Q3 2025 in Review

Investors are navigating a demanding environment, where forces are pulling in opposite directions. Equity markets sit near record levels supported by corporate earnings and consumer spending, while key economic indicators suggest the economy is slowing. The Federal Reserve’s September decision to restart rate cuts adds a supportive backdrop for equity markets, while elevated valuations serve as a reminder that risks remain, particularly if economic and corporate earnings growth slows more than expected. Some major policy uncertainties such as disruptions from tariffs appear largely behind us (for now), but with midterm elections around the corner, debates over fiscal and monetary policies will likely intensify, testing investors’ discipline and conviction. Our current view is that the positives have the upper hand, providing a cautiously constructive backdrop. By grounding our approach in data, applying historical context, and challenging our assumptions, we strive to guide portfolios through market uncertainties, while remaining attentive to evolving risks.

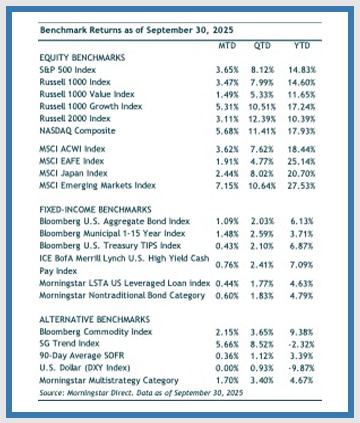

In the third quarter, the S&P 500 gained 8.12%, lifting its year-to-date return over 14.83%. Corporate earnings resilience, particularly in the technology and communication services sectors, continue to drive the index higher. The tech-heavy Nasdaq posted a 11.41% return for the quarter, lifted by continued optimism around AI-driven productivity and capital investment in cloud infrastructure. Large-cap growth stocks (Russell 1000 Growth) were up 10.51% nearly doubling value stocks’ (Russell 1000 Value) 5.33% gain. Small-cap stocks (Russell 2000) had a strong quarter (up 12.39%), outperforming large-cap stocks amid hopes that lower interest rates would benefit the asset class.

In the third quarter, the S&P 500 gained 8.12%, lifting its year-to-date return over 14.83%. Corporate earnings resilience, particularly in the technology and communication services sectors, continue to drive the index higher. The tech-heavy Nasdaq posted a 11.41% return for the quarter, lifted by continued optimism around AI-driven productivity and capital investment in cloud infrastructure.

Large-cap growth stocks (Russell 1000 Growth) were up 10.51% nearly doubling value stocks’ (Russell 1000 Value) 5.33% gain. Small-cap stocks (Russell 2000) had a strong quarter (up 12.39%), outperforming large-cap stocks amid hopes that lower interest rates would benefit the asset class.

Internationally, developed market stocks (MSCI EAFE) gained 4.77% in the quarter, lagging the S&P 500. Emerging markets rose 10.64% (MSCI EM) in the quarter largely because global financial conditions are easing, valuations are relatively attractive, and there is AI optimism in key markets, especially China. Year to date, developed international and emerging market stocks are still outperforming domestic stocks, thanks to a roughly 10% decline in the U.S. dollar.

In the U.S. fixed-income market, after holding rates steady for the first eight months of the year, the Federal Reserve resumed rate cuts in September. The Fed stated the cut was “risk management,” taking a more cautious stance toward slowing growth and softening labor conditions. Yet the path forward remains far from certain. While the Fed emphasizes data dependency and balancing the risks of inflation versus economic growth, markets are pricing in a more aggressive easing trajectory. Against this backdrop, yields moved unevenly across the curve. Credit markets remain strong with spreads near multi-decade tights, and fiscal pressures continue to influence long-term rates. Investment-grade core bonds ended the quarter up 2.03% (Bloomberg US Aggregate Bond), while high-yield bonds were up 2.41% (ICE BofA US High Yield).

INVESTMENT OUTLOOK

Markets are always reacting to news, but today it feels even more pronounced. Every data release, policy comment, or geopolitical headline seems to carry an outsized influence on investor sentiment. This heightened sensitivity seems justified, as investors try to determine the path forward. Will the economy continue to slow under the weight of tighter financial conditions, or can momentum continue?

Against this noisy backdrop, there are reasons for optimism. One important tailwind comes from monetary policy. The Federal Reserve’s recent rate cut, after a prolonged pause, provides a constructive backdrop for both equities and bonds. Lower rates reduce borrowing costs for consumers and corporations, potentially fueling further investment and spending. History also offers perspective. A study by J.P. Morgan found that when the Fed cuts rates with the S&P 500 within 1% of an all-time high, the index has averaged a 15% gain over the following 12 months.

The consumer also remains a source of strength. The U.S. economy is primarily driven by consumption, often described as the backbone of growth. Spending has held up well across much of the economy, even after adjusting for inflation. While income and spending levels are not distributed equally, i.e., there are meaningful disparities across households, overall consumption has been supported by real wage growth that has outpaced inflation in many segments. This has enabled households to absorb higher costs without meaningfully pulling back. Balance sheets, meanwhile, remain generally healthy, the result of higher brokerage accounts and stable housing values. Despite higher mortgage rates, housing continues to serve as a source of household wealth and an important piece of consumer confidence.

Corporate fundamentals add another layer of support. Earnings growth rose 11.7% in the second quarter, making it the third consecutive quarter of double-digit growth. Many companies reported expanding margins, improved efficiency, and positive forward guidance. These results provide a foundation for higher equity valuations.

Importantly, market leadership has begun to broaden. While much attention has been focused on a handful of large-cap technology companies, gains have recently extended across a wider set of sectors. This improved breadth suggests a healthier rally, less reliant on a narrow cohort of stocks.

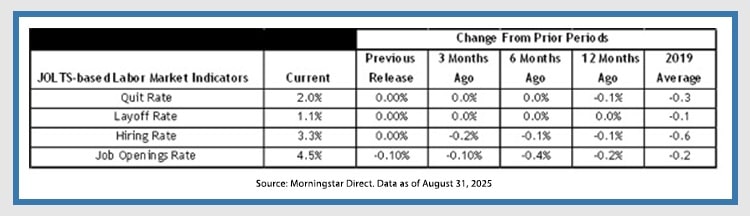

Of course, risks remain. We are closely monitoring the labor market. Key indicators such as quit rates, layoff rates, and initial unemployment claims have all flatlined. We seem to be at stall speed, and conditions could shift either way, so we’re monitoring developments closely, especially the unemployment rate.

Since April, job gains averaged around 53,000 per month, which aligns closely with estimates of breakeven job levels needed to keep unemployment steady. We are not yet seeing broad-based layoffs or the kind of deterioration that typically signals an outright downturn. In the table below, we show some current key labor market stats compared to prior periods.

Deciphering the job market data is not as easy as reading the headlines. In recent years, immigration has led to large swings in labor supply and distorted the relationship between payroll growth and unemployment. When labor supply expanded quickly in 2023 and 2024, job gains looked strong but were outpaced by labor force growth, leading to higher unemployment. Conversely, when supply growth slowed in late 2024 and early 2025, job growth weakened but the unemployment rate held steady. More recently, employment growth has slowed further, yet the number of job seekers remains roughly in line with available jobs. The key point is that payroll growth can look strong when conditions are deteriorating and appear weak when the market is relatively balanced. Today’s combination of modest job growth and a stable unemployment rate suggest the labor market is slowing but not collapsing. We continue to watch the data closely for signs of further weakening.

In short, while near-term uncertainty can test long-term conviction, we believe this environment highlights the importance of discipline. Staying focused on fundamentals and resisting the temptation to be swayed by short-term noise remains the most effective approach to navigating today’s markets.

CONCLUSION

We enter the final quarter of the year with both opportunity and uncertainty. Equities are supported by resilient earnings, healthy consumer demand, and a more accommodative Fed, yet valuations remain elevated, and policy debates loom large. In fixed income, tight spreads reflect strong corporate fundamentals even as fiscal pressures and policy divergence create risks at the long end of the curve. Labor markets are softening but not collapsing, reinforcing the view that growth is slowing rather than outright stalling.

This is a moment to stay disciplined. Near-term volatility and policy noise will likely continue, but fundamentals (i.e., healthy balance sheets, consumer spending, and improving breadth in equity markets) provide a constructive backdrop. We continue to maintain diversified portfolios, balancing risk and opportunities, and positioning to benefit from long-term secular trends while staying alert to evolving macro and policy risks.

DISCLOSURE:

For discretionary use by investment professionals. Portions of this document are provided by iM Global Partner Fund Management, LLC (“iMGPFM”) for informational purposes only and no statement is to be construed as a solicitation or offer to buy or sell a security, or the rendering of personalized investment advice. There is no agreement or understanding that iMGPFM will provide individual advice to any investor or advisory client in receipt of this document. Certain information constitutes “forward-looking statements” and due to various risks and uncertainties actual events or results may differ from those projected. Some information contained in this report may be derived from sources that we believe to be reliable; however, we do not guarantee the accuracy or timeliness of such information. Investing involves risk, including the potential loss of principal. Any reference to a market index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indexes are unmanaged vehicles that do not account for the deduction of fees and expenses generally associated with investable products. A list of all recommendations made by iMGPFM within the immediately preceding one year is available upon request at no charge. For additional information about iMGPFM, please consult the Firm’s Form ADV disclosure documents, the most recent versions of which are available on the SEC’s Investment Adviser Public Disclosure website (adviserinfo.sec.gov) and may otherwise be made available upon written request.

Certain material in this work is proprietary to and copyrighted by iM Global Partner Fund Management, LLC and is used by OJM Group with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.

For informational purposes only. OJM Group, LLC is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. For more information about OJM Group please visit https://adviserinfo.sec.gov/ or contact us at 877-656-4362. Not intended as legal or investment advice or a recommendation of any particular security or strategy. Information prepared from third-party sources is believed to be reliable though its accuracy is not guaranteed. Investing involves risk and possible loss of principal capital. Past performance is not indicative of future results.

Index Disclosure: An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. Index returns shown are price returns, which exclude dividends and other earnings.