Yield Curve Inversion and Trade Tensions Cause Continued Volatility

August was a choppy month for stocks. Half of the 22 trading

Trade tensions escalated in August with the United States imposing 10% tariffs on another $300 billion of Chinese goods and formally accusing China of manipulating its currency. In response, China announced additional tariffs on $75 billion worth of U.S. products in August. The tit-for-tat trade situation—it may now be appropriate to call it a “trade war”—between the world’s two largest economies continues to drag on with a great deal of uncertainty around its duration, intensity, and ultimate outcome. As the saying goes, “equity markets hate uncertainty,” particularly in the context of a weak and slowing global economy.

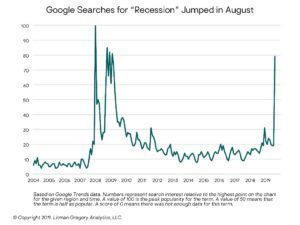

On the other hand, bond markets like economic slowdowns. Interest rates continued to fall in August after the Federal Reserve cut interest rates at the end of July for the first time since 2008. The 10-year Treasury yield fell 50 bps to close the month at 1.5%. The sharp drop in yields was accompanied by an inversion of the 10-year and 2-year portion of the yield curve (we have written about the curve being inverted at the 10-year and 3-month points, which has been true for much of the summer). Many in the market believe a yield-curve inversion is a recessionary signal—as it has preceded previous recessions and signals investors’ concern about the near-term prospects of the economy. While we have been highlighting the economic risks for a while, recession fears went “mainstream” after the curve inverted. As shown in the chart below, Google Search registered a huge spike in people Googling “recession” last month.

Developed international equities fell roughly as much as their U.S. counterparts in August. The Vanguard FTSE Developed Markets ETF dropped 1.9% and the Vanguard FTSE Europe ETF lost 1.6%. A great deal of uncertainty remains around how the United Kingdom will deal with their upcoming departure from the European Union. Investors are also looking toward the European Central Bank’s September meeting for additional stimulus for the European economy. Emerging-market stocks lost 3.3% for the month, partly due to a strengthening U.S. dollar, which was a headwind for dollar-based returns.

—OJM Group Investment Team (9/9/19)