RANKING THE BEST SOURCES & UNDERSTANDING THEIR ROLE IN FINANCIAL PLANNING

An emergency fund is one of the most fundamental, yet overlooked, pillars of personal financial planning. It serves as a dedicated reserve, money that exists solely to protect you from unexpected events that could otherwise disrupt your financial stability. Life’s surprises come in many forms: medical emergencies, job loss, car or home repairs, or even a sudden drop in income. Without a financial cushion, these events can trigger a dangerous cycle of credit card debt, loans, and/or liquidation of long-term investments. An emergency fund acts as your shock absorber, allowing you to manage crises with confidence instead of panic.

Most financial planners recommend setting aside three to six months of essential living expenses, but the ideal amount depends on personal circumstances. A single individual with low fixed expenses might only need three months, while a family of four with a mortgage and tuition payments might target nine to twelve months. Those in commission-based or self-employed roles benefit from even larger reserves to offset income fluctuations. The key is liquidity (your emergency fund should be accessible within days, not weeks) and safety, meaning the money shouldn’t fluctuate in value or be exposed to market risk.

Top Sources and Vehicles for Emergency Funds (Ranked)

High-Yield Savings Accounts (HYSA)

A high-yield savings account remains the most effective foundation for an emergency fund. These accounts combine liquidity, principal protection, and competitive yields, often in the 4%–5% range as of 2025. They are FDIC insured up to $250,000 per depositor per bank, ensuring peace of mind. You can transfer funds instantly to your checking account or access them within a day, ideal for immediate needs like car repairs or medical bills. While the rate can fluctuate with interest movements, the balance between safety and return makes HYSAs the gold standard for most households.

Money Market Accounts (MMA)

Money market accounts occupy a close second place, offering slightly higher yields and the flexibility of limited check writing or debit card access. They’re best suited for people who maintain higher balances and want quick but slightly more structured access to their money. The main drawback is that some banks impose minimum balance requirements or limit the number of withdrawals per month. Still, for disciplined savers, MMAs blend stability and convenience perfectly.

Treasury Bills (T-Bills)

U.S. Treasury bills are among the safest investments in the world, backed by the federal government. They come in maturities from 4 to 52 weeks and can be purchased directly through TreasuryDirect or via brokerage platforms. Their yields often rival or exceed those of savings accounts, and they’re exempt from state and local taxes. Because they aren’t immediately liquid — you typically wait until maturity or sell in the secondary market — T-bills work best for the portion of your emergency fund you’re less likely to touch.

Money Market Mutual Funds (MMMFs)

Money market mutual funds are another strong option for investors already comfortable managing brokerage accounts. These funds pool capital into short-term, low-risk securities such as government and corporate notes. While not FDIC-insured, they are heavily regulated to maintain stability and preserve a $1 share price. Government-only funds offer near-total safety and daily liquidity, often with yields matching or slightly exceeding HYSAs.

Short-Term CDs (Certificates of Deposit)

Certificates of Deposit (CDs) provide predictable, guaranteed returns, making them appealing to conservative savers. Short-term CDs, typically 3 to 12 months are ideal for tier-three reserves that you rarely need to tap. The trade-off is liquidity; early withdrawals trigger penalties, but many online banks now offer ‘no-penalty CDs’ that give flexibility without sacrificing yield. Strategically laddering CDs can also provide rolling access to cash every few months.

Roth IRA (as a Backup Emergency Source)

While a retirement account might not seem like an emergency fund, Roth IRAs offer unique flexibility. You can withdraw your contributions (but not earnings) at any time tax- and penalty-free. This makes a Roth IRA a potential ‘dual-purpose’ tool — it grows for retirement but doubles as a backup emergency resource. However, tapping it too often can jeopardize long-term compounding, so it should only serve as a fallback after exhausting cash reserves.

Home Equity Line of Credit (HELOC)

For homeowners with substantial equity, a HELOC can provide access to low-cost credit in major emergencies. It functions as a revolving line of credit, meaning you can draw funds as needed and only pay interest on what you use. That said, it’s critical to secure a HELOC before an emergency occurs, since lenders may freeze or reduce credit lines during economic downturns. Use it as a safety valve, not as a substitute for liquid cash.

Credit Cards or Personal Lines of Credit

These options represent the true last resort. While they offer immediate access to funds, their interest rates — often 18%–30% — can turn a temporary problem into long-term debt. Using them responsibly requires strict repayment discipline. Ideally, you should rely on these only to bridge a short-term gap while transferring funds from safer sources.

Top Sources and Vehicles for Emergency Funds (Ranked)

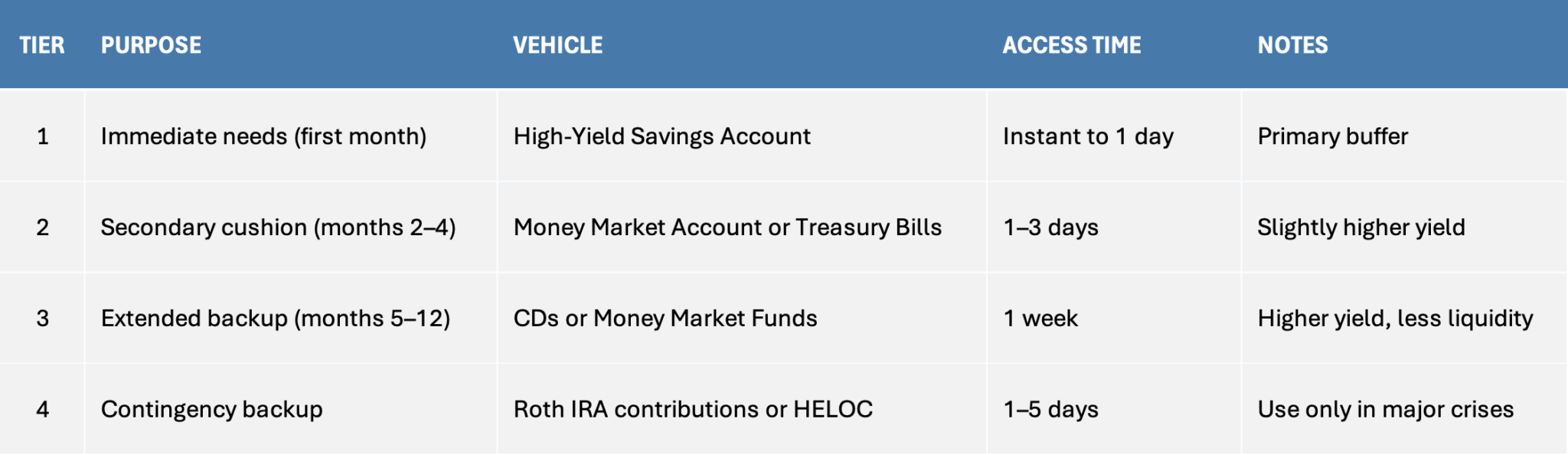

A tiered structure for your emergency fund helps balance liquidity and yield. The first tier covers immediate expenses and must be fully liquid. Subsequent tiers can hold slightly less liquid but higher-yielding assets. This layered approach ensures you can handle small disruptions without dipping into long-term savings.

Building and Maintaining an Emergency Fund

Building an emergency fund takes time and consistency. Automate transfers from checking to savings to make it effortless. When you receive a bonus, tax refund, or side income, allocate a portion toward your emergency fund before spending or investing elsewhere. The goal is to make saving automatic and emotional spending optional.

Revisit your fund annually. As your income, expenses, or family size changes, your target amount should evolve too. Once fully funded, consider shifting additional cash into higher-yielding investments to maintain balance between liquidity and growth.

Common Mistakes with Emergency Funds

Even well-intentioned savers make errors that weaken their safety net. A common mistake is investing the emergency fund in stocks or long-term bonds. While tempting for higher returns, this exposes the money to volatility just when you might need it most. Another mistake is mixing emergency savings with general-purpose cash, blurring the line between necessities and wants. Finally, some people underestimate their real monthly expenses, leaving them underprepared when a true emergency strikes.

The Broader Role in Financial Planning

An emergency fund isn’t just a savings tool — it’s a foundation for financial independence. It prevents panic selling during market downturns, supports confidence in career decisions, and offers emotional peace of mind. In essence, it gives you time and options. When paired with proper insurance, debt management, and long-term investing, it forms the bedrock of a resilient financial plan.

For households with higher incomes or complex financial lives, a larger emergency fund can also act as a liquidity bridge providing flexibility for tax payments, real estate repairs, or funding short-term opportunities without disrupting investment portfolios.

Conclusion

A comprehensive emergency fund strategy transforms uncertainty into security. While high-yield savings accounts remain the top choice, layering them with money market accounts, T-bills, and CDs provides a thoughtful balance of safety, access, and return. For homeowners and long-term savers, HELOCs and Roth IRAs serve as valuable backups. While its initial objective is to save money, the true purpose of an emergency fund is to buy peace of mind and preserve financial stability through life’s inevitable surprises.