We will continue to monitor and advise, but for now, we turn our focus back to market developments in a record-setting January.

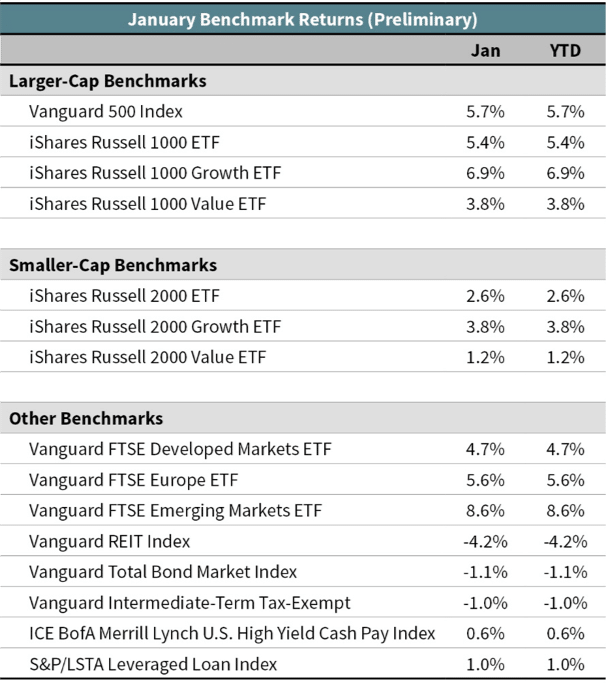

January was another positive month for equity markets, picking up where 2017 left off. Domestic larger-cap stocks gained 5.7 percent (Vanguard 500 Index), the strongest start to a year since 1997. Smaller-cap stocks also rose during the month, gaining approximately 2.6 percent (iShares Russell 2000 ETF). Since the beginning of November 2016, U.S. stocks have now risen an impressive 36 percent (cumulatively) without a single negative monthly return. The strong returns in January were broad-based across the different sectors of the index. Two sectors were negative, real estate and utilities—both are tied to interest rates and have been used as a bond proxy by some yield-seeking investors.

Speaking of interest rates, the yield on the 10-year Treasury jumped more than 30 basis points in January, ending at 2.7 percent. And in a change from months of yield-curve flattening, January witnessed a steepening of the yield curve, as longer-end rates increased while shorter-term rates remained largely unchanged. Credit spreads narrowed during the month, but mostly from the rise in Treasury rates (i.e., credit yields didn’t move much in January). U.S. core bonds lost 1.1 percent in January (Vanguard Total Bond Market Index). The U.S. high-yield market was mildly positive in the month, up 0.6 percent (ICE BofA Merrill Lynch U.S. High Yield Cash Pay Index). Floating-rate loans gained 1 percent (S&P/LSTA Leveraged Loan Index).

Overseas markets also performed well in January. The broad developed international stock index gained 4.7 percent (Vanguard FTSE Developed Markets ETF), while European stocks increased 5.6 percent (Vanguard FTSE Europe ETF). The U.S. dollar continued to weaken relative to other currencies, which helped dollar-based investors with unhedged exposure to international markets. Emerging-market stocks gained 8.6 percent, driven by double-digit returns in Brazil, Russia, and China (Vanguard FTSE Emerging Markets ETF).

Our overall portfolio returns were strong in January and driven by a handful of factors. Our positions in emerging-market equities and floating-rate loans helped performance, as did our managed futures exposure. Active developed international equity funds also performed better than their benchmarks. Furthermore, all our active bond funds outperformed the U.S. core bond index and added value to active models during the month.