HOW THEY WORK AND WHY THEY ARE NOT PERFORMING WELL IN AN INFLATIONARY ENVIRONMENT

Treasury Inflation Protected Securities, aka TIPS, provide investors with a return that is indexed to inflation over the life of the bond. With the sharp rise in inflation that began in 2021, many investors who own TIPS expected to see gains as a result. But actual TIPS’ performance during this span has disappointed them and, for some, become a source of confusion. We’ll do our best to explain what’s going on with TIPS performance and set appropriate expectations for the future.

HOW TIPS WORK

A quick reminder of TIPS basics is a necessary starting point.

- TIPS are issued by the U.S. Treasury in 5-, 10- and 30-year maturities with the initial interest rate set by auction. In other words, the market decides what it is willing to pay for the inflation protection built into TIPS (e.g., if investors expect higher inflation they will pay more for the bonds and thus receive a lower interest rate, and vice versa).

- Once issued, the value of a TIPS bond is adjusted twice a year in accordance with changes in the Consumer Price Index (the CPI). If prices increase (aka inflation) the principal value of the bond increases commensurately, or, more rarely, if the CPI is negative (deflation) the TIPS value declines by that amount.

- While the interest rate or coupon is fixed at the time the bond is issued (per the auction), that rate is applied to the principal value of the bond, which increases along with inflation. The result is that changes in inflation result in increases (or decreases) in both the value of the bond and the interest payments it generates over time.

- While the price of a “conventional” bond changes with changes in nominal interest rates (meaning the “regular” rates we see quoted every day which are gross of inflation) the price of TIPS is affected by changes in “real” rates, which are net of inflation expectations. (More on this shortly.)

HOW TIPS BEHAVE, AND SOMETIMES SEEM TO MISBEHAVE

TIPS are reliable in delivering on expectations if held to maturity. You know the bond’s cost and interest rate up front. You know those values will increase with inflation and that if held to maturity you will receive that value (making any volatility along the way of little consequence).

Over shorter periods, though, TIPS can be volatile. TIPS with long maturities are more sensitive to changes in real rates (which is the mashup of nominal rates and inflation expectations) and investor expectations on those variables affect prices. Generally speaking, TIPS can be expected to perform well when unexpected inflation emerges, and real rates don’t spike, as was the case in 2021. During that year, inflation rose from 1.4% to 7.0%, a level well above expectations, while 10-year real yields ended the year virtually where they started.

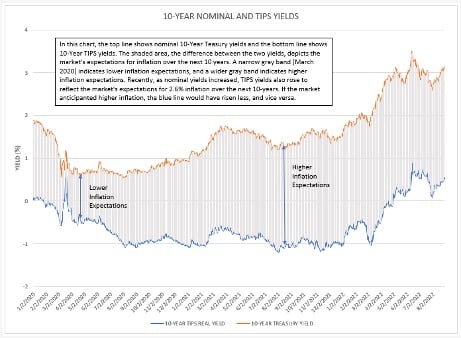

This takes us to this year, in which we saw TIPS fall in value during a period of higher inflation. While TIPS’ investors benefited from higher principal and interest payments, investors have expressed their collective belief that inflation won’t remain at today’s high levels. At the end of August, investors are anticipating inflation to be 2.6% to 2.7% in five to 10 years, a far cry from today’s elevated levels. The result of nominal interest rates spiking higher at a time when investors believed longer-term inflation would come back down was effectively an increase in real rates. (The chart below illustrates this.) And as we know, TIPS prices move inversely to changes in real rates just as conventional bond prices change in accordance with nominal rates. That is what drove the decline this year; interest rates rose by enough to more than offset the benefit that TIPS received from the inflation adjustment

One way of thinking about this is that the normally reliable “bond math” around rates and prices that we see with conventional bonds is less definitive for TIPS – especially in volatile periods – because there is more for investors to anticipate with both interest rates and inflation rates. Just as investors would pay less for the stock of a company if they had a strong belief its earnings were going to fall, TIPS buyers are paying less than what current inflation numbers suggest in anticipation of inflation coming down from elevated levels.

CONCLUSION

Treasury Inflation-Protected Securities (TIPS) are among the many types of debt securities offered by the U.S. Treasury Department. But unlike ordinary Treasury bonds, TIPS are designed to protect investors from inflation by adjusting the value of the principal as consumer prices rise. Because they are impacted by the market’s expectation of where inflation will be 5, 10 or more years in the future, TIPS may experience periods of decline even when inflation is high and increasing presently. Nonetheless, TIPS can make sense as an element of risk management within a total allocation and investors should work with a professional advisor who understands such instruments and how they may impact their individual portfolios.