A Balanced Approach

As physicians approach retirement and contemplate a stage of life when they will not be earning a paycheck, they typically begin to consider social security as part of their post-career income planning. Not surprisingly, comes the simple question that has a much more complex answer: When is the optimal time to begin claiming benefits from Social Security? In this article, we will begin to answer this important planning question. As you likely expect, the answer isn’t “always wait until age 70” or “always claim at 62” as this will largely depend on your personal circumstance. Deciding when to take social security will depend on numerous factors, most notably when you retire, your other investment assets, the need for income, and your longevity.

As you likely expect, the answer isn’t “always wait until age 70” or “always claim at 62” as this will largely depend on your personal circumstance. Deciding when to take social security will depend on numerous factors, most notably when you retire, your other investment assets, the need for income, and your longevity.

The earliest one can begin drawing on social security is age 62 with the maximum age running until age 70. The simple math will state that each year you delay taking social security results in approximately 8% additional benefits annually. While this isn’t an exact number, it’s a universally held rule. Also, delaying social security until age 70 typically means you must live until age 78 to age 81 for that decision to have made economic / financial sense.

How to Determine your Breakeven in Benefits

The Social Security Administration provides a statement that is personal to you where they project your benefit amount at various ages. Here is a basic break-even age calculation that you can utilize:

Break-even age = Total additional benefits received by delaying / Monthly benefit difference

For example, if your benefits are $2,797 at 62 and $5,049 at 70:

- Monthly difference: $2,252

- Opportunity cost: $2,797 x 96 months = $268,512

- Break-even point: $268,512 / $2,252 = 119 months (about 10 years)

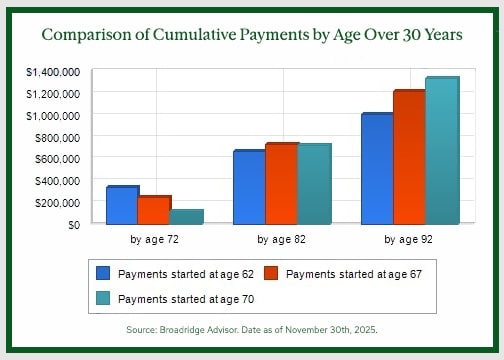

This chart compares the cumulative benefits received for the above scenario over 30 years, beginning at age 62.

Strategy 1: Use a “Bridge” Approach to Maximize Spending

One strategy gaining traction is the “bridge” method. In this scenario, you delay claiming Social Security benefits until later (say age 70) and in the meantime draw down other assets or income sources.

By delaying benefits, retirees can lock in larger inflation-adjusted payments for life. (When the higher-earning spouse delays to age 70, the survivor locks in the higher benefit for life, too.) Here, you allow your Social Security benefit to grow each year you delay, which is commonly thought of as approximately 8% per year for each year you delay past your full retirement age. A stronger Social Security baseline means fewer potential withdrawals later in life, when market risk and longevity risk can be the highest.

Using the bridge approach also allows you to coordinate other strategies like doing partial IRA conversions to Roth IRA while your income is relatively low before RMDs kick in during your 70s. It also can help you better manage the Medicare IRMAA tax brackets.

This strategy does come with trade-offs. You must have other income or assets available to fund your retirement until you start Social Security and delaying may not make sense if you have limited life expectancy or pressing financial needs.

Strategy 2: Claim Sooner When the Circumstances Fit

The alternate view is that for many individuals, taking Social Security earlier (even at the minimum eligible age) can make real sense. Consider these scenarios:

- Current Income Needs: If you already have enough income from other sources, you may afford to delay and boost your benefit. If not, earlier claiming may provide necessary support.

- Health concerns or shortened life expectancy: If you face a short time horizon or poor health where delaying gives little return.

- Unexpected Retirement: You have an urgent need for income today as retirement has arrived sooner than expected or other income sources are insufficient.

- Potential Social Security Structural Changes: You anticipate that the system may change or prefer to lock in benefits while you can.

In those cases, claiming early may maximize lifetime value, especially when viewed as a floor of income rather than purely optimizing the monthly benefit size.

Key Decision Factors to Weigh

Aside from what has been noted, here are some other important levers to evaluate when deciding when to claim:

- Spousal or Survivor Considerations: Benefits tied to a spouse’s work record or survivor benefits may change the calculus. Maximizing benefits for both parties sometimes means delaying.

- Risk of Work or Earnings Penalties: If you claim early and continue working substantially, some benefits may be withheld until full retirement age, reducing effective income in early years.

- Investment & Inflation Risk: Waiting means your benefit grows and may better keep pace with inflation if COLAs (cost-of-living adjustments) are applied. On the flip side, early claiming lets you lock in certainty.

Practical Steps You Can Take

The first step in deciding begins with gathering your Social Security statements and projections. Understanding what your benefit would be at different ages is valuable and necessary information to obtain. Next would be estimating your spending needs both in the immediate and in your later retirement years.

Conclusion

Every doctor, as they approach and wade into retirement, will need to make a decision about when to begin their social security benefits. As we have seen, there is no one-size-fits-all answer. The “delay as long as possible” advice is valid for many, but not all. Similarly, claiming early is not a mistake in every case as it can be the right choice under the right conditions. The best outcome comes when you align claiming timing with your income needs, asset base, health, and broader retirement plan. Many physicians will benefit from working with a financial professional to help them navigate the options and make the best decision for their specific facts and circumstances.