7%. Still, inflation remains above the Fed’s 2% target, and tariff-related pressures could soon reaccelerate inflation. The persistently elevated inflation can still largely be attributed to services inflation that remains higher than it was pre-pandemic. And within services, health care and housing remain the key contributors to the elevated number. Inflation for goods has been essentially flat since 2022.

Trade policy developments continued to inject volatility into markets. While tensions had calmed earlier in the month, late-May saw renewed uncertainty as conflicting court rulings on President Trump’s tariffs emerged. In addition, Trump accused China of violating a tariff truce, further straining relations. Investor sentiment has become highly reactive to such developments, underscoring the market’s sensitivity to political news over economic fundamentals.

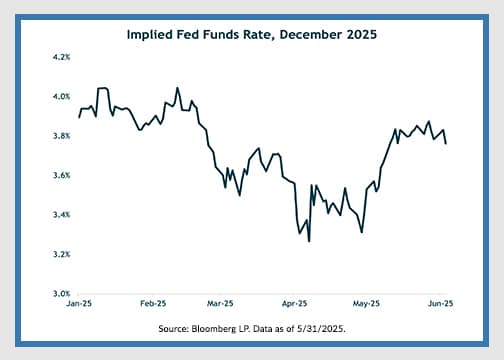

The Federal Reserve, for now, remains on pause with respect to its interest-rate policy. Despite political pressure from President Trump to ease rates, the Fed continues to describe the economy as being in a “good place,” emphasizing that future policy decisions will be data dependent. Their focus remains on achieving their dual mandate of price stability and maximum employment. A more dovish pivot may not materialize until later this year if economic conditions weaken. For now, market pricing (as shown in the chart below) implies just over two cuts, or 50 basis points, by the end of this year, bringing the Fed Funds target rate to a range of 3.75-4.00%

Looking ahead, we remain cautious. While May’s rally was a welcome reversal from April, it appears sentiment-driven rather than fundamentally supported. With fiscal concerns mounting, trade tensions resurfacing, and inflation potentially bottoming, we believe markets could bring further volatility as investors seek clarity on economic direction, policy response, and geopolitical risks.

INVESTMENT IMPLICATIONS

In today’s rapidly shifting environment, where government policies, particularly around trade and tariffs, can change with little warning, the market landscape has become increasingly difficult to predict. These policy swings can create sudden volatility across sectors, geographies, and asset classes. In such an uncertain climate, diversification remains one of the most effective tools investors have to manage risk.

In this environment, disciplined diversification and prudent portfolio construction are more important than ever. As we move into June, staying flexible will be key to managing investment strategies effectively in this evolving environment.

DISCLOSURE:

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.