Many investors have recently been asking their advisors, “Is a recession coming?” This question is often on the minds of investors because the financial media repeatedly brings up the topic.

The current economic environment doesn’t suggest a pending recession. Unemployment is well below 4%, consumer spending is at record levels, and both personal and corporate balance sheets are healthy. Inflation rates have been cut in half.

Last year the S&P lost 18% and all major equity asset classes finished in the red. Now that inflation is slowing (although not quite to the level the Federal Open Market Committee (Fed) is seeking, high-interest rates are identified as the likely culprit leading to a recession. The Fed has stated they want the economy to slow, and their desires are relevant because the Fed sets short-term interest rate policy. An economic slowdown does not necessarily mean a stock market sell-off is certain to follow. It is important to keep in mind the stock market is forward looking, and an argument can be made that the forward-looking stock market has already priced in higher rates via the 2022 sell-off.

Returning to the original question: Are today’s interest rates telling us a recession is imminent? We are required to address three additional questions to find the answer. What is the concern with high rates? Are today’s rates considered historically high? Has the historical interest data been predictive of market performance?

Why are high rates a concern?

When interest rates are high, they can impact the performance of stocks in several different ways. High-interest rates can make it more expensive for companies to borrow money, which can impact their profitability and ultimately their stock prices. Secondly, high-interest rates can cause investors to favor bonds over stocks, as bonds offer a guaranteed rate of return and are perceived as less risky. This can result in a decrease in demand for stocks, which can lead to a drop in prices. Elevated rates also increase the cost of financing consumer items, which can slow consumption, and ultimately impact stocks.

Are today’s rates historically high?

As of April 2023, the 10-year Treasury was in the range of 3.5%. The yield touched 4% in early March. While these rates are higher than what investors have witnessed over the last decade, the 10-year Treasury exceeded 5% in the summer of 2006. Starting with the 1970s, the 10-year Treasury spent most of the next 30 years above 6%.

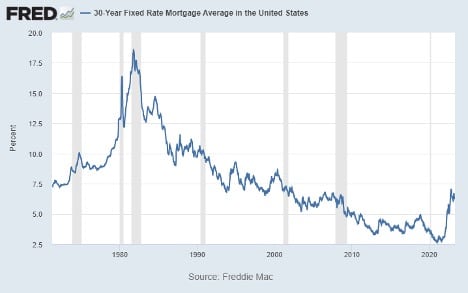

Thirty-year mortgage rates tell a similar story, as they tend to correlate with intermediate-term Treasuries. As you can see in this chart from the Federal Reserve Bank of St. Louis[1], while 30-year mortgage rates are higher now than they have been in more than 10 years, they are clearly lower than they were at almost any time between 1970 to 2000.

What does prior data tell us about market performance and interest rates?

The data is inconclusive. In fact, the data suggests neither the level of interest rates nor their direction are reasons to sell equities. The 1970s-90s essentially provided three decades of high rates. We broke down S&P 500 returns by decade.

During the 1970s, the US experienced high inflation and the Federal Reserve aggressively raised interest rates to control it. The S&P 500 struggled during this period, with significant volatility and posting negative returns in several years. Average annual returns were slightly above 6% during the decade.

In contrast, during the 1980s, interest rates were elevated, but the S&P 500 performed favorably. High-interest rates were a result of efforts by the Federal Reserve to combat inflation, and once inflation was brought under control, the economy and the stock market rebounded. The S&P averaged greater than 16% annually.

Similarly, in the 1990s, the S&P 500 performed well despite relatively high-interest rates. The S&P averaged more than 18% annually during the decade.

If we include the most recent example of rising (although not historically high) rates, we found a series of hikes transpired during the period of 2015-2018. Although the Federal Reserve raised interest rates by 225 basis points (2.25%) from effectively zero, the stock market performed solidly in response to the rising rates, averaging 8.6% during the four-year period. [i]

Our evaluation of the relationship between interest rates and the performance of the S&P had a few shortcomings. The sample size reviewed is relatively small, and a case can be made that using the beginning and ending dates of a decade is somewhat arbitrary. While the 90s offered outsized returns, the next decade experienced two recessions. Returns from the S&P 500 the following decade were essentially flat for the entire ten-year period.

Conclusion

While we may not be able to provide assurance the US economy will avoid a recession, the intent of this article was to clear up a few misconceptions:

- While both short-term and intermediate-term interest rates are higher than what we are accustomed to over the last two years, rates are not high by historical standards.

- Stocks have outperformed their historical average return numerous times in history when interest rates were equal to or above current levels.

- Rates at today’s levels have not been an accurate recessionary indicator in the past, including a period from the 1970s through the 1990s.

- Rising rates have not proven to be a reason to sell stocks. Strong economic growth is a variable often accompanying rising rates and is frequently associated with a rising stock market.

- Falling rates naturally occur after interest rates have peaked. Typically, economic growth has already slowed, and the Fed is creating an environment that is stimulative for stocks. While economic growth has continued to slow in many cases, cutting rates has frequently created confidence among investors and successfully boosted stock prices. Stocks have averaged positive returns during periods of declining interest rates.

In summary, the relationship between interest rates and the performance of the S&P 500 is complex and depends on a range of factors including inflation, economic growth, and investor sentiment. While periods of high-interest rates have historically been associated with mixed performance for the S&P 500, it is important to look at the broader economic context in

order to make an accurate assessment of how interest rates might affect the market going forward.

The current interest rate environment does not tell us a recession is imminent, and current rates are certainly not a reason for long-term investors to sell stocks. Tuning out the noise is more challenging now than at any point in our lifetimes. An experienced team of advisors can deliver facts and historical context to help you make educated decisions about your investment portfolio and financial goals.

[1] https://fred.stlouisfed.org/series/MORTGAGE30US#

[i] https://www.officialdata.org/

[ii] https://www.spglobal.com/spdji/en/documents/research/much-ado-about-interest-rates.pdf